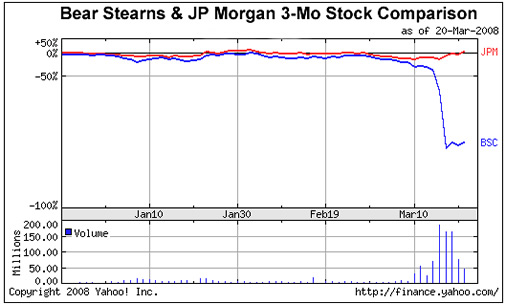

As if last weekend’s shotgun merger agreement between Bear Stearns and JP Morgan was not wild enough, things just keep getting weirder. Bear Stearns stock is trading above $5, which says something about what the market thinks of Morgan’s $2 purchase.

Rather than address the fact that NY pension funds lost millions (1) (2) (3) on the Bear Stearns deal, the new Governor and First Lady of New York instead entertained the global audience with details of their sex lives:

Governor Paterson Admits to Sex With Other Woman For Years

By Juan Gonzalez – New York Daily News (18 Mar 2008)

target=”_blank”Governor Paterson Amits To Numerous Affairs

By Celeste Katz & David Saltonstall – New York Daily News (18 Mar 2008)

While other pension funds simply spun that the millions lost was not a lot of money or they made it back on their JP Morgan stock:

Bear Stearns Sale Buoys Most Public Employee Pension Funds

By Jim Provance – Blade Columbus Bureau Chief (18 Mar 2008)

While the individual shareholders who are scheduled to lose more than $1 billion at closing tried to switch-hit the deal, it turns out that is a formidable task. JP Morgan has built in a $6 billion litigation budget and the deal includes some unique poison pills:

JP Morgan’s Bear Stearns Deal Reveals Poison Clauses

By James Quinn, Wall Street Correspondent – London Telegraph (21 Mar 2008)

With a .75% drop in interest rates, a new Fed loan facility, (1) (2), bank coffers filled by a VISA stock offering and increased limits on Fannie Mae and Freddie Mac, the financial mafia was rich with new resources. Perhaps the greatest support for these stocks came not just from the massive injection of capital, but the clear message that the law no longer applies to them.

What the financial mafia may have forgotten is that their liquidity depends on not just the Fed’s ability to print money, or the Treasury to live in fear of their derivatives mess. Real liquidity is ultimately determined not in the bubble economy but in the real economy. Millions of honest, hardworking people must be willing to faithfully get up and go to work to process the paper of financial systems or allow their savings to be invested in financial assets. If the course of events causes a critical mass of serious people to feel that financial institutions and media are violent children who can coerce government officials into being pornographic entertainers, the myth of the rule of law is slipping and all bets may soon be off.

Fed, Wall Street Might Not Survive These Questions on Bear Deal

By Martha Graybow – Reuters (20 Mar 2008)< /blockquote>