By Catherine Austin Fitts

Here we go again. Another “official reality” of the financial coup’ d’etat. This one is about AIG. The last one I reviewed was about Goldman Sachs.

We just keep paying millions of dollars to compensate people whose mistakes are innocent, who can not be expected to really know what was going on, and some of them are good guys who work really hard. Trillions disappeared was just a horrible accident, right? Things just, well sort of, got out of hand. There is no $400 billion of global money laundering, no black budget, no narcotics trafficking, no criminal fraud, no intentional economic hits on countries and communities around the world with the help of GATT and the WTO, and at the end of the day, no one is accountable.

The myth that the rich and powerful can not be expected to run things responsibly bears the same fruit as the myth that the minority poor run narcotics trafficking while institutions like AIG stick to the legitimate, low margin businesses.

If you are looking for some of the details of the overt side of the house, this book adds some pieces of the jigsaw puzzle. If, however, you want to know what really happened, this one will not add much. For some insightful coverage on AIG, check out Mark Sweeny’s work long ago in Arkansas and Lucy Komisar at The Komisar Scoop.

Note: In the interests of full disclosure, I made the mistake of using AIG as my E&O insurer for my last company and had the pleasure of getting to know them over a decade of litigation.

If I had the choice of doing business with AIG or the Russian Mafia, I believe I would prefer the Russian Mafia, although there were times over the years that it felt to me like AIG and the Russian Mafia might be one and the same.

Related reading:

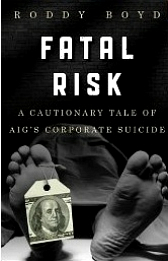

Fatal Risk: A Cautionary Tale of AIG’s Corporate Suicide

amazon.com

Gray Money

copvcia.com (Originally Published, 1995)

Solari Report Blog Commentaries

Puffing Goldman

By Catherine Austin Fitts (5 July 11)