View the Money & Markets Presentation

ARVE error: The [[arve]] shortcode needs one of this attributes av1mp4, mp4, m4v, webm, ogv, url

Read the Transcript

Read the transcript of Precious Metals Market Report with Franklin Sanders (PDF).

Listen to the Money & Markets MP3 audio file

The Solari Report 2013-11-14

Listen to the Interview MP3 audio file

The Solari Report 2013-11-14

Listen to the Complete MP3 audio file

Subscriber Resources:

Government Debt and Household Debt Vs. GDP

Gold Spot Price: Seasonal Monthly Performance

Related:

What Percentage of My Assets Should I Hold in Precious Metals?

” Everyone has a plan until they get punched in the face” ~ Mike Tyson

By Catherine Austin Fitts

This week on The Solari Report, we will post my Precious Metals Market Report interview with Franklin Sanders of the The Moneychanger. Given recent events in the precious metals markets, we have a lot to cover, including a wealth of questions from subscribers.

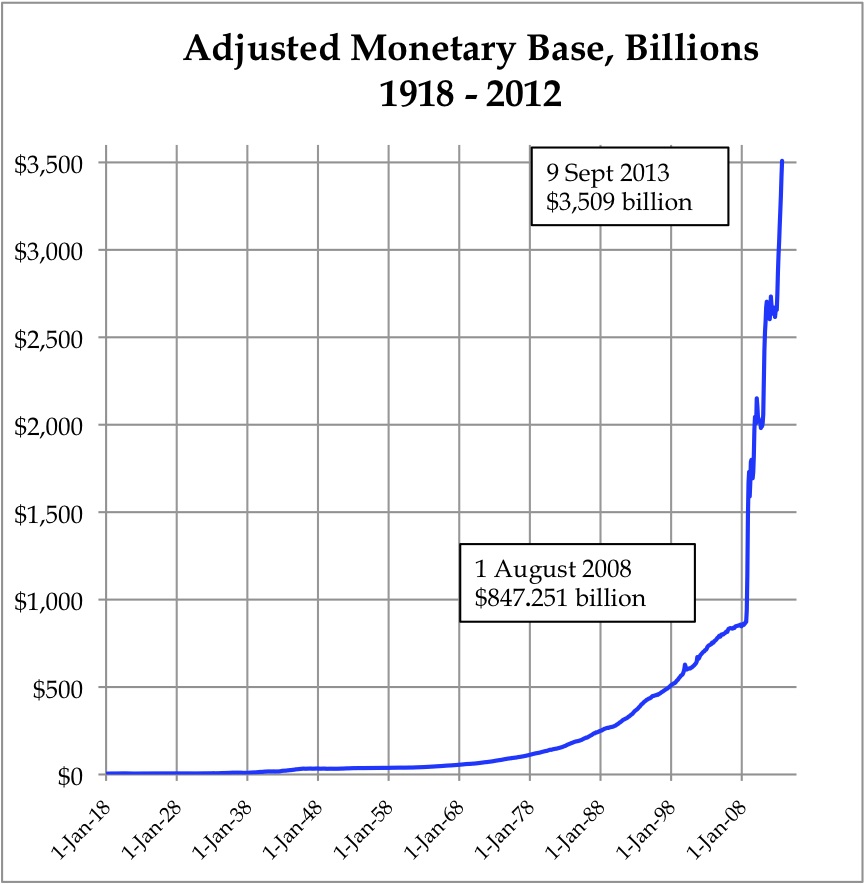

Increases in the the monetary base over the last five years have not resulted in hyperinflation. The dollar remains relatively strong and the “slow burn” scenario continues for now.

Can this continue? What are the deflationary forces at work? We will discuss the possibilities ahead. Look for the charts in your subscriber area and keep those great questions coming!

In Money & Markets, I will cover geopolitics and current events in the financial markets.

In Let’s Go to the Movies, I will discuss a new documentary Terms and Conditions May Apply about user service agreements on social media and online services and the conversion to social financial control by a partnership between these services, governments and the large financial institutions. The slow burn scenario depends on exactly this type of invasive intelligence. This documentary provides an important piece of the puzzle.

[arve url=”//player.vimeo.com/video/75993946″ width=”325″ height=”242″ webkitallowfullscreen mozallowfullscreen allowfullscreen>

Talk to you Thursday!