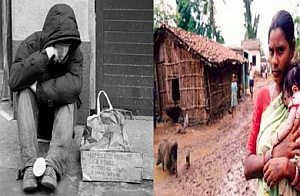

Far from being a panacea for fighting rural poverty, microcredit can impose additional burdens on the rural poor, without markedly improving their socio-economic condition, write Patrick Bond and Khorshed Alam.

Pambazuka News — For years, the example of microcredit in Bangladesh has been touted as a model of how the rural poor can lift themselves out of poverty. This widely held perception was boosted in 2006 when Mohammad Yunus and Grameen Bank, the microfinance institution he set up, jointly received the Nobel Peace Prize. In South Asia in particular, and the world in general, microcredit has become a gospel of sorts, with Yunus as its prophet.

Consider this outlandish claim, made by Yunus as he got started in the late 1970s: “Poverty will be eradicated in a generation. Our children will have to go to a `poverty museum’ to see what all the fuss was about.”