Listen to the MP3 audio file

Download the MP3 audio file

Read the Transcript

Transcript of the 2011 Year End Wrap-up [PDF]

Charts

View year-end charts [PDF]

Audio Chapters

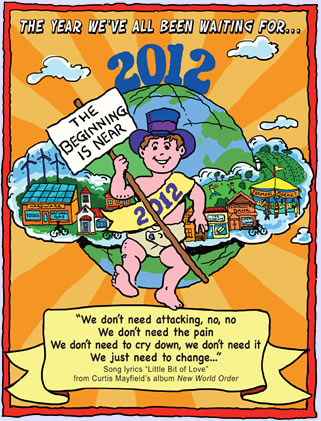

1. Introduction & Theme – 0:00 – 2011 Theme: Slow Burn; 2012 Theme: The Beginning is Near; Curtis Mayfield quote …

2. Demographic Imperative – 3:52 — US Census World Population Clock; 7 billion networked people; American individual and property rights have historically depended on violating others – can’t continue to work that way; One of the positive developments is that we are in the process of facing and dealing with that issue; Michael Ventura – we are standing in the psychic storm of our own being; highlights Tiller – coherence….7 billion coherent or 7 billion incoherent people; it matters; another aspect is a new deal between the aging in the first world and the young in the emerging markets. …

3. Transformations & Awakenings – 11:05 – Traditional institutions continued to lose credibility in 2011; the New York Times declared 2011 as the Year that Governments lost credibility; governments have been the juggernaut of wealth destruction – note Peter Wallison on HUD, Fannie Mae and Freddie in creating the financial crisis rather than the banks; negative return on investment of government money – buying people off can cut both ways over time; creating wealth falsely for large corporations and banks is now MUCH better understood; challenges of budget deals in US and Europe underscored how far off the whole affair has become; perfect example is the challenges both US parties are having attracting interest or attention in the US primaries. The disgust with both parties is growing; activism of various kinds broke out across the planet – Arab Spring, Occupy Wall Street and continuing Tea Party activism; concoction: Frustration with food prices, centralizing regulation and manipulation and corruption combined with the explosion of hand held devices and social media; unfortunately, I think there was plenty of manipulation involved in all of these efforts combined with a lot of sincere young people; test of activism – and all of our actions – going forward is:

- Is it Decentralizing

- Is it Wealth Building

4. Planet Earth – 20:41 — The weird weather we talked about in last years wrap up continued; unprecedented number of disasters & emergencies; earthquakes in NZ; cyclone/Floods in Australia; hurricane Irene on East Coast; earthquakes in Turkey; monsoons in Thailand; water wars; peak everything continues; questions on space weather and deterioration of electromagnetic field; sun spots; don’t let it talk you into a carbon tax: fraudulent scheme to create a non-accountable global taxation system that will make derivatives look like something Mother Teresa came up with; are all these problems natural? I don’t think so. I believe technology to influence weather is here, that is part of the motivation behind chemtrails and weather wars will intensify going forward; consolidation of farmland continues – started talking about the importance of farm land in 2004 when I started doing investment advisory. Now Shiller has come out to say it will be the best performing asset class. Don’t agree with Shiller on that but it will certainly be the best performing real estate asset; be prepared for more weird weather and the value of owning food producing land and water and water rights. …

5. Science & Technology – 23:02 – Developments in physics continue to astound; what the energy model will be; continue to believe that the rush to seed and food control is to replace the oil as control asset for currency – so change energy technology; will not happen in 2012, given the importance of the oil card…but it is coming; advanced manufacturing – robotics – could bring manufacturing back on shore – ONI story; the Entrepreneur and communities are going to want to use these developments:

- Maker movement

- Open source blueprints

- Increased awareness of Suppression of scientific advances – what happens as more and more people realize this is happening

- Crowdfunding – importance of community and micro venture to dovetail

Has potent

ial for POWERFUL decentralization and wealth building; desktop to handheld – impact on possibilities for communication and collaboration; phone companies less committed to open source; much more control on people dependent on hand held; create inroads for invasive surveillance and compromise of privacy; singularity & artificial intelligence; greatest concern: turning our mind over to the empire cloud computing Kindle risk; CAF: Action keep important knowledge in book – not e-book form – what I do. …

6. Half Pregnant Empire – 32:36 – It has to keep going; profound sadness that comes from being lead by people we do not like or admire the absence of leadership (missing Sir James) in part comes from absence of transparency; 2010 and 2011 – lots of time talking about the build out of the empire as investment shifted into the emerging markets; empire continues to build out; sea lanes, satellites and space; central banking – warfare model; maintain hegemony in Asia; Fukashima- nuclear war – already had nuclear war; auto industry; oil card – shut-down of nuclear plants in Europe; Asian hegemony – was allegations about nuclear weapons lab at Fukashima true? China launching first aircraft carriers and satellite capacity to not be dependent on us; asset control of the middle east and maintain the oil price; stopping leakage….outside the model; Libya Gadaffi killed (not in model); boots on ground expensive….withdrawal from Iraq and Afghanistan; Iran – sell oil China and Japan in yen; IMPORTANT DEVELOPMENT IN 2011: Privatization of space; taxpayers pay…private corporations will get the technology and equity; satellites vs sea lane; insecurity domestically: fast and furious – what it means; FEMA camps? NDAA, capital controls, invasive technology.. smart meters, entrainment technology, beware social media; explosion in gun purchases; collapse of the economy as a result of collapse of individual human and property rights and government needing more and more of the capital to finance a government dependent population and corporate infrastructure; Powerful trends continue:

- Shift to emerging markets

- Paper vs tangibles….force will defense paper…how long will it work?

- New technology

- Change vs depopulation

7. Financial Coup d’Etat & The Slow Burn – 41:33 – the power of debt entrapment to gain control continued to play out whether it was households trapped in mortgages and student loan debt or nation states trapped by sovereign debt; those challenges lead to global currency wars that reflected powerful decentralization whether Mr. Global liked it or not; mortgages/MERS – illegal circumventing of local systems to engineer fraud – back to Peter Wallison’s thesis of HUD, Fannie and Freddie doing this, not Wall Street.

- Privatization moves knowledge, technology and liability beyond reach

- Capital controls

- European Unions split-up/problems

- Retirements end game? More promises than assets?

- MF Global – whacking the commodities market

8. Market Round-up – 47:26 – Dow up 5.5%….note Christmas in New York 2010; global stock markets down… with the brics and emerging markets hit hard; (see charts in PDF at blog post or transcript); gold up 8%….1400 to 1900 and then back down into the 1500s; my predictions did not do so well – I had predicted 1650…and then took it up when it headed towards 1900… should have stuck to my original; it is now hovering around 1620; silver down 11% after rising from 30 to 50 and then falling back down into the 20s; the ten year treasury was up 16% – outperforming equities and commodities but that took MF Global and the wipe out in the futures market before that cycled through; stock markets are doing very badly but still investors persist in riding these falling trends; stock markets will benefit temporarily from QE but it is still our view that they will fall another 90% against gold in the next few years; municipal bonds did just fine, ignoring Meredith Whitney’s predictions of catastrophic bankruptcy, as the us dollar index roared above 81 in the fourth quarter; proof that the politically managed system can keep a slow burn going… albeit with escalating force that is counterproductive to economic health; it is wealth destroying. …

9. Solari Report Highlights – 50:25 – Framework for Investment in this environment:

- Unpacking Financial & Investment Advice, Part I

- Unpacking Financial & Investment Advice, Part II

- Investment Strategies for Changing Times – Mill Valley

Franklin Sanders – connecting in with the Sanders Galaxy – family enterprise precious metals, farm, church, community, businesses; Top Ten Dates in the History of Precious Metals; Adam Trombly; Bill Tiller – underscores individual rights and doing everything you can to improve your coherence; one of my my new year resolutions is improving my coherence; make sure physically healthy, rested; have made list; Gwen Scott; Jim Norman – Oil Card – 2012 oil card year; Peter Dale Scott – District 9 in the Empire; Laura Thompson – how to protect ourselves from radiation poisoning – knowledge Fukashima; IF YOU HAVE NOT LISTENED YOU NEED TO DO SO, IF YOU HAVE WORTH LISTENING AGAIN; Foster Gamble – Thrive power and importance of individual human and property rights and the principle of non-violation. …

10. Unanswered Questions – 1:00:00 –

- who is really in control and why are they doing what they are doing – ufos and crop circles

- what is the end game of unemployment combined with austerity and retirement demographics?

- depopulation and shut down of liquidity vs entrepreneurship, technology and education

- questions on space weather and deterioration of electromagnetic field

- manipulating the solutions

- ecovillages vs labor camps. beware solutions- gold standard can be an avenue to feudalism

- can the new world order manipulate activists into teeing up Constitutional Convention in 2013 or 2014 after the election

11. New Year Resolutions – 1:07:00 – Here are mine; every person is different:

- Coherence

- Not get tricked by the volatility

12. Movies & Resolutions Continued – 1:07:51 – Buzkashi: Rambo 3 and The Horsemen; financial market; more resolutions:

- Not have my faith perturbed by the fear and anger mongers

- Focus as many of my actions and transactions on things that are both decentralizing and wealth building

- On the Solari Report in 2011 – wanted to help you see the game. In 2012 focus The Solari Report on “how tos”, continue to illuminate what new science and research is teaching us about what is possible

- Continue to build a global network and conversation

- Food, water, health, detox

13. 2012 Predictions – 1:12:22 –

- War with Iran 85 % – covert, air war or Israel… DOD is sick of being spread too thin

- Chance of a nuclear event 75%

- Slow Burn 70%, 2008 25%, Melt Down 5% – turns out that was the same as last year, adjusted to 65, 30, 5 after

- Fukashima….given how the global economy handled Fukashima, I am back up to 70% on Slow Burn for 2012

- Weather wars will continue

- Oil card will continue

- Obama reelected 65%, Romney, 30%, other 5%,including military coup

- 401k, IRA changes, 30% rising to 60% in 2013

- Big wildcard, if warfare goes wrong, could the dollar get slammed or destroyed? – slow burn will be good for the dollar, but if we get 2008 or melt down; beware the dollar bubble.

- Look for the precious metals bull market to continue. I expect gold to rise through 2000 this coming year

- Look for equity markets to continue to struggle under the debt loads with unprecedented volatility

- It is hard to imagine that interest rates could go lower, but but they are unlikely to go up. So despite the ongoing currency wars, the bond market will still be with us at this time next year

- December 2012 planetary alignment will be a beautiful moment for our consciousness; don’t expect anything momentous in the material world

So turtle forward, creating new beginnings. Our future will be what we make of it. …

14. Heroes – 1:19:48 – Fukishima 50; YOU! …

15. Up Next & Closing – 1:23:52 — January 12: Precious Metals Market Report – annual wrap up on precious metals and response to any questions that you have on this report; January 19: Lynne McTaggert – author of The Field and The Bond; February 2: Jon Rappoport: Nuts and Bolts of The Matrix …

By Catherine Austin Fitts

Happy New Year!

This is the year we have all been waiting for…2012. It will be an interesting year — full of challenges, opportunities and surprises.

Change is in the air. We are moving through multiple changes – in our lives and in the culture and economy around us. It is a time to remember that breakdowns bring breakthroughs.

This Thursday night on The Solari Report (6pm PT/9pm ET) is my annual wrap up. I will cover the key events of 2011 and important trends going forward into 2012. Topics include:

- The Demographic Imperative

- Transformations and Awakening

- Science and Technology

- Planet Earth

- The Half Pregnant Empire

- Financial Coup d’ Etat & the Slow Burn

- Market Round Up

- Solari Report Highlights

- The Unanswered Questions of 2012

- Heroes

- New Year Resolutions

- Predictions for 2012

In Let’s Go to the Movies, a comment on what the Afghan game of buzkashi (see scenes in Rambo 3 and The Horsemen) can teach us about managing our finances in markets defined by intense economic warfare.

This will be a two hour special with a transcript available later this month.

If you have comments, thoughts or questions that you would like me to address, please post by Thursday.

Listen live on Thursday evening by phone, Skype or online, or listen at your convenience by downloading the MP3 after it is posted on Friday.

If you would like to learn more about The Solari Report and subscribe, click here.