![]() In our new audio seminar, Positioning Your Assets for Growth in Uncertain Times, among the many issues we address are one of the risks of holding your savings in a currency that is falling in value relative to other currencies and real things.

In our new audio seminar, Positioning Your Assets for Growth in Uncertain Times, among the many issues we address are one of the risks of holding your savings in a currency that is falling in value relative to other currencies and real things.

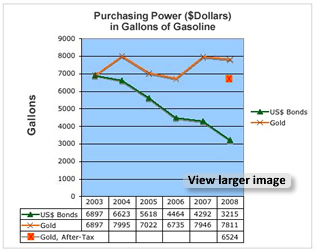

As an example, we show the cash flows of a 5% five-year corporate bond from 2003 to 2008. When the investor gets principal back in 2008, the dollar investment has dropped 50% in purchasing power when measured in the price of gallons of gas.

Now, let’s scale that up for an entire household. Let’s say we have a mother and a father, two children and an elderly grandmother living in the San Francisco Bay area. They have three checking accounts, with total balances of $5,250. The grandmother has two CDs at a local bank for an additional bank balance of $100,000 and the older child has a savings account of $75 from what she saved cutting yards during the summer and babysitting during the school year.

The couple has a 401k and an IRA. Among the assets held in these accounts are dollar- denominated money markets with another $20,175 as well as several dollar-denominated bond funds worth $70,000. They also share a brokerage account that has $30,000 in California municipal bonds and $23,000 in another money market account.

If you look at their collective wallets and the coin jar they have in the living room, they have another $500 in cash within the household. They also have reserves in some of their financing and vendor relations, including a $200 deposit with their utility company and an $800 balance on average in their mortgage reserve for taxes and insurance.

For simplicity’s sake, let’s say they have maintained these average balances from the beginning in 2003 to the beginning of 2008. That is, they have had $250,000 in dollar- denominated assets during this period that produce no or a modest income.

How much have they lost in purchasing power when we use gas as our currency instead of dollars?

They have lost approximately $250,000 of purchasing power in current dollar terms – a quarter of a million dollars!

That’s right. Whatever your average balances held in dollars are over the last five years, that is approximately how much you have lost in real purchasing power when we measure it in gallons of gas priced as of the beginning of the year. Of course, things are worse since then.

Does that help you understand why you are feeling drained?

This type of drain is part of a phenomenon we call the Slow Burn. We want to help you understand the Slow Burn and reverse the drain that a falling dollar is causing in your life. Remember – it is never too late to act!