“Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make, so you can give money back and have money to invest. You can’t win until you do this.” ~ Dave Ramsey

By Catherine Austin Fitts

Overview

The 1st Quarter was choppy at best. We finally got a 15 percent correction in the US equity markets. While prices recovered by the end of the quarter, investor spirits had not. The Federal Reserve cancelled their anticipated interest rate increase and bonds outperformed equities as investors worried more about return of their principal rather than return on principal.

Note: This chart reflects prices adjusted for dividends; charts below may not.

U.S. Dollar Index

After eighteen months of a rising US dollar index, prices softened in the 1st Quarter.

Equities

Emerging markets outperformed the developed equity markets. However, all markets were defined by global corrections and concerns about slowdown in global growth.

SCHA (U.S. Small Caps), SCHM (U.S. Mid Caps), SCHX (U.S. Large Caps), PKW (Buybacks)

U.S. Equities: 1, 3, 5 Year Sector Performance

IBB (Biotech)

Obamacare ETFs: XLV(Health Care Select), IHE (U.S. Pharmaceuticals), IHF (Providers), IBB (Biotech), IHI (Medical Devices)

After leading the markets for several years, the price of health care equities took a pause. Biotech took a beating!

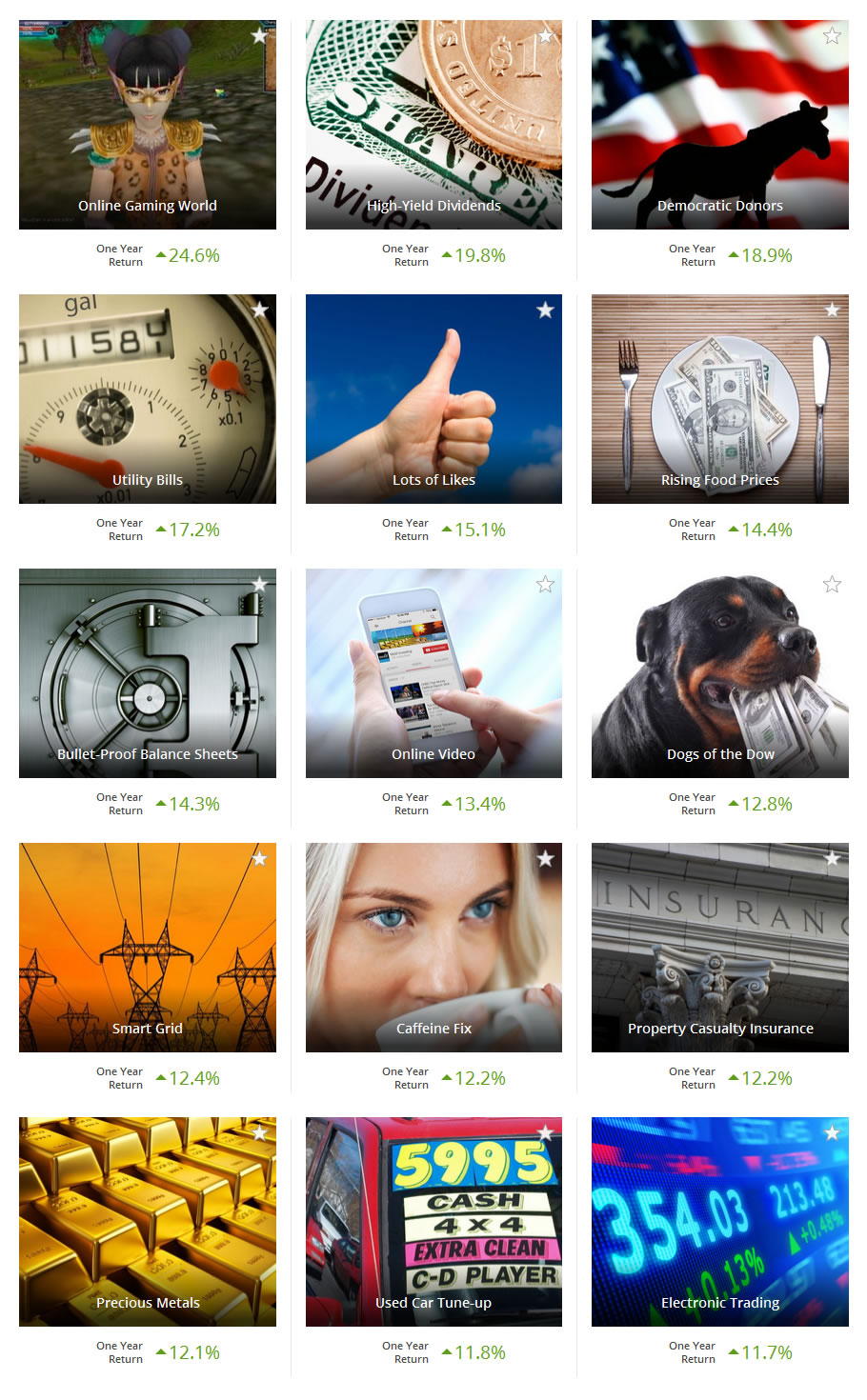

Motif Investing

There is always a bull market somewhere. For the last twelve months as of the end of the 1st Quarter, virtual gaming, junk securities, and democratic donors performed the best of all motifs. That is not an inspiring comment on the future of our economy!

ITB (U.S. Home Construction)

US homebuilders outperformed the markets as the US presidential primaries got underway in 2015, but prices backed off with the market in 2016.

IYR (U.S. Real Estate)

Real estate held up reasonably well, likely by investors seeking yield.

OIL (Crude Oil)

Sharply lower oil prices deepened in the 1st Quarter, contributing to the drop in equity markets and real concern in the junk bond and bank markets.

U.S. Coal Producers

Say goodbye to the US coal producers as US energy policy favored gas and renewables.

RSX (Russia), OIL (Crude Oil)

Russia continued to feel the squeeze of G7 sanctions, lower oil prices and efforts by the US to keep the Russian government from selling $3 billion in sovereign bonds into Western capital markets. Despite the headwinds, Russian equities outperformed global markets for the 1st Quarter, closing some of the significant divergence.

DAX (Germany)

Germany continued to struggle with global slow down, Russian sanctions, a melt down of Deutsche Bank stock and the politics of the EU and immigration.

FXI (China Large Caps)

The Chinese economy slowed with rising food prices and falling equity prices.

PIN (India)

Indian equities corrected and recovered with global markets in the 1st Quarter.

EEM (Emerging Markets)

Emerging markets were the strongest area of global equity markets.

EFA (International Developed)

International developed equity markets under performed the US market and emerging markets.

WAFMX (Frontier Markets)

Frontier markets also under performed.

Fixed Income

So much for thinking that 2016 would finally see the end of the great bond bull! Bonds outperformed equities as interest rates went lower and Europe and Japan sovereign bonds moved to negative interest rates.

AGG (Bond Aggregate), IEF (5-7yr Treasury), TLT (20yr+ Treasury), JNK (High-Yield)

Long treasury bonds outperformed short and intermediate maturities. The high yield market experienced a serious le down during the 1st Quarter over concerns regarding lending to and refinancing in the oil and gas sector but recovered the majority of losses by the end of the 1st Quarter.

Commodities

GLD (Gold), SLV (Silver)

Gold and silver were the star performers in the 1st Quarter. The big question is whether we have seen the bottom on precious metals or this is a head fake like last year.

CRB (Commodities Index)

Read it and weep!

YTD Commodities Performance

Lumber, hogs and soybeans got a break. Since I live in a cotton farming community, I still don’t feel much improvement.

Baltic Dry Index

The shipping indices say to me that there is more global slowing ahead.

Looking forward to the 2nd Quarter, my advice is “Get ready to duck!”