By Catherine Austin Fitts

Yesterday, Rawesome Foods in Venice, California was raided by a Los Angeles swat team. Several people were arrested.

There are numerous unanswered questions about why.

Nearby, at Whole Foods in Venice it was business as usual. Indeed, having just agreed to “co-exist” with GMO food, they should be enjoying a regulatory honeymoon.

Yesterday, Whole Foods’ stock closed at a price earnings ratio of 34.34X. That means that for every dollar of profit, their stock market value goes up 34.34 times. So $1 of profit on sales generates $34.34 for all investors. If an investor owns 10% of the stock, then each additional dollar in profit will increase their stock position value by $3.43.

[click on the image for a larger version]

This means that if the Rawesome club members switch their purchases to Whole Foods, depending on the amount of sales and relative profit margins, a corporation trading at that multiple should get in increase in profits that translates into as much as a $1-2MM increase in their total stock market value.

This means that for every 100 small businesses you can shut down in your market area across the country, a corporate grocery store trading at that stock multiple can get a pick up of, say, up to $100MM-200MM in stock market value. If you own 10% of the shares, you can enhance investor value by $10-20MM.

What this means is that one way for investors in corporate food companies to ensure healthly stock performance in a recession is to arrange complex laws and regulations and selective enforcement that force the small companies out of business. This will be touted with notions of “helping” the consumer through “food safety.”

They can fund the costs of lobbyists and political donations from their capital gains on their stock — another reason why it is so important to keep the tax rate on capital gains low. Traditional capital gains on real estate and stock is the largest source of political contributions.

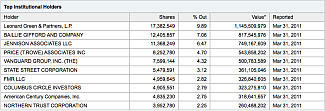

Here are reports from Yahoo Finance and from the Whole Foods annual proxy regarding their largest investors:

Top Institutional Holders

[click on the image for a larger version]

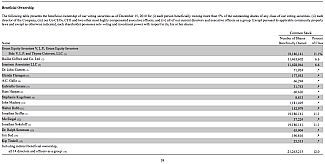

Whole Food Market Inc. – Proxy 2011

[click on the image for a larger version]

Interestingly enough, the largest investor in Whole Foods is a private equity group in Los Angeles. Perhaps the Rawesome club members should open up a dialogue with them about how to reengineer the food financial ecosystem and preserve food freedom. With 10% of the stock, the largest investor, and in turn their investors, stand to benefit if the Venice community is afraid to shop outside the corporate model or has no where else to go. Alternatively, if they participate in the early equity in a community venture fund, perhaps they could make more money on a community where small enterprise thrives and people are free to choose the food they prefer.

Leonard Green & Partners, L.P.

It does make you wonder what promises Whole Foods or their investors received in exchange for promoting GMO co-existence.

More on the events at Rawesome tonight on The Solari Report with Sally Fallon of the Weston Price Foundation.

Take Action:

Farm-to-Consumer Legal Defense Fund

Solari Report Blog Commentaries:

The Organic Elite Surrenders to Monsanto: What Now?

(28 Jan 11)

Related Reading:

Dirty Secret Behind Rawesome Raid

Jon Rappoport’s Blog (7 Aug 11)

Rawesome Raid: Federal Agents Arrest Owner, Dump Food

Huffington Post (3 Aug 11)

Breaking News: Multi-agency Armed Raid Hits Rawesome Foods, Healthy Family Farms For Selling Raw Milk and Cheese ?Natural News.com (3 Aug 11)

Rawsome Foods Raided AGAIN by SWAT

Food Renegade (3 Aug 11)

Government Agencies Raid Venice Food Club

l. a. activist (10 July 10)