I never cease to be amazed at the extent to which successful policies are portrayed as failed policies, and the transfer of public resources to private parties are spun as the result of government and bureaucratic “incompetence.”

Recent financial headlines are full of news of record profits by oil companies and strong stock performance, proof positive that the invasion of Iraq has been successful.

Oil Profits Fuel Envy, Discord

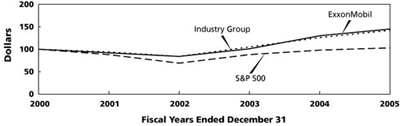

By Brian Love and Jan Strupczewski, Yahoo News, May 5, 2006Exxon Mobil Stock Performance — 2006 Proxy

Source: exxonmobil.com 2006 ProxyFIVE-YEAR CUMULATIVE TOTAL RETURNS

Value of $100 Invested at Year-End 2000

* Industry Group comprises: BP, Chevron, and Royal Dutch Shell

Those who are saying that the Bush Administration has failed in Iraq or that we are not winning the war apparently do not understand that a policy must be judged according to its goals. If oil company profit and resulting stock market performance left any doubt, the fact that the cost of the war is expected to top $1 trillion should make the case.

Cost of Iraq war could surpass $1 trillion

By Martin Wolk, MSNBC, March 17, 2006

A successful war policy is one that pours money into the private pockets that promoted it. So to whom is the $1 trillion going? It appears that the Pentagon may not have to say because they are still allowed to hide behind the ruse that they and the most powerful corporate contractors and banks in the world who run their systems are not capable of maintaining a basic accounting system.

A new report says the Pentagon’s finances are in disarray

By Drew Brown, Knight Ridder, May 11, 2006 (also archived here)

When Kelly O’Meara was writing about the $3.3 trillion of undocumentable adjustments at DOD, the head of the General Accounting Office committed to publish the names of the contractors responsible for the Pentagon’s financial, accounting and payment systems. As far as I know, this never happened. For descriptions of reasons given by the federal government as to why it can not balance its books, see:

Treasury Checks and Unbalances

By Kelly O’Meara, Insight Magazine, April 14, 2004See other related stories on wordpressdevurl.com’s:

Missing Money — Articles and Documents

Not surprisingly, defense contractor profits and stock market performance are also on the rise.

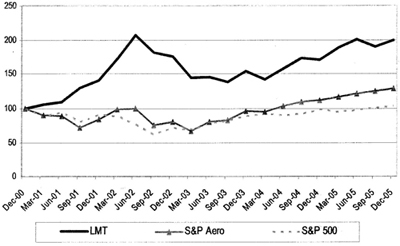

Lockheed Martin Stock Performance — 2006 Proxy

Source: lockheedmartin.com 2006 Proxy (Page 26)Comparison of Cum. Total Return Thru 2005

Lockheed Martin, S&P 500 Index and

S&P Aerospace & Defense Index*The S&P Aeospace & Defense Index comprises:

Boeing, General Dynamics, Goodrich, Honeywell International,

L3 Communications, Lockheed Martin, Northrop Grumman,

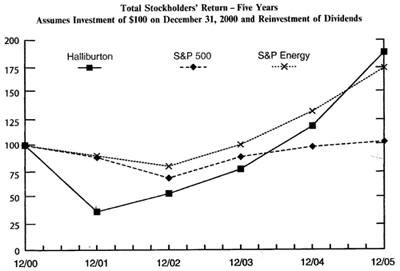

Raytheon, Rockwell Collins, and United TechnologiesHalliburton Stock Performance — 2006 Proxy

Source: halliburton.com 2006 Proxy (Page 21)

It is worth asking the question: “What is the relationship between the corporate contractors billing government agencies and the corporate contractors and depositories running those agency information, accounting and payment systems?”

One thing is clear – the combined policies of war in Iraq and a ten year refusal to maintain basic books and records have created a grand slam home run success for the Tapeworm.

The military is not alone in engineering public failure to achieve private profits for political success. The other half of the central banking-warfare coin is engineering similar achievements. As the price of gold reached record dollar highs last week, the Bank of England came under fire for having sold half of its gold reserves between 1999 and 2002 — a time during which the gold price was supressed by central bank market manipulations. Hence, these sales incurred an opportunity loss of as much as $6.5 billion at 2006 prices.

Chart – Long-Term Price of Gold in US$

The PrivateerChancellor’s losses hit $6.6bn as gold touches record high

Labour’s sale of half the Bank of England’s gold reserves to invest in euro and yen was ‘impatient’ and ‘badly timed’

By Jason Nissé, The Independent, May 14, 2006

Perhaps the Bank of England’s gold sales were not ‘badly timed.’ Perhaps they were beautifully timed. Some private parties made off with a $6.5 billion windfall. Wouldn’t you love to know who was able to buy so much gold at supressed prices?

If someone were to ask for those transaction records, they might be hard to find. Unanswered question: Could this explain why some dealers have been leaving the business?

Rothschilds Quit Gold Market & London Fix

Tax Free Gold, London, 2004 (also archived here)

It is invaluable in understanding the world around us to assume that government is perfectly capable of being competent when it is politically desirable to the private parties that finance and operate government. Therefore, governmental and central banking policies which continue are policies which are successful in terms of their real goals.

Hence, it should come as no suprise that the “strong dollar” policy is succeeding in destorying the value of the dollar:

Central bankers are backing Plaza-lite

On Friday the dollar plunged to a 12-month low…

By Liam Halligan, Telegraph.co.uk 14/05/2006U.S., Seeking Smaller Deficit, Signals Comfort With Dollar Drop

US retreats from strong dollar policy

By Kevin Carmichael, Bloomberg.com, May 15, 2006Foreign Investors Slow Purchases of U.S. Securities

Foreign governments sell U.S. bonds as Caribbean ‘banks’ buy

By Alison Fitzgerald, Bloomberg.com, May 15, 2006

And that the power of the IMF to dictate policies to Congress is rising:

IMF Acts to Avoid Market Meltdown

By Heather Stewart, The Observer, May 14, 2006

Failed policies and government incompetence are “spin.” Don’t fall for them. We are watching an epic transfer of wealth and a coup d’etat — a fundamental reordering of global and national institutions that has been intentionally planned and executed.

We are watching an

epic transfer of wealth

and a coup d’etat

The big financial question hanging out there is whether or not the events in and around Iran in the coming months will resolve themselves in terms of a bounce in the dollar and a significant drop in the gold price, or will the rise of precious metals and the fall of the dollar continue. There is no way to know. I believe it is possible to spend full time trying to understand events and still not have the reliable information we need to make an educated guess.

My advice is to be prepared to live with significant volatility either way and stay focused on building financially intimate wealth according to long term fundamentals.Ultimately we all need to be good at predator evasion. Other than knowing when to duck, it is wise not to spend too much time trying to figure out what the Tapeworm is up to. Tracking the destruction of wealth ultimately detracts where our focus should be — on withdrawing our resources from the Tapeworm’s control and investing them in financially intimate ways in a manner that shifts the game entirely.

Need more on how to do this?

See our Coming Clean web resources page, and

Our audio seminar series (order individually or as a set)