“When we took over berkshire, berkshire was selling at $15 a share and gold was selling at $20 an ounce. And gold is now $1600 and berkshire is $120,000. but you take take a broader example. if you buy an ounce of gold today and you hold it for 100 years, you can go to it every day and you could coo to it and fondle it and 100 years from now, you’ll have one ounce of gold and it won’t have done anything for you in between. You buy 100 acres of farm land, it will produce for you every year. You can buy more farmland, all kinds of things. And you still have 100 acres of farmland at the end of 100 years. You could buy the dow jones industrial average for 66 at the start of 1900. Gold was then $20. At the end, it was 11,400, but you would have gotten dividends for 100 years. So a decent productive asset will kill an unproductive asset.”

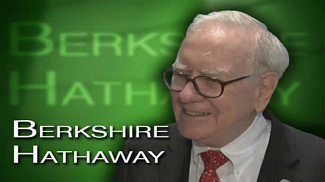

Warren Buffett, explaining his position on gold at 2012 Shareholders Meeting in a subsequent interview.

Related reading:

Financial Face-Off: Warren Buffett Vs. Gold and Silver

Yahoo Finance (8 May 12)