By Matt Nesto

It’s official. Through the persistence of Bloomberg’s lawyers and the teeth of the Freedom Of Information Act we can now all add “Saint Omo” to our list of cool crisis acronyms that can impress (or scare away) people on the cocktail party circuit.

Saint Omo stands for the far less fun Short Term Open Market Operations, which was a lending entity dreamed up in the throes of the financial crisis, when Hank Paulson, Tim Geithner and Ben Bernanke were secretly bailing out a fleet of sinking ships as fast as they possibly could, and in ways and amounts never seen before.

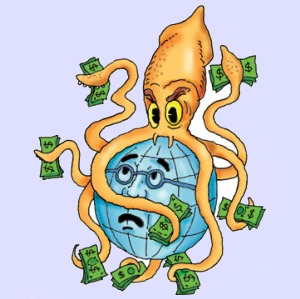

The latest revelation in this story is that Goldman Sachs (GS), enemy of the common man and vampire squid atop a cowering nation, imbibed itself on a $15 billion life line — the single biggest gulp of them all — and, of course, courtesy of Saint Omo, the Fed and therefore, us taxpayers.

Are you mad yet?