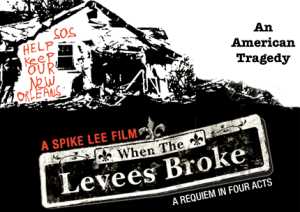

I just watched Spike Lee’s documentary about the floods in New Orleans during the aftermath of Hurricane Katrina.

There is a lot that has gone unexplained about what happened in New Orleans, including the poor condition of the levees and why they did not hold up when the force of Hurricane Katrina missed the city.

The significant mortgage fraud plaguing New Orleans at that time is not mentioned. No connection is drawn between the ethnic and economic cleansing and how it may relate to efforts to keep the subprime mortgage market afloat in 2005. I am suspicious that there is one.

New Orleans was one of the most concentrated areas of FHA/HUD mortgage fraud. A national emergency in that area could have been used to write off significant mortgage losses into the FHA Funds. I assume the same is true for Fannie, Freddie and numerous securities pools.

I mention this because areas of concentrated mortgage fraud have a habit of experiencing fires, floods, riots and other disasters. I have come to suspect these events covertly clean out the accumulated liabilities of the last round of black budget mortgage and mortgage securities fraud.

This is why you should care about whether mortgage fraud is occurring in your community. Not only will it eventually harm your property values and increase your property taxes, it can literally kill you.