By Chuck Gibson

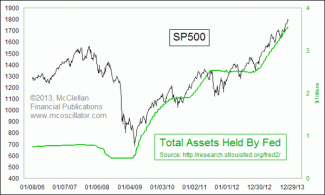

At the start of every year I like to take the time and sketch out a game plan for the year. Part of that includes identifying major areas of risk and creating a mental game plan on how to respond. Two weeks ago, I identified interest rates as being one of my major concerns. When I speak of interest rates I am really speaking of the FED as their open market operations add or subtract to the economic liquidity which helps set interest rates. Its this liquidity (either too much or little) not only has the effect they desire by controlling interest rates but an unintended consequence is its indirect effect on the prices of other assets, such as stocks. So when I hear the FED is reducing liquidity I become concerned as this move in the past has been the catalyst for a market correction. An article from one the Fathers of technical analysis, Tom Mclellan, came across my inbox recently where he does a wonderful job at capturing this relationship and I thought it worthy of presenting its highlights.