Monday, 7 April 2003, 5:16 pm

Column: Catherine Austin Fitts

Mapping the Real Deal…

The Real Deal About Enron

… an interview with Scoop Real Deal Columnist Catherine Austin Fitts

Part Three Of Seven Parts

By Daniel Armstrong*

Originally Published By Sanders Research Associates

[*Daniel Armstrong is a writer and novelist based in Eugene, Oregon. Mr. Armstrong is a graduate of Princeton University and attended the University of Oregon School of Journalism.]

If my years working on the clean up of BCCI and the S&L crisis taught me one thing that I would communicate today to the shareholders, retirees and employees who have been harmed, it is this: people like those on the board of Enron absolutely make money from insider trading, bid rigging and fraud, and they do so with help from the highest levels.

— Catherine Austin Fitts.

IMAGE: Enron

*************************************************

(Click Here for Part Two)

(Click Here for Part Three)

**************************************************

In Part One, we introduced Catherine Austin Fitts and described some of her experiences in taking on the criminal powers who lie behind the modern U.S. Governmental apparatus. In Part Two the interview transcript began.

DA: The law firm Milberg Weiss has a consolidated class action lawsuit against Enron management and directors in the U.S. District Court in Houston right now. The lead attorney William S. Lerach will charge certain Enron executives and directors, its accountants, law firms, and banks with violations of the federal securities laws and that they engaged in insider trading. [9] So Mr. Lerach is seemingly serious about this private investigation. Will the timing of the bankruptcy filing get in Lerach’s way?

IMAGE: DoJ – Department of What?

CAF: My best guess is that the bankruptcy filing has helped ensure that any monies laundered and/or stolen through Enron and the monies that investors made on the pump and dump of Enron stocks has had plenty of time to get away. The good news is that federal court’s dismissal of MorganChase’s fraud charges against its insurers may be just what Milberg Weiss needed to proceed against Enron’s complicit banks, attorneys, and CPAs. This could be the key to the recovery of billions for employee pension funds and other shorted investors here and around the globe. In the meantime, however, federal investigators are steadily chewing up time by slowly giving up or indicting Arthur Andersen, then others in Enron management. But the real bad guys are not in the management or Arthur Andersen. The real bad guys are the private investors, working through the banks or investment firms, who have already gotten their money out and so far are scheduled to keep it—and those members of the board, if any, who traded under third party names. These are the people and institutions who have the power to ensure that people like Ken Lay and Andrew Fastow are hired in the first place and who ensure that the right regulators are in place to ignore what is going on, perhaps even help it along.

*****************

Annual report 1999: [or a myth in the making . . .]

To Our Shareholders

Enron is moving so fast that sometimes others have trouble defining us. But we know who we are. We are clearly a knowledgebased company, and the skills and resources we used to transform the energy business are proving to be equally valuable in other businesses. Yes, we will remain the world’s leading energy company, but we also will use our skills and talents to gain leadership in fields where the right opportunities beckon.

In 1999 we witnessed an acceleration of Enron’s staggering pace of commercial innovation, driven by a quest to restructure inefficient markets, break down barriers and provide customers with what they want and need, when they want and need it. We reported another round of impressive financial and operating results. In 1999 revenue increased 28 percent to $40 billion, and net income before nonrecurring items increased 37 percent to reach $957 million. Our total return to shareholders of 58 percent was eight times higher than our peer group and almost triple the S&P 500 return. We believe the future will be even more rewarding. We remain the world’s leader in wholesale and retail energy services. Our new broadband subsidiary, Enron Broadband Services, is redefining Internet performance by designing and supplying a full range of premium broadband delivery services. The value of products bought and sold on our new eCommerce platform, EnronOnlineTM, is destined to exceed the value transacted on any current eCommerce web site. To reap greater growth and value in our traditional energy businesses without a parallel increase in capital spending, we have evolved into a series of global networks each of which is a leader in its specific region. These networks work our physical assets harder and drive more highreturn products and services into the market. We believe that our broad networks will give us unbeatable scale and scope in every business in every region in which we operate.

IMAGE: Jeff Skilling, President and COO; Ken Lay, Chairman and CEO; and Joe Sutton, Vice Chairman

The New Economy

When you define a New Economy company, you define Enron. A New Economy enterprise exhibits four traits:

1. Its strength comes from knowledge, not just from physical assets.

Enron has become a preeminent energy and communications company not only by building and con trolling physical assets, but also from our unique ability to add knowledge to those assets to create a marketmaking network, such as our electricity and natural gas markets in North America and Europe.

2. A New Economy player must operate globallyeffortlessly transferring ideas, people and services from region to region.

Our knowledge and expertise crisscross the globe. What we’ve learned about natural gas pipelines in the United States helps us build new natural gas markets in South America and India. Our knowledge of optimizing capacity in energy networks will allow us to revolutionize the bandwidth market.

3. New Economy companies understand that constant innovation is their only defense against competition.

Enron often introduces a product before the competition even senses a market exists. Crosscommodity trading, weather derivatives, energy outsourcing and 1999’s two major initiatives EnronOnline and Enron Broadband Services demonstrate our resourcefulness. No wonder a Fortune survey recently named Enron the “Most Innovative Company in America” for an unprecedented fifth year in a row.

4. Success in the New Economy requires the adroit use of information to restructure an organization and boost productivity.

The connectivity of our networks allows us to gather massive amounts of market data to provide instant market snapshots and to identify emerging trends. This information is available to, and accessed by, every Enron marketer and originator in every part of the world, ensuring that we make informed moves and spot opportunities at the first possible moment.

The fluidity of knowledge and skills throughout Enron increasingly enables us to capture value in the New Economy.

*****************

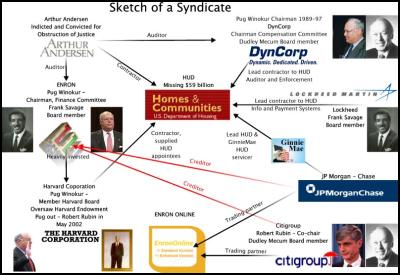

IMAGE: Sketch Of A Syndicate

Graphic: J. Ward

DA: So Ken Lay’s not one of the big guys?

CAF: As far as I’m concerned, Ken Lay was just the lead patsy. We’re talking about a top ten Fortune 500 company with annual revenues exceeding $100 billion—which suddenly fell off the map. What the Enron CEO’s made was nothing compared to what the insidetrading investors made—both with corporate assets liquidated out before the implosion or in the pump and dump of stocks. And many of these investors look to be from the same syndicate that I saw playing the IranContra/S&L game in the eighties.

DA: “Syndicate.” Now there’s a loaded word. Webster’s defines a syndicate as “an association of bankers, corporations, etc, formed to carry out some financial project requiring much capital, especially to gain control of the market in a particular commodity.” Sounds quite like Enron’s position in the energy market. Can you be more specific about this syndicate you just referred to?

CAF: Sure. Let’s see what Milberg Weiss uncovers. But in testimony already, former Chief Accountant of the SEC, Lynn Turner, offered that these banks and investment banks “shopped their structured finance vehicles” around to other corporations. Turner indicated that in one case where the SEC was able to intercede on his watch, a bank had people sign privacy agreements as not to divulge details of the scheme proposed to regulators and others.

DA: Then these are the kinds of linkages we’re looking for—the little private “courtesies” that quietly make the syndicate a whole. What about the investors working through these banks—are they the bad guys you keep referring to? Who are they?

CAF: I don’t believe it’s appropriate to throw out names here—without lengthy explanations and qualification. To understand how the investors use interlocking corporate designs and trusts to protect themselves, I recommend going to Linda Minor’s series Follow the Yellow Brick Road: From Harvard to Enron (http://www.newsmakingnews.com/lindaminor/lm3,19,02harvardtoenron,pt1.htm) or Pete Brewton’s book The Mafia, CIA, and George Bush or Truell and Gruwin’s book False Profits—also Tom Flocco’s work on Harken Energy helps.

IMAGE: Cover Image “The Mafia, CIA, and George Bush ”

DA: Then these networks of investors, which in no far stretch of the word are syndicates, they are the ones protected by the mishandling of the investigation?

CAF: They will try to get away with the money, yes. And all the right documents may have already been shredded to ensure that—which takes us to the fourth step: You never permit shredding of documents. There are lots of different ways to work with the attorneys, the accountants and other people to ensure that shredding doesn’t happen. Not only has it happened, but also Arthur Andersen and Enron have admitted to what appears to me to be criminal obstruction of justice, by shredding the documents. This is even more shocking because of the government’s right to assert control over any federal contracts and seize government payables owed to the guilty parties. Enron, since 1997, has enjoyed substantial federal contracts, and Arthur Andersen enjoys very significant and sensitive federal contracts. Those contracts can be cancelled at the convenience of the government, and it can be done within the space of 24 hours. I have direct experience with the government doing this.

DA: That is, when your company Hamilton was being investigated?

CAF: Precisely. Which moves us along to the fifth step: You assert control of all the company cash, both onshore and offshore. Because of laws passed in connection with the War on Drugs and related money laundering and RICO laws, the Department of Justice and the US Treasury have developed an extensive infra structure dedicated to seizures of cash and other assets—both company and personal—in situations where fraud is indicated. Typically, proof of fraud or an indictment or a conviction is not required. Indeed, as I just said, I have personal experience with the Department of Justice asserting rights of seizure against company and management and board member’s personal assets when their own investigators have determined that there is no fraud and the parties are entirely innocent. Hence, this is an area where law and practice combines to make it possible for the DOJ to seize cash and assets aggressively when they want to. Investigators used the mere possibility of fraud as a pretext to demand control of all Hamilton records. Notwithstanding indisputable evidence of fraud, no reports indicate actions by the government to seize any records or offices from Enron. We have to wonder why? When Manuel Noriega was sent to jail, my understanding is that we used PROMIS software system to sweep offshore bank accounts and seize back $2 billion of his money. The technology here is important. Tools like PROMIS software and “Echelon” under the control of the DOJ and NSA and other military and intelligence agencies have the capacity to track and identify worldwide bank deposits and flows and to transact through bank settlement systems to effect seizures.

DA: Thus operationally we have the capacity to track Enron’s bank transactions and take back significant monies and haven’t?

CAF: I have been told that the congressional audit teams have preserved some settlement system records. However, I am skeptical. The proof is in the pudding. A year has passed. Where is the money? The failure to assert control of the records and money for this length of time can only be a cover up.

***********************

In Part Four the interview continues and we meet one of the most interesting characters in the Enron saga, Smug Pug The Cancer Man, Aka Herbert Winokur, former doyen of Harvard. Part Four

***********************