“The reverberation often exceeds through silence the sound that sets it off; the reaction occasionally outdoes by way of repose the event that stimulated it; and the past not uncommonly takes a while to happen, and some long time to figure out.”

~ Ken Kesey

By Catherine Austin Fitts

Since WWII, one of the largest government investments in the developed world has been the effort to keep citizens in the dark regarding outer space and what we may be doing there. At the same time, the amount of money disappearing into hidden systems of finance and black budgets – likely related to space programs and space weaponry – indicates that there is quite a lot going on in space. It is a mystery whether this secrecy relates to the UFO phenomenon, our response to it, or to the hidden control of sovereign governments and the financial system.

Those of us who were inspired by President Kennedy’s support of space exploration believed that we were headed into space in a major way a long time ago. After Kennedy’s death, the NASA budget peaked at 4.5 percent of the federal budget. It is currently 0.5 percent.

Did our investment in space decline following the 1960’s – or did it simply go dark? Was one of the goals of the Kennedy assassination to ensure that the U.S. effort in space would be kept secret to insure U.S. unipolar dominance?

I believe that it was.

Secrecy regarding space has driven the need for centralization of control. And satellites in the orbital platform have been instrumental in implementing that control. Note that these activities have been funded with your tax dollars and retirement savings as well as through the black budget, bailouts, and organized crime. Whether you know it or not, you have a big investment in space. And with this much money at stake, you may want to pay attention to what is happening with your investment.

The hardware in the orbital platform is currently responsible for an ever-increasing flow of data including GPS, communications, financial payment and transactions, media, and military and intelligence functions. This is why I sometimes refer to the orbital platform as the “sea lanes of the 21st century.” Before Sputnik was launched in 1957, the US Navy policed the global sea lanes as a means of maintaining the US dollar as the global reserve currency. This was the backbone of the Bretton Woods system. Following Sputnik, the Navy’s scope was expanded to include the equivalent of the seas in outer space around us.

I believe that this development included secret space weaponry which has been instrumental in preserving the US dollar as the world’s reserve currency. Such weaponry will likely be a deciding factor in the evolution of global digital currencies.

The Global Positioning System (GPS) of the United States was the first space-based navigation system to provide location and time information in all weather conditions, anywhere on or near the Earth. It was fully operational in 1995, the same year in which the World Trade Organization was created. GPS, along with a network of communication and earth observatory satellites, made the rebalancing of the global economy possible.

This re-balancing raises a “Which came first, the chicken or the egg?” question. Did it take place because our infrastructure – including satellite infrastructure – simply made it possible? Or did we rebalance the global economy to create the human, intellectual, and industrial capacity necessary to invest in space infrastructure and to become a multiplanetary civilization? Was rebalancing the global economy the goal, or was it simply a strategy used to attain a much larger goal?

Today, largely a result of the global re-balancing, China has more people working in its space industry than does the United States. Thanks to the creation and growth of Asian space programs since 1995, global space industry employment has more than doubled.

In 1996, I visited the Beijing University of Aeronautics and Astronautics. Hiring a PhD database software developer associated with the university at that time cost $10,000 annually. The same year, my Washington, DC based company was paying a less motivated database developer $125,000 annually.

When the global rebalancing began, this disparity represented twelve times the brainpower for every $1. More important are the population numbers. China, India, Japan, and South Korea, with a combined population of 3 billion people, can produce far more engineers than America and Europe combined.

Over the last fifty years, we have launched satellites, laid cables, built cell towers, and distributed smart phones, smart TVs and now smart meters. This system is being built out globally. One recent estimate predicted that every person on the planet will have a smart phone by the year 2025. Combined with artificial intelligence and cloud-based database technology, this distribution is creating a surveillance infrastructure which can conduct surveillance, harvest financially, and manipulate with mind control on an individual basis. Increasingly, it appears that entrainment and subliminal programming to influence thought and emotion have been added.

With every person carrying a surveillance and entrainment device in the form of a smart phone and updating their personal surveillance files via social media, a “free range” totalitarian state is being built. This state depends on space infrastructure.

The better you understand the space-based economy, the more transparency you will bring to it and to the legalities of its historical funding. Thus, the better your chances of living the life you choose rather than a life dictated by those promoting centralization.

Whatever is happening in space – or our feelings regarding the national security state, its expenses, and its methods – the fact of the matter is that the human race has a better chance of surviving and thriving if we become a multi-planetary civilization.

I believe that amassing the capacity and capital to make this happen is the right thing to do. Perhaps we can use this fact to rebuild alignment among ourselves – an alignment which will bring down the walls of secrecy and build a more advanced human civilization rather than destroy what we have for the privilege of the few.

With unclassified investment in space growing, so are the opportunities to rebuild family wealth, entrepreneurial activities, employment, and the private and public equity markets. Expect this growth to continue for the foreseeable future.

As Robert Dean once said, “It is the destiny of our children and grandchildren to travel the stars.”

Space: Here We Go!

The Space-Based Economy

Introduction

“I’ve been thinking about laws on Mars. There’s an international treaty saying that no country can lay claim to anything that’s not on Earth. By another treaty if you’re not in any country’s territory, maritime law applies. So Mars is international waters. Now, NASA is an American non-military organization – it owns the Hab. But the second I walk outside, I’m in international waters. So here’s the cool part. I’m about to leave for the Schiaparelli Crater where I’m going to commandeer the Ares IV lander. Nobody explicitly gave me permission to do this and they can’t until I’m on board the Ares IV. So I’m going to be taking a craft over in international waters without permission, which by definition…makes me a pirate. Mark Watney: Space Pirate.”

Read the PDF of: 2015 Annual Wrap Up – Space: Here We Go!

~ Scene from The Martian

Now would be an excellent time to think about what is going on around us in outer space and what it means to our lives here on Earth.

Technically, the phrase “space-based economy” refers to an economy developed in outer space. Wikipedia defines it as follows:

“Space-based economy is industrial activity in outer space, including asteroid mining, space manufacturing, space trade, construction performed in space such as the building of space stations, space burial and space advertising”

“Space-based industrial efforts are presently in their infancy. Most such concepts would require a considerable long-term human presence in space, and relatively low-cost access to space. The majority of proposals would also require technological or engineering developments in areas such as robotics, solar energy and life support systems.”

I am using the term more broadly: that portion of our economy that organizes itself around what is happening in space and our response to it, including the economy that is developing the capacity to build things in space.

After two decades of studying the black budget and covert cash flows, I have reached the conclusion that the space-based economy is much bigger than most financial people can imagine.

Why Think About This Now?

There are numerous reasons why it will be valuable to integrate space activities into our worldview and to our analysis of the economy.

One reason is that global governmental and commercial investment in space is growing. And this investment is growing at a time when many other areas of our economy are not. Space investment is an area of human endeavor which is being protected from the vicissitudes of economic fortunes. Indeed, an effort is underway to promote space exploration.

Hollywood is making space the place where heroes go.

Clothing designers are making space fashionable.

Popular science magazines are encouraging young people to consider engineering careers in space. Pepsi is implying that space holds a deeper conspiracy.

Space tourism companies are encouraging the wealthy to travel into orbit in person, making space the “power destination.” So, communities are building spaceports.

Another reason to integrate outer space into our worldview is that the portion of our economy that is transported, stored or digitally analyzed in Earth’s orbital platform is growing. Our dependency on satellites for commercial, intelligence, enforcement and military applications is growing. To address the need for satellites and GPS satellite systems, more countries are developing space programs and launch capabilities and requiring additional products and services from defense, aerospace, satellite and private space companies.

The reasons why space most interests me, however, involve its covert side. I am convinced that if we can bring transparency to this topic, we will significantly improve our chances of reducing inequality and harmful centralization of control.

The great space mystery is driving the centralization of control and wealth. Decentralization necessitates demystification.

Exploring the issues involved in integrating our covert reality with what we know is happening in outer space and in the economy is the focus of this overview.

Secrecy & The Black Budget

Inspired by the extensive road system built by the Roman Empire, the medieval sentiment said “Mille viae ducunt homines per saecula Romam,” or “A thousand roads lead men forever to Rome.” The modern world has shortened this to, “All roads lead to Rome.”

Today, as we attempt to unpack the inexplicable conspiracies in geopolitics or the covert cash flows and black holes in our financial systems, all threads ultimately lead back to the secrets of what is happening around us in space. The enormous and expensive national security state which was created following WWII to keep those secrets lies at the heart of these questions.

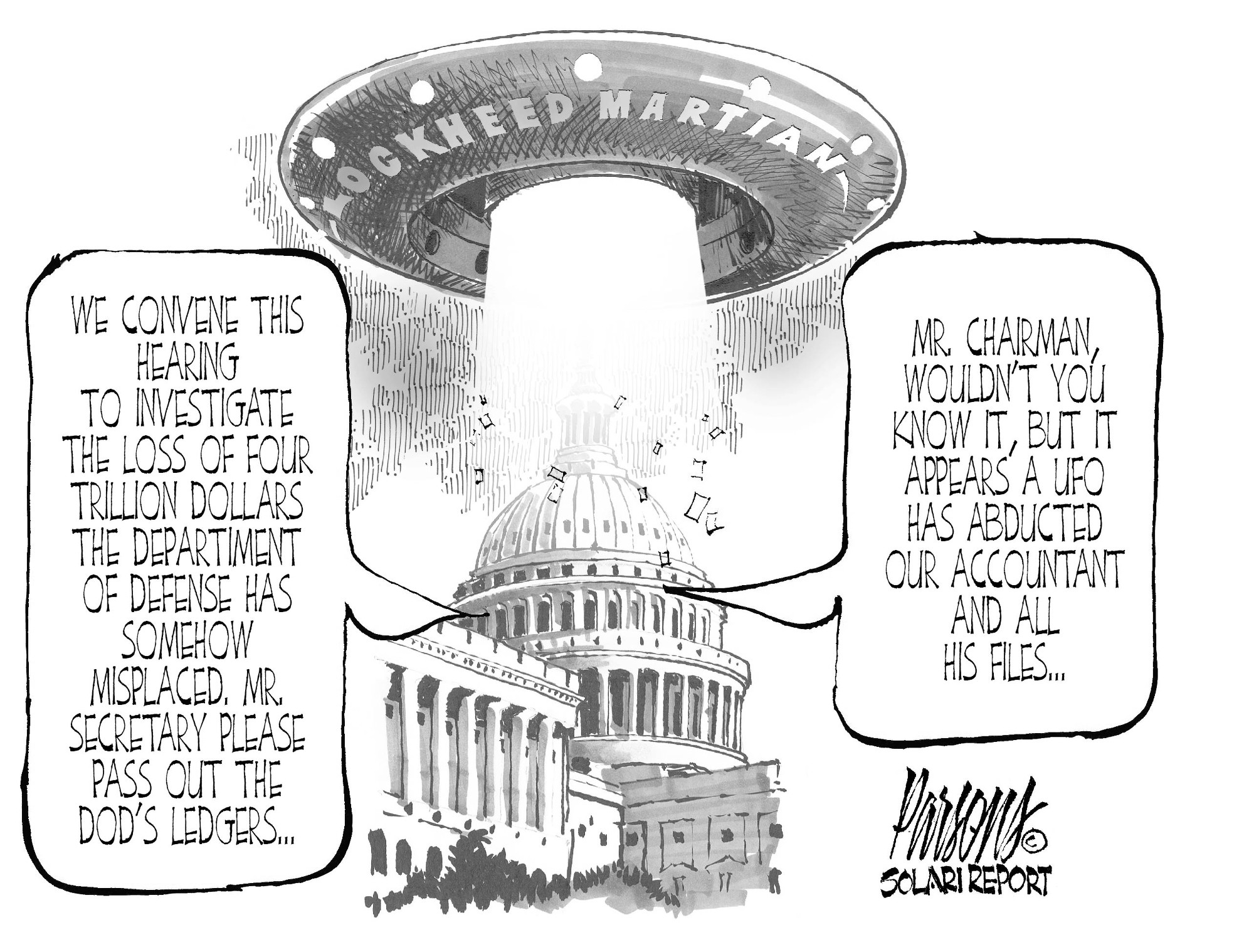

Why has $8.5 trillion dollars gone missing from the US government since 1995? Why did Wall Street, the Federal Reserve Bank and the US Treasury cooperatively engage in $27 trillion of collateral fraud and bailouts? The total value of residential mortgages in the United States at the time was approximately $8 trillion.

Why has nearly every community in America been overrun with narcotics trafficking and drug gangs? Why did American intelligence agencies and secret societies finance and manage networks of sex slaves and pedophilia rings? Why did they create an extensive system of control files allowing covert control of our courts, banking systems and legislatures?

And why has no one of consequence been fired or prosecuted as a result of decades of such egregious conduct? Instead, the enforcement bureaucracies have fired, harassed, or even assassinated those who attempted to stop these events or to warn that they were happening.

How is it that the national security state successfully killed a President of the United States in broad daylight while the majority of the country continued to pretend that his murder (and subsequent assassinations) were anything other than a coup d’etat? From the events of September 11 to endless school shootings, why do we tolerate ongoing false flag events?

When serious researchers follow these threads, what we find is an ever more powerful national security state obsessed with secrecy and centralized control. It demands growing amounts of funding for secret projects, secret technology and secret weapons to ensure that society is progressively more financially dependent upon it.

When you speak with some of the people who built the national security state, they insist that employing secret operations financed in covert ways was simply the best option available to them. The harvesting of the general population was justified by the urgency of what needed to be done in order to deal with the secrets on the other side of the black budget. Those secrets revolve around what is now happening in outer space and its implications for life on Earth.

Ultimately, whatever the UFO phenomenon is and whatever it demands as a response, a decision was made following WWII to keep it absolutely secret. What followed was the creation of a national security infrastructure built around a large array of private corporations and investors with a vast number of secret, private and government funding mechanisms.

This secret apparatus now controls the world’s most powerful technology while functioning “above the law.” It has created powerful, vested interests for continued secrecy. Some, perhaps all of it, has become a “breakaway civilization.”

The national security state is protected by an unending flow of disinformation.

- It is protected by Cointelpro operations targeting and harassing candidates, journalists and academics who attempt to uncover the facts.

- It is protected by a corporate media which broadcasts an unending stream of bizarre explanations for events and which increasingly depends on “manufacturing” news as if it were a reality TV show.

- It is protected by an alternative Internet media overrun by disinformation, “fear porn” and even more bizarre explanations.

I once spoke with a news producer who was fired by a major corporate news network for reporting a story about sarin nerve gas. The producer had the story right. However, the Pentagon threatened the network. In defense of the network, the producer explained that the Pentagon could interrupt or cut off the network’s satellite feed. What else could the network do?

The national security state is also protected by a federal government that launches an unending series of domestic and foreign “wars” designed to generate more government contracts and purchases and to further centralize its control.

It is protected by a Congress that continues to appropriate funds despite overwhelming proof that those funds are spent outside the laws stipulated by the Constitution or by financial management laws. Its subsidized cost of capital, access to intelligence and technology, and its impunity to any law is the primary source of inequality in our world today. In essence, there are those “in the know,” those who do their bidding, and those who have been left behind.

Why The Rush?

One of the videos I encourage Solari Report subscribers to watch is Sir James Goldsmith’s interview with Charlie Rose in 1994 in which he warns of the dangers of the World Trade Organization and the rebalancing of the global economy. This interview offers the best description of globalization available. Goldsmith does a remarkable job of describing how traumatic the change would be when globalization was implemented as planned.

The question we keep asking is, “Why?” Why unleash this process in such a dramatic, traumatic fashion? Because we have the power to do so? Because we’re greedy? Because following the collapse of the Soviet Union and the conversion of Eastern Europe and China to more market-oriented economies, it became essential to implement unipolar world dominance at high speed?

But, what if globalization took place in order to create the capacity to become a multiplanetary civilization – and to do so in a hurry? And if this were the case, then why the rush?

As with many things happening on Earth (and most things in space) this scenario simply raises a series of unanswered questions.

- Is the Earth at risk? Has nuclear testing damaged the ionosphere and caused irreparable environment damage?

- Are the risks of nuclear waste and accidents too great?

- What about geophysical changes – whether the risk of a direct hit by an asteroid or comet, a pole shift, further weakening of our magnetic field, or risky space weather?

- What about climate change as a result of solar inactivity?

- What about population growth and the economics of “peak everything?”

- Finally, what about the fear of having to govern through accelerating change?

Indeed, certain films have described the creation of artificial planets to provide safety and comfort for leaders. An elite few can enjoy much longer lives without risking the environmental impact of allowing everyone to do so. This approach presents a double standard regarding access to technology, particularly when that access threatens the control by elites.

There is no way to know which of these scenarios may be true. However, if you look at the risks involved in the rebalancing of the global economy, my best guess would be as follows:

- The United States possesses space weapons which are a critical component of the US dollar reserve currency status. Domestic leadership wanted to shift capital and rebalance while its dominance was ensured.

- As countries in Asia and Eastern Europe were creating private and public equity markets, the G-7 nations had the ability to print fiat currency and use it to buy real equity and to offset the resulting monetary inflation with labor deflation (via globalization). This ability was the equivalent of something-for-nothing on a global scale. It ensured that the number of billionaires in the City of London and G-7 would be greater than the number in Asia, despite the demographic differences.

- The G-7 governance group wanted to create a global currency and multiplanetary capacity quickly.

- The leadership felt it necessary to engineer a financial coup d’etat to create funding for these moves without having to depend on governmental or popular support.

Indeed, current surveys indicate that it is easier to create support for the war on terror than support for space exploration. It would appear that the terrorist “shriek-o-meter” is working.

One of the unanswered questions we continue to ask on the Solari Report is, what is the global spraying program and what are the goals of this very costly program? While some claim that the program began in the 1980’s, I first noticed it in the 1990’s at the same time the global rebalancing and financial coup occurred. Before we implement global climate change tyranny (enforced with the help of satellites) it is essential to understand these phenomenon and their interconnections.

This is one of many reasons why transparency around the US covert cash flows and space activities is so important.

Technology Transfer

The history of technology raises more questions about where some technological developments originated than it answers.

Why do we limit the innovation and implementation of new technology in certain instances? If you listen to the histories of Nikolai Tesla, Royal Rife and numerous inventors since, it is clear that our dependency on fossil fuels and pharmaceutical drugs is politically mandated. Why do we require dependency on legacy technology? And what would trigger a change?

A study of earnings flows of companies in the S&P 500 reveals that much of their cash flows depends on legacy technology, purchases, and contracts from the US government. But, if you look at the companies implementing more advanced technologies, it appears that a great deal was either funded by military R&D or by the black budget.

As a financial matter, some of this technology was funded by taxpayers. But it is owned by corporate investors, including pension funds and retirement accounts. This is one of the reasons why I believe that secrecy regarding outer space and the black budget are primary sources of growing inequality in wealth.

Were some technological advances derived from advanced space technology developed by private corporations and then held in secret? Do some of our advances come from extraplanetary civilizations? Clearly, we know from the many UFO sightings that someone is using breakthrough energy and antigravity propulsion technology. Such craft are clearly not fueling up at local gas stations.

In 1997, a think tank conducting a strategic plan for the US Navy asked me to provide assistance in an analysis of Navy operations in the event that world citizenry believed that aliens existed and lived among us. At this time, I was even invited to have lunch with “aliens.”

Although I declined the luncheon invitation, I asked if there were any books I might read on the subject. One of the recommended books was The Day After Roswell by US Army Colonel Philip J. Corso (Ret.) which was published in 1997.

Colonel Corso is one of many former military and intelligence officers who have described significant technology transfers out of military R&D or black budgets into major corporations and defense contractors. He claims that an extraterrestrial spacecraft crashed near Roswell, New Mexico in 1947 and was recovered by the US government. Corso was assigned to a secret government program that provided material from recovered spacecraft to private industry for the purpose of reverse-engineering. He served as a special assistant to Lt. General Arthur Trudeau who headed Army Research and Development and was in charge of the Foreign Technology Desk. Corso described aspects of modern technology including computer chips, fiber optics, and lasers that were transferred to various corporations such as IBM, Bell Labs, Hughes and Dow.

Corso also wrote that the world was “at war” with extraterrestrials at one point and that the Strategic Defense Initiative (Star Wars) successfully concluded that war in Earth’s favor.

Lest these claims sound ridiculous, it is worth contemplating the following statements made by Ben Rich, the former head of Lockheed Skunk Works, in 1993. Lockheed is the largest defense contractor and weapons manufacturer in the world with significant aerospace and space responsibilities for the federal government.

“We now have the technology to take ET home.”

“We already have the means to travel among the stars, but these technologies are locked up in black projects and it would take an act of God to ever get them out to benefit humanity…anything you can imagine we already know how to do.”

Regardless of what has happened behind the cover of the national security state, there is an unprecedented introduction of technology underway. This technology will significantly reduce the cost of putting satellites and space stations into orbit, in engaging in space exploration and in building a space-based economy which can access energy and build infrastructure in space.

This includes 3D printing (a 3D printer has been tested on the International Space Station), robotics and innovations in material sciences. And, if new materials such as graphene can be manufactured economically, the notion of elevators rising to space stations and to the orbital platform may be feasible.

What this means is that we are living, working and investing in an economy where asset valuations depend not simply on centrally managed financial systems but on highly political, often secret management of advanced technology including weaponry.

In a period of accelerating change, this dependence means that conducting due diligence on asset valuations will be quite complex. For example, what if the crash in oil and gas prices relates to steady advances in renewable energy technology and the decision to integrate breakthrough energy technology? What if investment syndicates are buying up positions in companies (or real estate) at low cost and plan to introduce new technology for a rapid increase in asset values? Sound clever? And, what if this is taking place via the use of entrainment technology and intelligence funded with taxpayer dollars?

Those “in the know” regarding these shifts will command an enormous advantage financially, politically and psychologically.

Which raises another unanswered question: Since the rebalancing of the global economy and financial coup d’etat began, why have US and NATO forces (as well as mercenary armies) been engaged in the destruction and seizure of Middle Eastern antiquities? Might these artifacts speak to the origins of ancient technologies? Perhaps the parting of the Red Sea was engineered with a directed energy weapon. Obviously, the powers-that-be would prefer to keep this information and other secrets in the cradle of civilization classified.

Global Financial Payment, Clearance & Global Reserve Currency

Solari Report subscribers already understand the importance of smart phones in the delivery of top-down surveillance and management as well as bottom-up communication and transactions. One of the reasons why there is a rush to add satellites to the orbital platform is to provide access to all global citizens via smart phones and the “internet of things.” This will take place on a basis that dramatically reduces transactions costs to affordable levels in the emerging and frontier markets. Effectively, it will create the equivalent of a new “gold rush” – the ability for everyone from politicians to consumer companies to “tender” for the entire global population on a one-to-one basis.

As I described in detail in my 2015 series “Promoting Women,” this is one aspect of the push to promote women candidates in business and politics.

The rush to claim the allegiance of the hearts and minds of women globally is driven by the financial opportunities created by the orbital platform. This rush is one of the reasons why other countries are moving aggressively to create their own global navigation systems in the orbital platform. They do not wish to be dependent on the United States for navigation or clearance and payment systems. They also don’t want their general populations manipulated against them via “soft revolutions.” This means having independent ocean cables and independent satellite systems.

Once this global system is built out, it will be possible to move to a digital global currency. Hence, it is not surprising that we now see prototypes such as Bitcoin combining digital currencies with freedom from sovereign deposit insurance – a great boon to G-7 governments if it can be achieved.

A global, digital, fiat currency – one free of sovereign deposit insurance – is the ultimate control mechanism. As I have said repeatedly, “So long as it is digital and centrally controlled, Mr. Global will not care if the new currency system is called dollar, peso, franc, gold, silver or wampum beads.”

The future of any digital currency system depends on redundant, seasoned satellite systems in Earth’s orbital platform. This makes the legal and governance issues regarding space all the more interesting.

Legal, Governance & Military Issues

A space-based economy will grow within the legal and regulatory framework for human activities in space. Since the real governance system on Earth remains a mystery, the real governance system for human activity in the Solar System – whether actual or intended – is also a mystery.

We are making an enormous commitment to investment in space as a global society. However, we lack clarity regarding how space will be governed and managed. Given the practical need for collaboration regarding orbital activity, there is serious need for investment in space governance and diplomacy.

To help our subscribers and readers understand the current state of space law in the U.S. jurisdiction, we asked attorney David Liechty to prepare an overview that the Solari Report published in October 2015: Issues and Framework of United States Law Concerning Outer Space.

Officially, human activities in space are governed by a series of international treaties.

- The 1967 Treaty on Principles Governing the Activities of States in the Exploration and Use of Outer Space, including the Moon and Other Celestial Bodies (the “Outer Space Treaty“).

- The 1968 Agreement on the Rescue of Astronauts, the Return of Astronauts and the Return of Objects Launched into Outer Space (the “Rescue Agreement“).

- The 1972 Convention on International Liability for Damage Caused by Space Objects (the “Liability Convention“).

- The 1975 Convention on Registration of Objects Launched into Outer Space (the “Registration Convention“).

- The 1979 Agreement Governing the Activities of States on the Moon and Other Celestial Bodies. (Source: Wikipedia)

While countries with developing space programs are preparing to travel to outer space, the inability to build an international governance structure for current and future activities there indicates deep disagreements between:

- sovereign governments

- governments and private corporations

- a variety of public and private factions

Crowded orbits and space debris have created serious safety issues for satellites, thereby increasing the need for cooperation. If fighting were to break out in the orbital platform, the problem of debris could be dangerous and expensive to everyone involved.

“If, however, space remains reliant on existing, largely cold war-era agreements and if countries fail to prevent the emergence of norms accepting of space weapons and conflict, then regional rivalries, U.S.-Chinese disagreements, and perhaps broader space instability could become major international problems in the future, possible spilling over into warfare.”

~James Clay Moltz, Asia’s Space Race

I believe one of the reasons why international efforts to create additional treaties and agreements regarding space have stalled since the 1980’s is that the United States prefers to maintain secrecy regarding its space-related weaponry. I also believe that the US dollar’s status as reserve currency depends on this weaponry. This dependence would include the use of satellites for surveillance, intelligence, cyber warfare, soldier and drone management, and the delivery of entrainment relevant to “soft revolution” warfare. It would also include “harder” functions that may relate to space delivery of lasers, directed energy beams, weather manipulation or other events disguised as natural disasters.

This raises a question as to whether the “bumpy” evolution to a multi-polar world on Earth will be made even more bumpy by what is happening in space.

The United States Space Act of 2015 was signed into law in November 2015. The Act allows “US citizens to engage in the commercial exploration and exploitation of ‘space resources’ [including … water and minerals].” In effect, the United States is authorizing private companies to own what they mine in space without such ownership being specifically authorized by international treaty. Clearly, this supports the US government’s effort to promote the privatization of space. However, an international legal structure necessary for such privatization is not in place.

How will this work?

While there is silence regarding what is happening in reality, Hollywood is leveraging interest in space weapons in a serious way.

In Captain America: Winter Soldier (2014), the U.S. government is bringing a new system called “Project Insight” online. It consists of three helicarriers linked to spy satellites designed to preemptively eliminate global threats. Project Insight, however, is really controlled by Hydra, a global terrorist organization which has grown since WWII with the help of Nazi scientists. Captain America is given the task of stopping the project from going live.

The latest James Bond movie, SPECTRE (October, 2015), revisits the global criminal and terrorist organization by that name and the notion of former Nazis in space we saw in Moonraker. Spectre is engineering global terrorist acts to justify the creation of “Nine Eyes,” a global surveillance and intelligence initiative shared by nine member states. With shades of Edward Snowden, Bond attempts to pull the plug on moles in the British intelligence service who are attempting to take Nine Eyes operational under their control.

In Star Wars: The Force Awakens (December, 2015), the defeated Galactic Empire has risen in the form of the First Order. It hopes to use its Starkiller Base, an artificial planet with the capacity to destroy complete star systems, to wipe out the Republic. The First Order logos, uniforms and storm troopers are eerily reminiscent of Nazis.

The constant reappearance of the Nazi theme is not surprising. If you have listened to our Solari Reports with Dr. Joseph Farrell on the roots of the military industrial complex (including Nazi organizations surviving after WWII and the “Breakaway Civilization”), you already know that there are serious unanswered questions in this area.

One of our top stories of 2015 is the move to private armies and mercenaries and what this will mean to global geopolitics. The issues of weapons in space become even more disturbing when you look at what’s happening with military and law enforcement applications using robotics and the integration of digital technology directly into human soldiers.

When you combine private armies with spaced-based corporations 1) existing outside the authority of sovereign governments and 2) armed with these technologies, you can envision some very strange scenarios.

Finally, an important question regarding legal and governance issues in space concerns whether or not space stations (or cloud-based operations in space) will have extra-territorial jurisdiction. Will we face an entirely new wave of “offshore havens” free of taxation and sovereign regulation and enforcement? The economics of taxpayer monies funding such a platform would take us to a whole new level of financial fraud. Certainly, this would only happen if space-based weapons were to provide protection.

Those Pesky Russians

The Cold War included a space race between the United States and Russia. With the collapse of the Soviet Union and the economic collapse of the Russian economy, Russia’s investment in space was curtailed. However, Russia has recently revived its investment in space – it now has an equivalent number of personnel dedicated to the space sector as does the United States (and a much larger percent of GDP officially dedicated to its space budget).

It is particularly interesting to note the timeline of recent deterioration in the relationship between the United States and Russia – the two largest weapons exporters in the world – relative to Russia’s launching of a global navigation satellite system and the revival and growth of its space programs.

Related News Stories

Russia, China Sign Range of Space Industry Agreements

Russia’s space agency Roscosmos signed a cooperation agreement on Thursday with China National Space Administration.

Russia, China Develop High-Precision Navigation System Draft for SCO, BRICS

Russian and Chinese experts have developed a draft project to create a global international navigation system based on China’s BeiDou and Russia’s GLONASS satellite navigation for the member states of BRICS group and the Shanghai Cooperation Organization, Russian Space Systems company said in a statement on Tuesday.

Washington Times: Russia and China Aim for the Moon and a Joint Lunar Base

China and Russia have announced plans for a joint space exploration project that ultimately could lead to the establishment of a Sino-Russian base on the moon. The announcement was made April 28 in the Chinese city of Hangzhou, when visiting Russian Deputy Prime Minister Dmitry Rogozin met with his Chinese counterpart, Vice Premier Wang Yang.

These efforts give tremendous support to plans by the Russians and the BRIC nations to build independent payment and clearance systems. China now has more personnel working on space than does the United States, making Russian-Chinese cooperation a formidable effort.

After the United States, Russia is the second largest exporter of weapons. The latest Russian weaponry, when combined with collaboration in space, further contributes to a multipolar world. In 2014, Russian state-run news media reported that a Su-24 equipped with an advanced electronic counter-measures system had disabled the combat system of the USS Donald Cook, a U.S. Navy guided missile destroyer deployed in the Black Sea.

Certainly, the United States’ increased self-sufficiency in oil and gas (combined with dramatically falling oil and gas prices) is putting strain on Russian budgets. Those budgets are heavily dependent on oil and gas revenues, including sales of oil and gas to Europe. And development of re-usable rockets by private companies in the United States could threaten the Russian’s lead in space launches.

It appears that the competition is back between the United States and Russia in outer space.

The Space Industry

The Organisation for Economic Co-operation and Development (OECD) has published an excellent overview of the Space Economy as of 2014. I strongly recommend this report as the best available overview of the publicly disclosed economy as it relates to outer space.

Our move into space is operating through governmental space agencies and private companies with the vast majority of unclassified funding coming through government budgets. At this time, the majority of profitable commercial activities in space are related to satellites and to the services that flow through them.

Not surprisingly, the crossover between aerospace and defense industries is significant: many of the companies involved in space also serve civilian agencies or the military in other capacities. Space businesses are often combined with defense contractors and aerospace businesses. The OECD provides a description of the supply chain in the broader space economy as follows:

One of the challenges in understanding financial performance is grappling with the inter-relationships of other governmental functions as well as the responsibilities for classified or covert operations. As part of the secrecy infrastructure, those classified operations now come with potential national security waivers related to disclosure and other securities laws.

One way to track what is happening in this sector is to observe the performance of the publicly traded companies. We are compiling a list of both publicly traded and private companies involved in the space-based economy. I plan to use this list to track equity market capitalization and what it may indicate regarding what is happening in space. If you would like to recommend additions to this list, please send them to space@solari.com or post them in the comments section of Solari Report blog posts.

Our Economy: Closed or Open?

When I do not understand a particular subject, I seek out people who have mastery in that area and attempt learn from them. When it comes the covert aspect of outer space and its impact on our economy, the two experts who have received the most air time on the Solari Report are Dr. Joseph Farrell and Richard Dolan.

In addition, the opportunities provided by Jeroen van Straten and the GlobalBem team to listen to a wider group of researchers at the Secret Space Program (SSP) and Breakthrough Energy conferences have been invaluable.

As background, I strongly recommend our Solari Report interviews with Dr. Farrell and Richard Dolan. These are available through the resources link in this wrap up or in the Solari Report libraries. I also recommend their books and their Secret Space Program 2014 and 2015 presentations (available through the online conference resources provided by globalbem.com and secretspaceprogram.org). These authors have succeeded in wading through highly complex phenomena to make the covert aspects of outer space much more accessible.

Many unanswered questions remain. However, what we now know is sufficient to frame the uncertainty.

When you digest the information available on the UFO phenomenon and testimony regarding ancient and current alien interactions with human civilization you come back to the same basic questions:

- Who is in control on Planet Earth?

- Who is behind the UFO phenomenon?

- Are we dealing with humans from Earth or from another time or planet?

- Are these beings extraterrestrial – a different species with a radically different intelligence and electromagnetic presence – from another time, another planet, another dimension, or perhaps from inside the Earth?

- Or, are these phenomena simply the product of elite imagination orchestrated at great expense with holograms and mind control?

Richard Dolan’s latest book, UFOs for the 21st Century Mind, lays out the big questions and describes why bringing these questions into everyday conversation and life is critical. We have recommended this book in our “Best Books for 2016” section.

One of the most important unanswered questions is whether or not our current economy is open or closed. Are we conducting trade with extraplanetary civilizations? Can we maintain our sovereignty in the face of their technology? Are we reverse-engineering extraterrestrial technology? Are extraterrestrial beings permitted to own property on Earth or to invest in our real estate, commodities, stocks, and bonds? Are we paying them interest and dividends?

The most important point to understand about such questions is that, regardless of the position you take on our economy (whether it is open or closed) that position is based on an assumption.

If you believe that our economy is closed and that we are trading solely with humans in an Earth-based, closed system (in line with the official reality), you cannot prove that this is true. Conversely, anyone who takes the opposite position – that we have an open economy and are engaged in economic activity with extra-planetary civilizations – cannot prove their position either. Both positions are based on assumptions and conjecture.

I don’t like betting the ranch on assumptions and conjecture. But if I must do so, I like to make those assumptions explicit.

This is more than a philosophical point. Almost all commentary on the financial markets today is based on the assumption that our economy is closed. However that assumption is never made transparent. It is never discussed. At the same time, trillions in financial transactions go unexplained, from the black budget to $8.5 trillion missing from the United States government.

Thus, the assumptions regarding the closed economy commentary are wearing thin.

This is important because a great many people have lost money by assuming that the economy was going to collapse. As part of their investment scenarios, these people assumed that our resources were limited to those on Earth and that our available technology was publicly acknowledged.

In fact, we now know this is not true. Indeed, I believe that the manipulation of technology transfers into the everyday economy is critical to maintaining the slow burn and to preventing or controlling financial collapse.

What if our economy is open? Or, if it turns out to be closed, what if the technology available – or that which is operating in secret – is much more powerful than we know?

One of the reasons why it is important to ask these questions is that our economy appears to behave more like an open economy. Our dependency on legacy technology could be explained, as Dr. Farrell has postulated, by treaty requirements. The immaturity of our adoption of new technology could be explained by the fact that it is transferred from another, more advanced civilization. We may be like cavemen playing with laser guns. Collapse, quite possibly, has not come because we have income, technology and capital flows coming in from off-planet.

It is worth playing out a scenario design in which you assume that the economy is open? If this is the case, who owns the outstanding debt? Debt is clearly a back door tool of control for someone.

If we have space weapons, were they created to control Earth or were they created to protect Earth from others who want to collect on their dividends and interest?

If private companies have been authorized by the Space Act of 2015 to own materials they mine in space, is this merely a cover story for interplanetary trade?

Is the War on Terror about a much more complex population control plan than we have ever imagined? Does the bombing of underground facilities in the Middle East relate, as some have claimed, to “exo-politics?”

It is time to make explicit our assumptions about the global economy – whether we believe it is open or closed – and to address the numerous bizarre phenomena with which we are dealing. If someone has the power to re-engineer the economy in radical ways, including maintaining a slow burn for decades, then we need to know how this is implemented.

We require a logical explanation for these questions. Adult fairy tales, shrieking and fear porn may satisfy our anger or grief for short periods of time. But they are not going to help us get to the bottom of what is happening.

Truth is the door we must pass through if we seek real change.

Risk Issues

There are numerous risks issues involved in the exploration of outer space.

First, major exploration can bankrupt a society. The Darien Scheme essentially bankrupted Scotland in 1700 after it invested heavily to establish a colony in what is now Panama. In addition, while military aerospace applications have proved highly profitable, it is worth noting that, to date, the returns on civilian applications have not been wonderful:

“The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines. Here, a durable competitive advantage has proven elusive ever since the days of the Wright Brothers. Indeed, if a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down.”

~ Berkshire Hathaway Shareholder Letter 2008

Second, exploration invites skepticism and schisms. Note the rejections overcome by Christopher Columbus.

“The committee judged the promises and offers of this mission to be impossible, vain, and worthy of rejection: that (it) was not proper to favor an affair that rested on such weak foundations and which appeared uncertain and impossible…”

~ Talavera Commission, 1491, turning down Christopher Columbus’ proposal for finding a new trade route to the Indies. Queen Isabella of Spain later funded the project.

Third, aggressive infrastructure projects, especially when there is a large gap in technological prowess between populations, have historically been associated with slave labor. This is one of the reasons why I have consistently asked whether mass migrations of immigrant populations are actually providing a labor force for underground bases.

Fourth, when we explore the unknown, we can bring back forces ranging from microbes to technologies which are potentially harmful to our health or to the environment…or we may invite contact with civilizations who do not wish us well. Hollywood has certainly worked overtime to warn us of these possibilities.

My vote is that our greatest risk is spiritual and cultural – the failure to face reality together – whether on this planet or as we move into outer space. Following that, our greatest risk is to bet the ranch on one planet. The risks of not colonizing other planets are greater than the risks we face in doing so.

What Does This Mean To Me?

It’s Time to Assert an Ownership Interest

No matter where you live, you have made a significant personal investment in space. First, if your country has a space program, which more and more countries do, you have funded space programs with your taxes. If you live in a developed nation, you have financed classified black budgets and private funding through your taxes, lost retirement savings and personal loss of time, health and well-being. If you live in an emerging or frontier market, you have experienced the same through exploitation of natural resources, exploitative labor practices and pumps and dumps of financial markets.

All of this has happened through a myriad of harvesting mechanisms, including losses from housing bubbles, market manipulations, fraud and bailouts, narcotics trafficking and organized crime, nuclear fallout and testing of bio warfare and mind control on humans.

The managers of the black budget may not have assigned you a personal locker in one of their underground bases or an ownership share of a spaceship. Nevertheless, I consider you an investor in a vast array of infrastructure, advanced technology and invisible weaponry.

When and if your government tells you that there is no money and that it must cut your retirement benefits, please be advised that you are well within your legal rights to insist on 1) equity certificates and royalties in the technology and companies you have funded and 2) common law rights of offset against the banks and government contractors involved. At a minimum, this will add some fireworks to the budget negotiations.

This is more than a theoretical nicety. Following the 2016 elections, we are likely to see a more radical reengineering of the federal budget and US national, state and local pension funds. The demands of the black budget have been one of the hold-ups in addressing the re-engineering of the federal budget before now.

You have a big investment in space, whether you know it or not. With this much money at stake, you may want to pay attention to what is happening with your investment and to how it may impact your other assets.

Global 2.0 to 3.0: Reinvestment Drives the New Economy

The financial coup d’etat began with the re-balancing of the global economy in the mid-1990’s and ended with the bailouts and central bank QE-engineered shift of an estimated $40 trillion out of the industrial economy (Global 2.0) and into reinvestment in the networked economy (Global 3.0).

When this much money moves into a sector, it has a profound impact on all areas of income, employment and asset valuations. This is particularly true as new technology is spun off and integrated into related sectors. Indeed, why is the technology sector leading the stock markets?

The leading US coal companies experienced a 77 to 95 percent drop in their stock prices in 2015. Since May 31, 2008, Peabody Energy (a leading coal company) has fallen by 90 percent and Netflix has risen by 941 percent. This is what happens as new technology shifts from Global 2.0 to Global 3.0 and transfers income, employment and asset values, thereby creating highly divergent patterns in the economy.

Our economy is not collapsing – it is being re-engineered. The portion of our economy attributable to outer space is growing and the related shift of technology into many sectors of the economy is accelerating change throughout individual lives and communities. As this happens, portions of the industrial economy are, indeed, collapsing or “being collapsed.”

Conclusion

Think back to where we were in 1915. Think about what happened between that year and the year 2000. Pretty incredible, right? The 21st century will be no different. If anything, the speed of change and technological development will be even greater. I believe that one of these changes is that we will become a multi-planetary civilization. Some believe that we already are.

Understanding the space-based economy and how it is an organizing principle of the change unfolding will help you access the education and knowledge you need to identify areas of economic opportunity and income for you.

At a minimum, I hope that greater awareness of the space-based economy will help you better understand what is happening around you. This awareness will protect you from having your time and money wasted by misleading financial and political commentary. It will empower you to contribute in a manner which best serves your purpose and skills and to invest with a strategic appreciation of where global investment is flowing.

I also invite you to bring transparency to what is happening in the space-based economy and, in so doing, to open the possibilities for a more human, enlightened culture that nurtures real wealth, whether on Earth or beyond.

“We choose to go to the moon in this decade and do the other things, not because they are easy, but because they are hard, because that goal will serve to organize and measure the best of our energies and skills, because that challenge is one that we are willing to accept, one we are unwilling to postpone, and one which we intend to win.”

~ John F. Kennedy

2016: Get Ready, Get Ready, Get Ready!!!

This is going to be a hard year for many and an amazing year for some. Creative destruction will be growing in the economy as Global 3.0 rises and the unraveling and reorganization of the global political order continues. – 2014 Annual Wrap Up

Much of what I said in the 2014 Annual Wrap Up remains as relevant to 2016 as it was for 2015. So here are my very similar suggestions to energize your path forward!

1. Do a Backcasting

A backcasting is a planning approach in which a desirable future is created. Then planning works back in time from the future to identify the actions that connect it to the present. You define how you successfully achieved your goals, inspired by the assumption that you will indeed succeed.

Although a map of the world around you is invaluable, the most valuable asset you can have is a coherent picture of your purpose and how you will live the life you wish to create. When I was in Texas this year I met a man who had weighed 600 lbs. He looked like he had lost about 400 lbs. I asked him how he did it. Full of vitality, he said one word: “visualization.”

Use a backcasting to visualize the future that attracts you in a powerful way.

2. Use Scenario Planning

For managing time and money, I use scenarios with estimates of probabilities.

Avoid whole-hearted commitments to highly specific predictions of an economic and political future. Predicting the future is prophecy. There is no more dangerous approach than getting locked into a fixed view of the future environment.

Use your strategic planning time to explore how you will be successful in the face of primary trends and multiple future scenarios. Prepare emotionally and mentally for a variety of feasible futures. Within the resources you have available, prepare financially, too. Identify the opportunities and risks in all of your reasonable scenarios. Think about wildcards.

This prepares you to respond opportunistically as events in the world and markets evolve.

In our 2013 Annual Wrap Up, I said the probability of the slow burn continuing in 2014 was 80%. That was what happened.

Last year, I divided the slow burn into two scenarios for 2015:

- Volatile & Violent Slow Burn (50 percent likelihood)

- North American Renaissance Slow Burn (40 percent likelihood)

I pointed out that some of what you experienced depended on whether you were in an area experiencing 3.0 reinvestment.

The other scenarios for 2015 were:

- 2008 Redux (1 percent likelihood)

- World War III or Environmental Disaster (8 percent likelihood)

- Transformation (1 percent likelihood)

As things turned out, the leadership assessment that the United States would help lead the world out of recession did not materialize. Which meant fewer areas in the developed world felt the benefits of 3.0 reinvestment, whether in North America or elsewhere. If anything the dirty tricks flew to ensure that North America looked relatively good and the general population continued to support government as a result of concerns about terrorism.

While more violent than renaissance, the slow burn continued as the dominant scenario. I am using the same scenarios for 2016. Here are the probabilities I am using for my planning for 2016.Volatile & Violent Slow Burn (70 percent)The fights over natural resources will continue. Increased covert economic warfare is getting nastier. In this environment, powerful players are way too volatile and violent for life to feel like the slow burn of the last decade. Compounding the volatility, creative destruction is dramatically eroding the value of some companies while producing large values on others overnight.

Last year I asked you to prepare for the US Dollar Index to rise by another 10% to 25%. It rose by 9.2%. Expect a strong dollar to continue in 2016. The pressure to keep it from rising above 100-105 will be intense, so I expect it to end the year in or near 95-100.A continued strong dollar is putting numerous global dollar borrowers over a barrel, particularly among those who depend on commodities for their revenues.

The Fed will continue to raise interest rates quarterly. They will be prepared to turn on the QE tap if the problems with global liquidity indicate it is necessary.

Events will feel scary, but they will provide opportunities to shift assets into quality global equities as well as some commodities when the time comes – which may take until 2017. Successfully defining quality will not be easy-because quality includes Global 3.0 skills and resources.

A lot could fall apart, starting with relationships in the European Union and the US relationships with a variety of allies in NATO and around the world. US leadership will not inspire confidence at home or abroad. Americans will worry a lot about bank deposit insurance and the reliability of their pension funds and social security, but the chances of a widespread compromise of bank deposit insurance or corporate and municipal pension funds experience is unlikely in 2016.

However, after the US presidential election, we face more radical changes in the federal budget, which could entail significant impacts on taxation, assets and savings.

For 2015, I am assuming a 70% likelihood of a Volatile & Violent Slow Burn – that is up 20% from last year. Growing deflationary trends will inspire way too much in the way of false flags, terrorism and dirty tricks for things to be comfortable. Add mass migration in many areas in the developed world, and it is clear many areas will experience a difficult environment.

North American Renaissance Slow Burn (10 percent)

In this scenario, energy self-sufficiency and rebuilding the industrial base in combination with its geographic advantages permit the United States to allow the global unraveling to work to its financial and economic advantage.

Violent covert operations may be engineering events around the world but these actions will be limited in areas of North America critical to the Global 3.0 economy.

Many consumers benefit from deflationary forces-low-cost imports, lower energy prices and continued low commodity prices that protect against price increases of essential goods and services. New technology will add enormous productivity-although the benefits will accrue to shareholders and labor will experience continued stagnation or deterioration in real income. Immigration will address shortages of skilled labor, replenish intellectual capital and keep the “demographic winter” at bay.

Divergence in the economy will continue. The economy will be strong in areas enjoying Global 3.0 reinvestment and innovation in applied technology and weak elsewhere. The areas left behind will continue in an economic depression kept afloat by government subsidies. In these areas, life expectancy will continue to fall.

U.S. weaponry and military standing will make it possible for the U.S. to manage the Treasury and derivatives markets, despite market jitters and some unpleasant moments.

Re-engineering of the financial sector with online systems will continue to squeeze financial providers, fees and employment. Financial repression will continue to ensure successful management of retirement liabilities. It will be offset by an endless series of media stories regarding:

The strength of selected sectors in the US stock markets. Corporate profits will still struggle in the face of a rising dollar on exports and reporting of foreign income but health care, biotech and technology will continue to show relative strength as well as housing during a presidential election),

The accomplishments of American technology, and The success of young people and immigrants.

There will be no renaissance for the boomer generation and low-income Americans. The squeeze will be relentless for those who do not adjust to the new environment. The targeting of low-income people will continue to support a shift of government subsidies and housing to support immigrants and to ensure continued Republican success at the polls.

One of the tensions in this scenario will be between, on one hand, the breakaway civilization and the hidden facilities and governmental operations financed with the black budget and, on the other hand, the overt economy. How will Congress reengineer the federal budget in the face of the secrecy? This is one of the reasons that the long-term continuation of the United States as a unified political entity will continue to be questioned during 2016, renaissance or no renaissance.

Finally, the economies of the United States, Mexico and Canada will continue to integrate rapidly, financed in part by expanding access to US street drug markets by the Mexican drug cartels.

For 2016, I give the North American Renaissance scenario a 10-percent likelihood. That is a significant reduction from 40 percent last year. The difference is due to the continuing drop in income by commodities producers, the resulting problems in the bond and derivative markets and the general deflationary trends. Contributing to this is the inability of the leadership to manage the economy without covert violence and migration. Expect violence to increase in 2016, exacerbated by factionalism during the elections.

While this scenario may feel safer to some, it presents fewer global investment opportunities than the volatile and violent slow burn – which is another reason that the volatile and the violent is more likely to happen for now. Insiders make more money with volatility.

2008 Redux (7 percent)

The financial coup is over and the majority of the civil and criminal liabilities have been extinguished. This has left a variety of investment interests in a very strong position. Other than environmental or geophysical problems, there are few reasons why we would face a near financial collapse or collapse unless it is desired or the economic warfare gets out of hand. However, in that case, war is the likely scenario.

Figure a 7-percent chance of a repeat of the last financial crisis, an increase from 1 percent last year. This increase is attributable to obvious speed bumps we are hitting moving to a multipolar world and the number of events in 2015 that inspired me to state that numerous major governments and businesses were not under “adult supervision.” Donald Trump is reason enough for serious investors to pull their money out of investment in the United States.

Expect this probability to increase for 2017, after the U.S. Presidential elections.

World War III or Environmental Disaster (12 percent)

A globally devastating war is not in anyone’s interest. Neither is an environmental disaster that could destroy the viability of a large part of the planet. However, the proliferation of weaponry and the tensions in a world where markets increasingly adjust through violence (banker and natural doctor deaths) rather than price means that a nuclear war or significant EMP attack could happen as unraveling accelerates. Although I have no idea what the risks of devastating solar flares, space weather or weird weather are, the fact that there has been a trillion dollar global spraying program since the mid-90’s and too many unanswered questions about Fukushima have me concerned.

I give this scenario a 12% probability, increased from 8% last year.

The significant investment in finding viable planets and colonizing Mars indicates that the G-7 leadership appreciates that a 10-percent chance of such an event over a sufficient number of years can grow into an unacceptable risk.

While the probabilities of war or global disaster are not high in 2016, the chances of an interruption in services in local areas is high (power outages, weird weather). So, don’t laugh at the preppers. You want to have resiliency in your personal arrangements and disaster recovery plans for your home and business. Whether addressing disaster recovery, cyberhacking, fire and theft or increased regulatory enforcement, please keep excellent, multiple copies of your financial records.

If you are in an area experiencing heavy migration anticipate and be prepared to manage a higher level of petty and organized crime.

Transformation

A transformation in global spiritual and cultural consciousness could shift our entire outlook.

I give this scenario a 1% probability in 2016. That is the same as last year.

The likelihood of transformation will rise as the global unraveling of the current order continues and we discover that the only way to attract people and enterprises that practice the golden rule is to practice it ourselves.

So keep praying!

I encourage you to invent your own scenarios and welcome you to post in the comment section.

Dealing with the US Presidential Elections

If you are a US citizen, one New Year Resolution you should make for 2016 is to strictly budget the amount of time and money you spend on 2016 federal, state and local elections.

Let’s say you budget twenty hours for the year. Add a resolution to spend 80% or more of your time and campaign donations making sure you are registered and learning about and supporting great local candidates. Since real economic control is engineered one community at a time, your local, state and US congressional representatives are critical to your governance and the governance of the country.

Let’s say that leaves four hours for the presidential elections. Here are recommended guidelines to help you make a sound choice with that amount of time:

Guideline #1: Focus a Week Before

Decide as to whether you will vote and for whom in the week before the primary in your state and a week before the general election.

Guideline #2: Entry-Level Positions

The Presidency of the United States is not an entry-level position. Ignore any candidates without serious political and government experience.

Guideline #3: A Multipolar World Favors Youth

Anyone over 50-55 years of age has been trained to function in a uni-polar world. They do not have the physical stamina or practical experience to thrive in the multi-polar world now emerging. Choose someone who has the capacity to lead on the road ahead by eliminating anyone over 50-55 years of age.

Guideline #4

Now that you have simplified the choice by adhering to Guidelines #1-3, assess the character and history of the eligible candidates that remain. Look at the quality of the people they attract and hire. In addition to staffing the top positions in the Executive Branch, the next President is likely to lead the choice of 4+ nominees to the Supreme Court. Do they believe in and are they attracted to a successful future? Go to http://opensecrets.org and review their personal finances and campaign funding. While their policy statements and promises may be interesting, the reality is that the winner will adhere to what the machine and financial realities require of them once in office.

Risk Management: This is for all global citizens. Add one more action to your New Year planning. For your scenario planning for 2016, choose the two candidates whom you believe would be the very worst for the United States, for your country and for you and your family. Build a scenario for a victory for each of these candidates with the worst possible consequences. Now, prepare a plan for what you will do if that were to happen. Once you have a plan for the worst case, you can stop fretting about it. Fretting increases the chance that you will waste time on election coverage and its related media entrainment and subliminal programming. The actual results in November will tell you what you have to do to revise your plans between November and a January 2017 inauguration.

In 2016, use your precious time to build health and wealth for yourself and the people you love. Any attention you give to the 2016 US presidential campaigns (beyond that which ensures that you exercise your responsibilities as a citizen) is at best a distraction. At worst, it is an expensive drain and theft of your time.

Financial Markets

How do these scenarios and the presidential elections translate into expectations for the financial markets?

International Equity Markets

Expect Northern European markets to outperform US equity markets in 2016. Otherwise, opportunities in the G-7 and emerging markets will likely be spotty until the dollar reaches a top. At that point, there may be significant opportunities to shift to markets with lower P/E’s and greater long-term earnings and dividend growth potential.

Bank Deposits

As a practical matter, I am not concerned about the viability of the FDIC system. However, it is essential to ensure that you use banks that are financially sound, as bail-ins will happen on a limited scale. The chances of interest rates rising sufficiently to give savers a reasonable return are still remote in 2016.

Housing

In areas enjoying foreign investment or Global 3.0 investment, housing prices are going to continue to rise particularly in the United States during a presidential election. Make sure you do not get shut out of the market by waiting if you want to own a home.

US Stock Market

Last year, I said there was a good chance that the US stock market would continue to be strong, but it was unlikely to match the 2013-2014 performance. In fact the S&P ended slightly down for the year, which means returns were essentially limited to dividends. In 2015, dividends mattered. Expect the same in 2016.

I said that a 10 to 25% correction was long overdue, and not to be surprised if it appeared in 2015. It did.

I expect that the bull market in US equities is not over, but the market is not strong and we are in for more consolidations and volatility.

Stick with companies with strong leadership and balance sheets that provide useful products and serves in a productive way that can support ongoing dividends. Forget glamour and focus on solid fundamentals.

The application of new technologies have the potential to have a very dramatic impact in the equity markets over the next ten years, including a “crash up” scenario in which the major indices could double or triple.

This is unlikely in 2016, but keep an eye on the high tech sectors to see what develops and how it translates into new applications in traditional industries, such as self-driving cars or restaurants with robots and how that translates in equity shifts between Global 2.0 and Global 3.0 stocks.

In the first trading day of 2016, the U.S. market was down by 2 percent. However, the 3D printing stocks that had dropped significantly in 2015, were up 5 to 10 percent in the first day of trading.

Watch for lots more divergence in the equity markets in 2016.

Precious Metals

My comments are going to sound just like the last few years of Equity Market and Precious Metals Reports.

If the dollar remains strong, gold and silver will continue to be under pressure. If the gold price breaks below the $1,000 line it could drop as low as $700. That probably will not happen as physical demand in Asia and geopolitical instability has the gold pricing hugging a floor.

Physical demand is the reason why I believe the primary trend will reassert-but that could take a while. New technology could also throw a ringer into the mix. Expect gold to move lower in a crash up scenario.

In the meantime, hold your core position and appreciate that the chances of attractive precious metals investments in 2016 are currently small. If the volatile and violent slow burn gets violent enough, that could change.

3. Address the Risks

For those who live in the United States, we are managing serious risks that need to be addressed now on an ongoing basis. Each person’s circumstance is different, so adjust accordingly. Some of these risks will translate to the other G-7 nations.

Education

The US K-12 public education system is not preparing your children to compete in a global marketplace. You need to make alternative arrangements for your children and grandchildren. If you are unable to do so, you must aggressively protect them (at the very least) from what you believe to be unnecessary vaccine and other programs and from invasive surveys and online systems. Ensure that they will receive a real education at night or on weekends. Whenever possible, arrange opportunities for them to travel and to live abroad and to learn other languages. Also, make sure that they learn practical skills: how to fix a car, household repairs, how to make and build things, not to mention math and financial literacy.

Do whatever it takes to avoid student loans. From the time a child is born, organize Christmas and birthday presents to be contributed to a 529 plan or a savings vehicle. Have children live at home or work part-time. Teach them to save and invest.

Arrange for them to spend extended period outside the reach of smart phones, Wi-Fi and media that delivers entrainment and subliminal programming.

Software and Hardware

Trying to create privacy in this world is next to impossible. Nevertheless, appreciate that many information and communication systems are deeply compromised and do the best you can to protect your information and financial account access from identify theft and other forms of compromise.

Health Care

The health care system is diverging in quality and subject to increased regulatory controls that result in the promotion of therapies that may not be cost effective or ideal. You are going to need to be proactive to assume responsibility for your own health, to invest in building up your immune system and removing toxicity. Ensure that you have relationships with medical providers that you can trust. I continue to research medical tourism for options abroad.

Mobile Payment Systems

Ditto for mobile payment systems: be very careful. It’s Ok if they steal your Starbuck’s card, but not if they gain access to your bank account.

Fresh Food and Water

Get radical about ensuring your access to fresh food and quality food at affordable prices. This is the most important aspect of your health care.

Environmental Pollution

My two cents is that I am on a detox program that never ends.

Wildcards: 1-3 Months on Your Own

Have provisions and a plan for living for 1-3 months without power or well-stocked grocery stores. Keep redundant copies of financial records in safe places. Katrina can happen.

There is No “Away”

Your problems are not likely to be solved by going far away to a new place where you are a stranger. Yes, there are thousands of lovely places in the world, including ones where you can live at low cost in a healthier environment. They may work for you particularly if lower costs and a better health care plan will make a big difference. However, be careful about assuming foreign lands can solve your problems and do your due diligence of potential destinations carefully. The aspects of Mr. Global’s plans that we do not like are, in fact, global and, as tensions rise, you may not always be welcome.

Filter, Filter, Filter

This was important when I said it last year. It is even more important this year.

Take greater care with your associations: people, vendors, and partners as well as your sources of information. The times require much greater discernment in all things.

Associate with people who have high standards of person integrity. Ideally, they are also people who have a high immunity to entrainment and subliminal programing

Surrounding yourself with people who are competent and ethical in this environment could literally be the difference between life and death.

In Closing

You are safe when you are serving your purpose for this life and being useful to the people around you. So proceed to attract the future you have visualized and, in so doing, have a wonderful 2016.

Links

- Backcasting

- The Secret Space Program: For Solari Suscribers

- Workshop Report: How do I Live a Free & Inspired Life?

Vision 2020

In 2015, my goal was to live a “free and inspired life” and to help you do the same.

I was able to spend significant time abroad in 2015. I spent time working, speaking and traveling “down under” in Australia and New Zealand in the summer. I was in Europe for two months in the fall, in Italy, Switzerland, the Netherlands and Scotland. As I do every year I was able to drive the full length of the United States with multiple trips to both East Coast and West Coast.

Meeting and getting to know subscribers, clients and colleagues continued to offer fresh insights and inspiration.