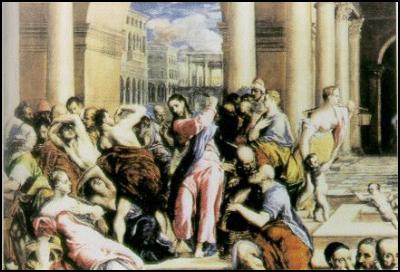

out them that sold and bought in the temple, and

overthrew the tables of the money changers”

~ Mark 11:15

Jesus and the Bankers

I think of Jesus as a real deal kind of guy who always cared deeply about his fellow man. That’s why we often ask “What would Jesus do?” when looking for the action of highest integrity. It is worth revisiting the story of what got Jesus killed. He stood up to the folks who controlled “the money.”

Jesus acted with ferocious and bold integrity when he threw the money changers out of the temple. Needless to say, he hiccuped their cash flows on what otherwise would have been a big grossing day. Their business model threatened, the priests who managed the money changers insisted that the Romans crucify Jesus. The Romans tried to pawn the problem off on the local king, Herod, who ducked and sent Jesus back to the Romans. The Romans, still looking for a way out, tried a flogging. That did not work. The priests meanwhile had succeeded in persuading the crowd to support them and scapegoat Jesus. Thirsting for a crucifixion, the crowd voted to set the criminal Barabbas free instead of Jesus.

Jesus died because the crowd voted for the criminal enterprise. The crowd voted for the priests and their rich endowments and their alliance with the money changers. The crowd did not ask “Cui Bono?” which is Latin for “who benefits?” If they had, they would have seen the real deal on who was making money on the death of Jesus and voted with their conscience, and for their own best interests instead.

Looking around today, it would appear that more than two thousand years later our popular vote is still backing an unholy alliance of “priests” and their rich endowments,“money changers” (now called central bankers), criminal enterprises and the continuous growth of dirty money, market manipulation and warfare.

It’s 2000 Years Later and We’re Still Supporting the Criminals

In 2000, I made a presentation on the subject of “dirty money” to a wonderful group of about 100 people gathered outside of Philadelphia to affirm and explore their commitment to the spiritual evolution of our culture. During my talk, after walking the group through an analysis of the enormous profits generated by narcotics trafficking, financial fraud and other types of organized crime, as well as the reinvestment of this money in the stock market and campaign war chests, I asked the members what would happen to the stock market if we decriminalized or legalized drugs and thus seriously adversely affected the narco profiteering business.

The stock market would crash, they responded.

What would happen to the government’s ability to borrow more money to finance the deficit if we enforced all money-laundering laws and, as a result, $500 billion to $1 trillion of annual laundered funds no longer moved through the US banking system?

If the government could not finance its operations by borrowing money at low cost, their taxes might go up. Worse yet, their government checks might stop as government program expenditures were cut, they said.

I then asked them to imagine a big red button at the front of the lectern. By the power of their imaginations, if they pushed that button they could stop all organized crime and money laundering in the United States.

Who would push the button?

Only one person in that audience of 100 people committed to spiritually evolve our society said they would push the button.

Upon reflection, 99 would not. I asked why. They said that if they pushed the button, the value of their mutual funds would go down, their taxes would go up and their government checks might stop.

I commented that what they were proposing was that an entire infrastructure of people continue to market hard narcotics to their children and grandchildren to maintain the value of their mutual and pension funds.

They said, yes, that was right.

Such popular support for cheap financing from dirty money goes well beyond this candid audience.

Each dollar we deposit, invest, donate or spend is a choice of what grows strong in the marketplace. We can finance the temple priests or we can instead choose leaders and businesses that demonstrate through their daily transactions and decisions that they truly care. What an enormous opportunity we have, if each one of us will switch our personal decisions and transactions.

Before we choose which banking and other financial institutions to support in the future, let’s take a quick look at big banking today.

Stealing Our Money

Increasingly, our US government assets are being transferred or outsourced to global private interests – typically at below market values that constitute windfall profits for undisclosed private investors. For example, the US Department of Housing and Urban Development (HUD) routinely resolves defaulted mortgages using methods that generate significantly lower recovery rates than is standard in the mortgage industry. This effectively amounts to a back door transfer of billions of dollars to special interests from all homeowners who bought Federal Housing Administration (FHA) mortgage insurance to finance their homes. As government mortgage guarantees encourage financial institutions to stop caring about the health of a place, the real estate values and community safety in neighborhoods throughout America decline, with more neighborhoods experiencing deterioration of services such as schools, along with a rise in criminal activities such as narcotics trafficking.

As neighborhoods experience more foreclosures and longer periods when foreclosed homes are empty, the value of surrounding homes and properties suffer further. Such practices are a part of engineering an enormous, fraudulent housing bubble.

Examples abound on the international playing field as well. BBC reporter Greg Palast’s revelations about the reasons for the resignation of World Bank executive Joe Stiglitz have exploded the myths about international privatization, describing the IMF and World Bank roles in forcing below market transfers to Enron, such as the water system of Buenos Aires and the pipeline that runs between Argentina and Chile.

Harvard University, funded as a financial advisory contractor under contracts between Russia and the US Agency for International Development, arranged auctions of Russian government-owned companies to international investors, including members of the Harvard network and its endowment, at below market prices. After this process of “privatization,” the number of people living in poverty in the former Soviet republics rose from 14 million in the early 1990s to 147 million. In the meantime, Harvard’s endowment — compounding at tax exempt rates — exploded in value from $4 billion to $18 billion.

Meanwhile, these same global private interests are transferring their liabilities back to government. When government contractor employees engaged in sex slave trading with local mafia in Eastern Europe or use the War on Drugs as a pretext to grab land for rich investors and local elites in Latin America while being paid from government contracts, the reputation, pocketbook, and spiritual health of America suffer along with the intended victims.

Meanwhile, there is approximately $4 trillion missing from our government accounts. This translates to approximately $14,000 per American resident. To date, under four Treasury Secretaries, the federal government has failed to comply with the laws requiring audited financial statements, and failed to make any significant effort to find or get back the missing money. Where is all this money going, and who/what is being hurt in the process? What does this mean to the environment, current citizens and future generations who are footing the bill?

The answer is that innocent people around the world are assuming those liabilities. And the leadership within the banking system is in charge day-to-day of implementing the majority of these transfers.

The US currency is managed by the Board of Governors of the Federal Reserve System, itself comprised of twelve privately owned Federal Reserve Banks, including the Federal Reserve Bank of New York, which in turn serves as depository for the US government bank accounts. The member banks that own and control the individual Federal Reserve Banks have received extraordinary credit and information subsidies through the governmental apparatus.

If you review a list of the leading banks in the Federal Reserve System that are involved as depositories, trustees, servicers or securities dealers in the US agencies missing more than $4 trillion:

- It’s the same banks whose names appear in allegations of gold market manipulations.

- It’s the same banks whose engineered Enron offshore deals.

- It’s the same banks implicated in 9/11 profiteering.

- It’s the same banks implicated by the big narcotics and arms trafficking and money laundering allegations.

- It’s the same banks implicated directly or indirectly in the “pump and dump” and naked short selling stock market schemes.

- It’s the same banks implicated in black budget government contracting and collateral schemes and the fraudulent asset stripping of our great manufacturing enterprises.

- It’s the same banks that are managing the huge derivative positions that are increasingly used to manipulate markets and drive monetary and fiscal policy.

- It’s the same banks whose senior management, attorneys and accountants cycle in and out of the top government jobs at the agencies missing $4 trillion.

- It’s the same banks that tell you that small business loans are not good business.

Banking Over Lunch

In 1993, in an attempt to obtain a small business loan for my business, I had lunch with the head of corporate lending in the DC area from a large multinational bank. He explained that his bank had no plans to make small business loans of any meaningful volume in the District of Columbia.

I had checked the bank’s latest SEC filings that morning. It had approximately $110 billion in long Treasury bonds on its balance sheet.

Essentially, the American taxpayers were providing this bank with the mechanism to borrow short term at a low price using the credit of the American people through federal deposit insurance, and then use those funds together with our deposits to lend those very same funds to our government long term at a 550 basis point spread. The bank had a recourse guarantee of our taxpayer credit by investing in US Treasury securities which are guaranteed by the full faith and credit of the US government, and refused to lend to my small business because it was not good enough business for the bank.

I estimated that this particular bank would reap $6 billion in risk free profit that year alone by inserting itself as an unnecessary intermediary — between businesses and individuals as depositors and guarantors, and the very same businesses and individuals in their capacities as US taxpayers financing the US Treasury “deficit.” The net result was that my taxes were financing my government “funneling” billions of dollars in back door profits to large banks, while I and my fellow citizens who were backstopping the FDIC and US Treasury credit that made it all possible were forced to go elsewhere to finance our small businesses.

To add insult to injury, government leaders such as Bob Rubin (former Treasury Secretary now co-head of CitiGroup) and Franklin Raines (former Director of the Office of Management and Budget and now Chairman of Fannie Mae) have explained that the government could not afford to finance parks, roads and schools because, instead we needed to pay the interest on the growing national debt. In fact, the “national debt” argument was a ruse. The actual intended use for American taxpayers’ hard earned money dedicated, nominally, to “reducing the national debt” was the financing of billions dollars of back-door, rigged subsidies to banks and mortgage market players who have made Rubin and Raines so rich.

And why should your children have to sign up for military service just so they can pay off their student loans, while at the same time $4 trillion is missing from the US government? Why can’t your children’s educations be financed by our tax dollars? Investing in education is the best thing we can do for our economy. Indeed, Peter Drucker notes that the GI Bill was perhaps the most profitable taxpayer investment of the 20th century. Why should you lose your home or small farm to foreclosure by the banks that are complicit in $4.4. trillion missing from the federal government? Are you earning 2% on your bank certificate of deposit while your neighbors are paying interest at 18% to Citibank or the IRS?

Who’s Who on Outsourcing Our Jobs

I would also look at withdrawing support from those banks involved in outsourcing jobs to other countries while withdrawing financing for jobs in our communities. Enticed by significantly lower tax burdens and labor costs, as well as a free reign in labor exploitation, more and more companies are exporting job exports while supporting policies that prevent the creation of new jobs and growth of small business domestically.

On one hand, many Americans are losing their jobs and either have no means of income or support, or they settle for reemployment at wages insufficient to make ends meet. Their communities are suffering diminished quality of life from lower tax collections, higher crime rates, decreased health, low morale and the family and community problems that unemployment and underemployment cause.

On the other hand, their lucky neighbors who still enjoy nice incomes – often coming directly or indirectly from the profits of outsourcing — promote the notion that such outsourcing is the natural flow of free markets optimizing economic performance. Alas, I wish it were true.

Analysis of the financial institutions that are the power behind the throne at the New York Federal Reserve and the US Treasury reveals a pattern of dirty tricks to: (1) stop policies that would permit the US work force to reengineer their skills; (2) prevent the flow of equity capital to small business; (3) subsidize themselves with insider trading and risk free federal credit profits; (4) maintain complicity in the trillions of dollars missing from the federal government; (5) prevent place based transparency of government budgets and credit activity that would reveal their complicity; and (6) use government contracts and subsidies to finance the creation of foreign capacity for outsourcing.

This is not free markets at work – this is the use of insider dealings based upon a corrupt campaign finance system, and misuse of the federal credit, not to mention black budget and covert operation activities, to profit from the destruction of markets.

This first hit me several years ago when I was working in an official capacity for HUD and had experienced first hand the affects of fraud and corruption. A Congressional staff member told me, “HUD is being run as a criminal enterprise.” Indeed, in fiscal 1998 and 1999, $17 billion and $59 billion respectively were officially reported as missing from HUD.

I realized then that I was banking at the same banks I believed to be intimately involved in running HUD’s extra curricular activities. I realized that my own banks and others that I had done business with were directly or indirectly costing me and my family a small fortune when I took into account my relationship with them as a citizen and taxpayer and their role as depositories and servicers for my government’s financial dealings.

It seemed to me that the least I could do was to try to clean up my own money. I decided I would learn how to “vote” with my money in the marketplace with all my transactions, including purchases, investments and banking relationships. I would start by withdrawing my money from the banks that were running my government’s bank account and securities operations in a corrupt manner at great expense to my family and me. I would shift my deposits to banks and companies that were trying to do something beneficial on Main Street.

I closed my accounts at Citibank and JP Morgan Chase and moved my bank deposits to a community bank.

If Acting With Your Conscience Isn’t Enough, Consider the Pricing

Since that time I have traveled around this and other countries speaking and networking with thousands of people. What I hear wherever I go is that we are choosing in the marketplace to bank with the very banks whose actions we say we detest.

How many times have I heard activists tell me that they cannot switch their bank accounts to well-managed local banks because their ATM fees would increase or their interest on savings would decrease? Apparently, we are prepared to finance and support a group of banks complicit in stealing $14,000 per American resident from the federal government so long as they kick back $25 a year to us in the form of saved ATM fees and incrementally higher interest rates. It’s one thing to be apathetic and go with the convenient flow of dirty money. It’s another thing entirely to fail to price your kickback at anything close to a free market level. If someone steals $14,000 from you and then kicks back $25, do you continue to support them? Apparently, the answer is “Yes.”

The day we understand the power of our opportunity to decentralize and “re-price” our banking business by taking it away from the Wall Street banks listed above, and banks like them, something magical can start on Main Street.

Care to Join Me in Switching Banks?

On July 4th, 2004, my colleagues and I are calling for 600,000 people worldwide to join us in closing our checking accounts, certificates of deposit, credit cards and other business out of the banks complicit in dirty money scandals and moving them to local, well-managed, community-friendly banks, savings and loans and credit unions.

Why 600,000? We estimate that 600,000 is 1% of 1% of our worldwide population. Since our financial system is highly leveraged, a relatively small shift (on the order of 1% of 1%) in customers from big banks to local financial institutions can cause a dramatic decentralization in political and economic power.

As a former partner and member of the board of directors at a major Wall Street investment bank and then Assistant Secretary of Housing in the first Bush Administration, I am amazed when people tell me that they feel helpless or that they have no power. I know from personal experience that we have significant power as depositors to impact the policies of financial institutions that exercise so much control over our government and communities. I know what can happen the minute even a small group of consumers starts shifting our deposits in the marketplace.

I also know that we can actually make money by “pushing the red button.” In financial terms, if we finance communities with equity while we bring transparency to government investment by place, and reengineer that investment to ensure optimal human and financial performance both by place and by function, we have the potential to bring the US economy back to a significantly more productive level. In layman’s terms, if we shift our purchases, banking and investing to the local level, change how small businesses and farms get financed, and at the same time transform how government money is invested at the local level, we can transform from an economy that is shrinking total wealth to one that is building new wealth.

That means we can pay off, convert to equity and eliminate or forgive significant amounts of debt and cleanse our system of governance of the dirty money that is draws us into war, environmental damage and a reduction in our Constitutional freedoms.

Let’s Start Now

Whatever your spiritual, moral or ethical practice, my colleagues in Solari and I invite you to make a commitment to start now to “vote” with your bank deposits for the values that you wish to govern our world and to do so in a manner that enhances your personal financial security.

If you are a Buddhist, ask yourself, “Where would the Buddha bank?”

If you are a Muslim, ask yourself, “Where would Mohammad bank?”

If you are a Confucian, ask yourself, “Where would Confucius bank?”

If you practice Judaism, ask yourself, “Where would Moses bank?”

If you are a Christian, ask yourself, “Where would Jesus bank?”

Whatever your spiritual or ethical tradition, ask yourself where the person of the highest integrity in history would bank if he or she were alive today.

Then look in your wallet and in your checkbook and ask yourself if you have an opportunity to choose with your banking business to build a better world.

Imagine the magical things that can happen when we take the time to understand and cleanse our own money. Imagine how magical things could be when enough of us tip the scale to the point that shareholders of the largest banks insist that these banks should cleanse their money and operations to win back our business or the business of the companies we also pressure to switch? Indeed, feel free to buy a few shares of their stock so that you can go to their annual meetings and express yourself on these matters of vital interest to all of us. Let’s welcome financial leaders to join us in devising ways to generate new profits and capital gains with clean money and honest values. We invite everyone big and small to participate in a new way of doing business.

Until that time, we look forward to the energy that can be created on Main Street when the honest bankers and credit union leadership and their investors and supporters who have been struggling to attract our business can start to enjoy the fresh new resources that come their way as we shift our deposits and our attention. Imagine their delight at having the resources they need to revitalize struggling small businesses and incubate new startups. Can you imagine what happens as we start to create a new generation of banking leaders who can make money from bringing some good old fashioned transparency, accountability and integrity to our financial system?

Is switching our banking business enough to fix all our problems? No. Are their many additional things we need to do? Yes. However, I invite you to begin our journey of change by switching your financial and market flows back into the hands of those we can trust.

Where would Jesus bank? You decide – then act!