By Dena Aubin and John Parry – Analysis

By Dena Aubin and John Parry – Analysis

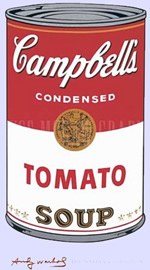

NEW YORK (Reuters) – Is Campbell’s Soup a better bet than U.S. government debt?

No, we’re not talking about stocking a bunker for survival. This is talk about safe investments.

U.S. Treasuries, traditionally considered the safest of all investments because the debt is backed by full faith and credit of the U.S. government, is losing favor among derivatives traders to Campbell Soup Co, Microsoft Corp and Intel Corp as concerns over the government’s massive deficits and costly bailouts mount.

Investors are apparently concerned that sovereign debt of the United States, the world’s biggest economy, is more vulnerable to a huge sell-off than bonds of these three companies amid the most protracted economic downturn in decades, strategists said.

Those concerns are reflected in the pricing of credit default swaps, which are used both to insure bonds against default and to place bets on the likelihood of default, of Treasuries and of the three companies.

The cost to insure debt of the United States with credit default swaps for five years was 43.7 basis points on Monday, versus just 27.4 basis points for Campbell Soup and 29.8 basis points for Intel Corp , according to data from CMA DataVision. Higher prices for credit default swaps, or CDS, reflect a greater perception of a risk of default.

Microsoft’s insurance costs were just 32.5 basis points on Friday when they last traded, according to CMA. “Some of those names have better-looking balance sheets than any sovereign in the developed world, so I don’t think it’s totally irrational,” said Jay Mueller, senior portfolio manager with Wells Capital Management, in Milwaukee, Wisconsin.

However, “the sovereign CDS market is perhaps not as liquid and efficient as it is in a lot of corporate credits, so I wouldn’t get too wrapped up in the specific quote level in the sovereign space,” Mueller added.

FALSE SIGNAL POSSIBLE

Pricing in the nascent credit default swaps market for the U.S. sovereign, which did not trade actively until two years ago, could be sending a false signal that conflicts with its top credit rating’s higher status than some corporate bonds.

Even so, the relative explosion of U.S. government indebtedness compared with some major companies does give analysts some cause for concern.

Intel, the world’s largest chip maker, and Microsoft, the world’s largest software company, both have minimal levels of debt, while Campbell Soup, the world’s largest soup producer, has been reducing debt.

U.S. President Barack Obama forecast a $1.75 trillion deficit for 2009 in February, about 12.3 percent of gross domestic product, the most since World War II.

Campbell is rated A2 by Moody’s Investors Service, five steps below the United States AAA rating. Microsoft is rated AAA while Intel’s senior unsecured debt is rated A1, four steps below the United States.

U.S. government bond insurance costs expressed via credit default swaps have widened from about 27 basis points just a month ago, according to CMA.

“It definitely reflects the concerns that people have over the trajectory of our budget deficit,” said Mary Ann Hurley, senior Treasuries trader in Seattle at brokerage D.A. Davidson.

“Do I think it reflects that we are closer to default on our debt? No However I think there is some concern about how big the deficit will be (as a proportion) of GDP,” she said.

TREASURY SELL-OFF FEARED

The large deficit ratio is still a big worry. Widening credit default swaps on highly rated governments such as the United States reflect the danger that foreign investors may balk at the low level of yields on offer and spark an acute government bond market sell-off, analysts say.

Since foreign investors hold about half the U.S. Treasuries outstanding, that outcome could also cause a major dollar crisis, adding to any inflationary pressures buffeting the economy.

Though a default by the United States is viewed as highly unlikely, investors may have used credit default swaps for trading opportunities as concerns about budget deficits mounted.

Foreign holders of U.S. Treasuries such as foreign banks and sovereign wealth funds also may be using credit default swaps to hedge their exposure to Treasuries, said Bob Bishop, senior portfolio manager at SCM Advisors in San Francisco.

Credit insurance costs on U.S. companies, meanwhile, have fallen amid signs in recent weeks that the worst of a recession may be past.

“Certainly after the economic data we saw in May there was big reduction in the market’s concern about credit risk,” Bishop said. “We’ve seen a big move out of government bonds into corporate bonds so it’s not surprising that CDS reflects that.”