Read the Transcript

Read the transcript of Year-end Tax Planning with Patty Kemmerer here (PDF)

Listen to the Interview MP3 audio file

The Solari Report 2014-12-04

View the Money & Markets Presentation

Listen to the Money & Markets MP3 audio file

Audio Chapters

Introduction

Theme“Oil Price Drops Rocket Around the Planet”

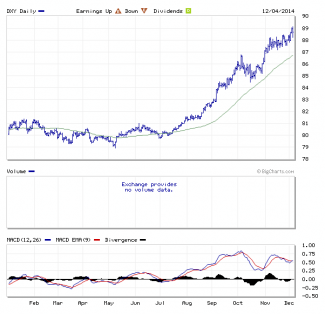

Money & Markets This week in Money & Markets, Catherine discusses the latest trends with the oil prices and how green energy is responding. She also looks at the possibility of a global slowdown.

Hero Our hero this week is Congresswoman Marcy Kaptur.

Ask Catherine Catherine answers questions submitted by subscribers.

Note: Question on websites for the stock market was addressed during Money & Markets.

Question #1:

Hi Catherine…

Loved it. We have listened to the podcast 3 times so far!

I wrote to Jim and got a very nice reply from him.

I asked him a question about this massive South of the border immigration….he gave me an interesting answer…one I sort of sus-pected. Of course it isn’t anything anyone else I’ve read or heard is mentioning. I love you and Jim because you are interested in the truth. No matter what your opinion may be. You want to know the facts.

Not too many people do.

Thanks again for this great website and for having Mr. Norman on. Very good stuff.

Question #2:

Thanks for forwarding these comments. I think what I said in the interview was that the FINDING cost of oil for majors like Exx-onMobil is on the order of $1 per barrel of oil equivalent. In fact, it was considerably less than that until just recently for XOM. Here is an excerpt from a 2005 8-K which confirms that:

http://www.wikinvest.com/stock/Exxon_Mobil_(XOM)/Finding_Costs.

Now that is just the cost of finding oil and gas (that is expected to become proved reserves). The further cost to develop those BOE goes into “Finding and Development” costs or F&D. Those costs for the majors have been rising steadily with oil prices (in part, no doubt, because their inherent profitability allows them to be less stingy with their exploration and production dollars). The charts on pp. 9-10 of this analysis show that pretty well:

http://cdn2.hubspot.net/hub/312313/file-437446448-pdf/Whitepapers/Top_7_Ways_to_Measure_FD_Costs.pdf

Even using the most expensive way to measure F&D, however, the costs for the majors has been running at only about a fourth to a third of the market price for crude. And Exxon until recently has been one of the lowest-cost of the majors upstream. Granted, the costs for finding and developing oil are more than for gas, generally speaking. But in the interview I was talking in therms of BOE — barrels of oil equivalents, which is the only way the num-bers are disclosed by companies, if at all any more. As I said, the all-in F&D costs for the majors has been running somewhere in the high teens (see the lime green line on p.9). That’s where it was when The Oil Card was written in 2007-8. I’d expect it has risen since then mainly because companies could afford to be less frugal, but it is still less than half the market price for oil. My point was that oil prices could still fall massively before they would reach the majors’ F&F costs. And even if that were to happen, once oil and gas wells are on production, they tend to remain so. Oil and gas production volumes might not fall much at all even if prices fall in-to the $40/bbl range. Indeed, there will be tremendous pressure on the Russians and others with surplus capacity to pump even more volumes to maximize whatever revenues they can get.

I have no idea what kind of methodology the EIA uses, but would have to say it is at some variance with what the companies report to the SEC. These three years are also problematic. There was a massive price drop in 2008 that forced a number of companies to write down high-cost properties, greatly reducing net reserve addi-tions and skewing per-barrel reserve addition costs markedly up-ward.

As to the main point of the writer, however, I could not agree more. A further sharp drop in the oil price will be devastating to the US independent oil sector, especially companies that have used a lot of debt financing (and who hasn’t?). Recall the 1980s, when the US economic war against the Soviets utterly decimated the US independent oil sector. It was a price worth paying, Washington evidently felt, even when it infected the S&L business and brought that tumbling to its knees. The independents almost always have higher costs per BOE than the majors, because they are going after smaller quantities in picked-over US venues. The majors hold down their costs by going for mega-projects with billion-barrel re-serves in low-cost foreign offshore fields. They’ll survive if prices fall. The little guys will get crushed again.

Question #3:

Dear Catherine:

In your opinion, how much of the evolution and degradation in the quality of television programming over the years has to do with the powers that be wanting to control what our minds are focused on?

Question #4:

Dear Catherine:

Could you see any reason why the powers that be might want to crash the value of the U.S. dollar?

Question #5:

Hi Catherine!

I met up with you in Albuquerque and so enjoyed our time togeth-er.

Thanks for doing this call today. I have the following question….

I am on the board of a non-profit that produces documentaries.

The Founder is planning to raise funds on kickstarter (KS) for the non-profit’s current film.

It is my understanding that KS distributes funds raised to the crea-tor of the project, in this case, the Founder of the non-profit. Can the funds be donated to the non- profit, and avoid personal tax, or will the funds be taxed as ordinary income before a donated can me made?

It is my understanding that Indiegogo does allow projects, to be created by a non-profit entity, thus avoiding all IRS problems but they do not have the tracking software or visibility of kickstarter.

Question #6:

I just good word from my sister that her 6 year old boy was sus-pended from school for drawing a gun and pretending to shoot it. I am not sure all the details yet but was wondering if they want-ed to pursue the legality of this where they might find a civil right lawyer that deals with these types of issues.

Question #7:

Hello Catherine,

I’m curious about what comments you might have on Anthony’s currency and interest-free economics proposals. Be well.

Question #8:

Dear Catherine,

Could you please comment on Martin Armstrong’s theories and do you think that he has in any way considered what you call Breakaway economy / UFO economy / Black budget in his Socrates models and predictions?

Let’s Go to the Movies! This week in Let’s Go to the Movies!, Catherine reviews the film If I Were You.

Closing

December 11: Precious Metals Market Report with Franklin Sanders

December 18: Unpacking Divide and Conquer with Junious Ri-cardo Stanton

Week of December 25: Special Report with The Contributor

Subscriber Resources:

“A good plan violently executed now is better than a perfect plan executed next week.” ~ General George S. Patton

By Catherine Austin Fitts

This week on The Solari Report, I speak with Patty Kemmerer of Kemmerer Schooley Smith, CPAs about U.S. year-end tax and financial planning. Our goal is to inspire you to take action now while there is still time to get things done before the end of the tax year.

Patty and I will be review the full gamut of issues, big and small, including gifting, college financing, 401ks and IRA investments, Affordable Care Act penalties and the tax implications of crowdfunding. We will also address administrative issues, including: “How do I find a CPA or a bookkeeper I can trust?” Look for lots of practical ideas to help taxes bite less and compliance go smoothly.

In Money & Markets, I will discuss the latest in geopolitical news and financial markets development.

In Let’s Go to the Movies, I suggest a comedy to warm your heart – If I Were You. A remarkable performance by Marcia Gay Harden as the jilted wife demonstrates what can happen when human kindness and imagination transform what is worth nourishing in a bad situation. There is a small bonus for those of us who love Shakespeare. Harden’s character drowns her sorrows by playing King Lear in an amateur production. The last time I saw King Lear performed, Anthony Hopkins played Lear in a serious, classic version. Watching a Harden offer up a more whimsical, female Lear is a most unique interpretation!

Talk to you Thursday!