Given the interest in the housing and mortgage bubble, here are links to introduce leading institutional players in the governance, regulation and credit guarantee/enhancement of the US mortgage market.

As the housing and mortgage bubble was a component of the “strong dollar policy,” the same players are also present in the other components, including the suppression of the gold price (a necessary step that preceded this bubble as the suppression of the gold price turns off the financial “smoke alarm”) and the refusal to produce audited financial statements for the US government from fiscal 1995 to date (as required by law) thus allowiing trillions to go missing from the US government.

INTERNATIONAL

UNITED STATES

Federal Reserve System

Federal Reserve Banks

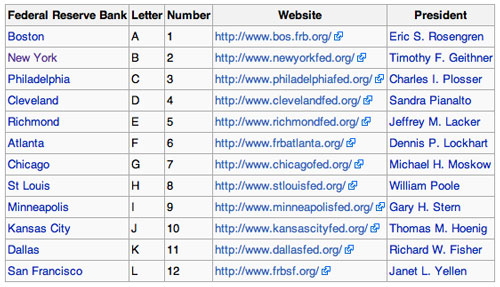

The Federal Reserve Districts are listed below along with their identifying letter and number. These are used on Federal Reserve Notes to identify the issuing bank for each note.

[Live chart available at Wikipedia]

Federal Reserve Bank of New York

Federal Reserve Bank of New York (Depository to the US Government)

Selected New York Fed Member Banks

To see top equity shareholders, a teriffic reader has provided the following:

The Great Dragon (Ownership/Control of a Publicly-Listed Corporation)

US Government

The Exchange Stabilization Fund

US Department of Housing and Urban Development

Office of Federal Housing Enterprise Oversight

Federal Housing Administration

Veterans Administration Loan Guarantees

US Department of Agriculture – Rural Development and Farmers Home

Congress

Authorizing Committees

House Committee on Appropriations for:

Senate Committes on Appropriations for:

Government Sponsored Enterprises

Government Sponsored Enterprises

To see top equity shareholders, a teriffic reader has provided the following:

The Great Dragon (Ownership/Control of a Publicly-Listed Corporation)

Industry Associations

National Association of Homebuilders