By Catherine Austin Fitts and Carolyn Betts, August 10, 2010

(Download a PDF version of this article)

Preface

In this article, we summarize some of the better-known custodial, vaulting, and digital gold arrangements available to individual investors in precious metals and provide a list of considerations for those interested in exploring these and other alternatives available to them.

With prices for gold denominated in U.S. dollars at high levels, increasing discomfort with prolonged global financial market uncertainties and increasing recognition of the risks inherent in investment in precious metals ETFs, the demand for precious metals storage services is growing. Witness a recent Financial Times article reproduced on the Gold Anti-Trust Action site entitled “Banks Set New Store on Building Gold Vaults.” At the same time, however, some banks reportedly are shedding their smaller, non-institutional clients in order to concentrate on more lucrative institutional customers. See, e.g., a recent Telegraph article, “HSBC Starts Gold Rush as It Kicks Small Clients Out of its Vaults.”

While we believe that the ideal precious metals storage alternative from many perspectives is a secure, at-home cache, in some cases home storage is not  practicable—for example, for particularly large holdings. Also, many investors desire to maintain holdings in a variety of places and legal jurisdictions.

practicable—for example, for particularly large holdings. Also, many investors desire to maintain holdings in a variety of places and legal jurisdictions.

The storage option chosen in many cases, providing convenient access during business hours in case of emergency is a safe deposit box in a trusted local bank. For a host of reasons, however, some precious metals investors prefer or want to supplement local holdings with off-shore institutional alternatives, storage facilities that can provide insurance, accounting and transportation services, institutions that provide digital gold or silver payment systems or custodians or other depositories that provide the security of an established name or governmental entity standing behind the authenticity of their metals holdings. In addition, use of third party storage facilities permits investors with multiple residences or transient lifestyles to hold precious metals in one or more jurisdictions of their choosing based upon convenience or tax or national or economic security considerations.

In this article, we summarize some of the better-known custodial, vaulting, and digital gold arrangements available to individual investors in precious metals and provide a list of considerations for those interested in exploring these and other alternatives available to them. This is not a comprehensive list and our summary is no substitute for individual due diligence, but we hope this will help to introduce new investors in precious metals to the important considerations in arranging for third parties to hold their precious metals investments.

A. Some Key Definitions

Allocated Account (versus Unallocated Account): It is important to read the definition of this term as used in a contract with a particular storage company, vault or custodian, because the term as used by different precious metals storage facilities may vary according to the individual arrangements. Generally, an allocated account is a custodial account, with the storage facility holding as a bailee or agent  for the title owner who, in the case of a bankruptcy of the storage company, is entitled to the return of the physical metals held in storage. Unless otherwise specified, unallocated holdings are not physically segregated from the accounts of the storage company or other investors and, as in the case of Perth Mint, do not necessarily even exist in manufactured form, but rather appear as entry on the storage company’s balance sheet as an asset to that company and as a liability to the investor. In the case of a bankruptcy of the storage facility, the investor is a creditor and may take a loss. Metal in allocated storage is a tangible asset, but unallocated metal is only, or additionally, a financial asset, una, with counterparty risk.

for the title owner who, in the case of a bankruptcy of the storage company, is entitled to the return of the physical metals held in storage. Unless otherwise specified, unallocated holdings are not physically segregated from the accounts of the storage company or other investors and, as in the case of Perth Mint, do not necessarily even exist in manufactured form, but rather appear as entry on the storage company’s balance sheet as an asset to that company and as a liability to the investor. In the case of a bankruptcy of the storage facility, the investor is a creditor and may take a loss. Metal in allocated storage is a tangible asset, but unallocated metal is only, or additionally, a financial asset, una, with counterparty risk.

As used by the Perth Mint, the term “allocated” as to a precious metals account refers to a physical holding of coins or bars that is segregated from holdings of other investors, separate and apart from the holdings of the storage company (in this case, Perth Mint).

As used by BMG Management, the term “allocated storage” is synonymous with “custodial storage,” which it defines as:

- “Supervised, secure storage arrangements for owners who have full legal ownership of specific bullion bars and wish to place them in storage. Unless the bars can be specifically identified by refiner, exact weight, fineness and serial number they cannot be allocated and they do not qualify for custodial storage.”

Bailee (quoted from Law.com Dictionary): A person, also called a custodian, with whom some article is left, usually pursuant to a contract (called a “contract of bailment”), who is responsible for the safe return of the article to the owner when the contract is fulfilled. These can include banks holding bonds, storage companies where furniture or files are deposited, a parking garage, or a kennel or horse ranch where an animal is boarded. Leaving goods in a sealed rented box, like a safe deposit box, is not a bailment, and the holder is not a bailee since he cannot handle or control the goods.

Chain of Integrity (quoted from Buillon Management Group, Inc.): A locally recognized chain of custody among trusted trading partners where bullion bars are accepted at face value without an assay test. COMEX rules specify an official “chain of integrity” for COMEX GOLD contracts. The London Bullion Market Association maintains a “Good Delivery List” of member refineries that meet certain membership requirements and have passed assay tests. Bullion products from these refineries will generally be accepted by other members of the LBMA [at] face value without further assay testing. However, the LBMA’s chain of integrity is purely informal. When purchasing bullion products the face value can generally be accepted if the product can be shown to have remained in the custody of a certified bullion repository since its manufacture at an acceptable refinery.

Custodian: See “bailee.”

Depository (quoted from Merriam-Webster Dictionary): A place where something is deposited especially for safekeeping. Even though this term is properly used for both bank and non-bank facilities and the entities that own them (also called “depositaries”), due to its derivation from the term “deposit” and the association of “deposit” with financial institutions, we have generally preferred the term “storage facility.” Nevertheless, that term, too, is imperfect, given that in some cases of  unallocated precious metals holdings (as described below), no tangible metal is held physically on the investor’s behalf.

unallocated precious metals holdings (as described below), no tangible metal is held physically on the investor’s behalf.

LBMA (quoted from Buillon Management Group, Inc.): London Bullion Market Association established in 1987 with the brief to represent the interests and well being of all the participants of the bullion market. Within its charter are codes of conduct covering protocol, behavior and ethics. Membership is open to any wholesale organization involved in the storage, refining, assaying or trading of bullion within the UK.

LBMA Good Delivery Status (quoted from London Bullion Market Association): Historically, the members of the London bullion market compiled lists of accredited melters and assayers whose gold and silver bars they would accept without question in settlement against transactions conducted between each other and with other acceptable counterparts. Such bars earned the distinction of London Good Delivery status.

The LBMA Good Delivery List is now widely recognized as representing the de facto standard for the quality of gold and silver bars, in large part thanks to the stringent criteria for assaying standards and bar quality that an applicant must satisfy in order to be listed. The assaying capabilities of refiners on the Good Delivery List are periodically checked under the LBMA’s Proactive Monitoring program.

The main requirements to be considered for listing are normally that a refiner must:

- Have an established track record of at least three years of producing the refined metal for which the listing is being sought;

- Produce a minimum quantity of refined metal per year – 10 tonnes of gold and 30 tonnes of silver;

- Have a tangible net worth of at least £10 million equivalent;

- Furnish evidence of their ownership structure and directors; and

- Provide, if required, a suitable letter of endorsement, e.g., from the central bank or an acceptable commercial bank in their country of operation.

The Good Delivery Rules for Gold and Silver Bars contain a complete description of the rules governing the specifications for good delivery bars and the application procedures for listing.

Safe Deposit Box (quoted from Merriam-Webster Dictionary): A box—usually located inside a bank—which is used to store valuables. A safe deposit box is rented from the institution and can be accessed with keys, pin numbers or some other security pass. Valuables such as documents and jewelry are placed inside and customers rely on the security of the building to protect those valuables. The contents of a safe deposit box are not insured in the same way bank deposits are. In the case of U.S. banks, the Federal Deposit Insurance Corporation insures cash deposits up to a certain limit, but due to the fact that there is no way to verify the contents of a safe deposit box, banks will not insure their contents. Also, if heirs are not told about the location of the drawer, upon non-payment, the box is considered abandoned, and its contents are turned over to the state’s unclaimed-property offices for auction.

Storage Facility: As used in this article, the term “storage facility” or “storage company” refers to any third party that holds precious metals either physically or on its books on behalf of a customer. Thus, as explained in greater detail herein, the term incorporates a host of situations, including:

- both fiduciary and bailee/custodial relationships and situations in which the facility has no access to the client’s assets unless the client provides a key and, thus very limited duties to the client with respect to the held assets

- both tangible holdings in physical form and book-entry financial assets potentially subject to claims of the facility’s creditors

- both undivided interests in commingled coins, bullion or unminted precious metals and individually identified and/or packaged bars or coins

- both situations where the company performs all holding, accounting, insurance, conversion and transportation functions and situations where third parties (who may or may not have any direct contractual relationship with the customer) perform such functions

Trustee: A trustee is similar to a bailee but may have additional duties and has additional responsibilities to the owner of assets (which may be intangible assets) held on behalf of the client. The client is the “beneficiary” of the trust created by the relationship and, at least under U.S. state law, is owed a fiduciary duty by the trustee. As in the case of the custodian/bailee, in the event of a bankruptcy, the client’s assets held by the trustee do not become subject to the claims of the trustee’s creditors. Generally, precious metals held in an account with a bank trust department, as part of a family trust or in an IRA or 401K would be subject to a trust agreement describing the functions performed by the trustee, although trust arrangements may exist in the absence of a written agreement (in which case proof may be an issue in the event of challenge to the ownership of the assets).

Vault: A secure structure made of steel and often embedded in reinforced concrete for the safekeeping of valuables. A vault may be:

- located at the residence of or other real estate owned or controlled by the owner of the stored assets;

- within a bank or other financial institution rented on a monthly, annual or other basis to which the renter has exclusive access with a key;

- within a financial institution to which only bank personnel and its agents, and not clients, have access;

- an armored facility (with or without guard services) within a larger non-financial storage operation providing services to the public or invited clients.

B. Questions to Ask

- Are your precious metals held in allocated or unallocated, segregated or unsegregated, form? If both options are available, what are the price differentials for individual metals?

- If in allocated form, how are they segregated:

- • only on the records of the storage company

- • by individual bar number

- • according to the institution through which the metals are held

- • physically according to the individual investor’s name

- If held in unallocated form, what is the credit of the entity in whose name the metals are stored? What is the name of the entity that has a direct “fee” title to the metals and how do the precious metals holdings appear on the company’s balance sheet? Can the investor take delivery of his or her metals and what are the conditions and expenses of doing so? Does the investor hold an undivided interest in metals with other investors? Can the storage facility or any third party borrow, lease or otherwise use the investor’s metal for other purposes? If so, does the investor receive any benefit? Does the storage company publish a list of its holdings on a website or otherwise?

- Can the storage facility use sub-custodians for storage and, if so, what is the liability of the subcustodian(s) to the investor?

- What relationship does the storage facility have to the investor, i.e., is it a bailee/custodian, agent or trustee or does it provide limited services at the investor’s risk?

- What are the arrangements for physical access and delivery, if any?

- What arrangements are available for assigning an interest in the precious metals holdings to third parties (e.g., as security for a debt)?

- Is there insurance against theft? Fraud? Does the insurance run to the investor individually, or to the storage facility or to some other intermediary? What are the procedures and requirements for an insurance claim? What risks are covered? Are there any limits on the insurance? Is the investor’s precious metal insured at all stages of its holding, e.g., when converted into currency form, when in transit, when held by third parties or in digital form? Who is the insurance carrier and what is its credit? Is proof of insurance available to the investor?

- What auditing arrangements are provided? What is the reputation of the auditor? What exactly is audited – the databases and other records of the storage facility, the physical holdings by weight, the physical holdings by bar number, a sample of holdings or every holding? May the investor or his or her representative audit personally and on what basis? What references and security clearances are required for such a visit?

- What are the standards for purity and chain of title? Are London Good Delivery Standards (LBMA) satisfied? Does the storage facility have arrangements to take delivery of exchange purchases?

- In what country are the metals stored and what provisions and charges are there for transportation, liquidation, conversion into other metals or currencies and transfer to another vault?

- Which country’s laws apply to the investor’s contract with the storage facility? Is the storage facility a regulated entity? If so, by what regulatory authority? Does the storage facility report the investor’s holdings under money-laundering or other reporting provisions? For U.S. investors, is the storage facility a foreign financial institution for purposes of IRS and FINCen “FBAR” reporting requirements?

- If an online purchase or liquidation facility is involved, what security measures prevent identity theft? Who is responsible for breaches of the system? What is the credit of any responsible party?

- If the facility also handles purchase and sale of the investor’s holdings, what is the source refinery, exchange member, LBMA member or otherwise for the metals and what charges are involved for purchase and liquidation? What is the relationship between the dealership entity and the custodial entity?

- If the precious metals are purchased and/or held in a foreign country or state, what tax, customs, privacy and other laws apply? For example, for those considering depositing their precious metals in Switzerland or within the European Union, it is important to note that gold, but not silver, is exempt from the value added tax. This means that silver coins or bullion can be subject to a non-recoverable VAT of significant amounts.

- If the storage facility or an affiliate also operates investment funds, how does that relationship affect holdings of precious metals by individual investors? Are individual holdings segregated from those of the fund?

C. Some Examples of Precious Metals Storage Facilities1

- GoldMoney

- VIA MAT International

- Bullion Management Group

- Perth Mint

- Delaware Depository Service Company

- GoldSilverVault.com

- Security Center

(1) GoldMoney

GoldMoney is a method of purchasing and storing gold, silver and platinum offshore in third-party vaults owned and operated by VIA MAT International [see separate listing below for more on individual VIA MAT storage facilities], an established independent vault company, in London, Zurich and Hong Kong. Storage facilities are shared with  other GoldMoney precious metals investors. Investors hold either undivided interests in the entire holdings in allocated storage held for GoldMoney customers or own specific bars identified by bar number. GoldMoney has a claim on the metal only for unpaid fees. “GoldMoney” is the business name of Net Transactions Limited, a limited liability company incorporated in accordance with the laws of Jersey, British Channel Islands. GoldMoney is regulated by the Jersey Financial Services Commission, which is the regulatory body responsible for regulation of financial services businesses in the Channel Islands. GoldMoney takes the position that since it is not a bank, customers do not have “accounts” with GoldMoney, but rather “Holdings,” which are records of the physical metal they own.

other GoldMoney precious metals investors. Investors hold either undivided interests in the entire holdings in allocated storage held for GoldMoney customers or own specific bars identified by bar number. GoldMoney has a claim on the metal only for unpaid fees. “GoldMoney” is the business name of Net Transactions Limited, a limited liability company incorporated in accordance with the laws of Jersey, British Channel Islands. GoldMoney is regulated by the Jersey Financial Services Commission, which is the regulatory body responsible for regulation of financial services businesses in the Channel Islands. GoldMoney takes the position that since it is not a bank, customers do not have “accounts” with GoldMoney, but rather “Holdings,” which are records of the physical metal they own.

When logged in to their Holdings, GoldMoney customers with full holdings may elect options to:

- convert gold, silver and platinum they own into various currencies

- reallocate Holdings among the three precious metals

- make internal payments, such as those for goods and services, to any other cap-verified full GoldMoney holdings owned by a third party with gold, silver or platinum as a form of digital precious metals currency (an option not available to residents of Germany)

- link to up to five of their bank accounts held in the holders name in any of 85 countries, including the U.S.

- in the case of gold, take delivery of bullion in the form of London Good Delivery bars of approximately 400oz each or exchange their goldgrams for kilobars (approximately 31.1oz and 3.2oz/100-gram bars)

- in the case of silver, (i) take delivery of London Good Delivery bars in amounts of thirty (30) 1,000oz bars or more, (ii) for smaller amounts of silver, (a) pick up 1 or more 1,000oz bars in London or (b) GoldMoney will transfer silver to the customers account at Kitco in Canada. Kitco will arrange delivery in smaller bars and coins. To ensure the specifics of Kitco’s policies, confirm with Kitco at the time a delivery is in planning, as to what they may deliver depending on inventory at a given time and what their fees are for this service.

- add funds or liquidate precious metals holdings and return sales proceeds to their bank account by wire transfer

- individually register 400oz London Good Delivery gold bars

GoldMoney vaults are audited every six months by a “big four” accounting firm, which produces a SAS 70 Type II audit report. This audit includes scrutiny of all activity involving addition to and removal of metals and of the metals database based upon vault reports and database logs and review of governance practices, order processing and IT security. The audit report is available to customers upon logging in to their Holdings.

VIA MAT provides quarterly bar list reports posted on the GoldMoney website that include bar number, weight, refinery, and fineness.

Andium Trust Company, the metal administrator, prepares a quarterly reconciliation of VIA MAT bar lists and GoldMoney’s database. Andium also manages the addition and removal of bars from the vaults. Andium is located in Jersey, the British Channel Islands and is regulated under the Financial Services (Jersey) Law 1998 by the Jersey Financial Services Commission to conduct trust company business in Jersey.

Inspectorate International Ltd. serves as the GoldMoney vault auditor. It performs quarterly physical inspections, on a random sample basis (except that registered bars are inspected on a 100% basis), to assure that the bar weight lists correspond to bars in the vaults.

The GoldMoney website indicates that VIA MAT holds insurance, including for theft, in the amount of the aggregate value of all customer metals. The insurance certificate indicates that the maximum claim amount is $500MM USD for property held in any single vault location, but according to the company the limit is periodically raised whenever the limit is approached to ensure metal is insured at all times. This insurance does not run directly to investors and does not cover losses for assets held other than at VIA MAT. Customers are responsible for any misuse of the customer’s pass phrase and Holding number. GoldMoney is, however, responsible for any breaches of the GoldMoney system itself and, under the user agreement, agrees to restore any goldgrams paid out fraudulently as the result of any such a breach, provided it is notified as provided in the agreement.

All precious metals purchased from and held by GoldMoney are required to meet London Good Delivery standards established by the London Bullion Market Association (“LBMA“) for gold and silver and the London Platinum and Palladium Market for platinum bars. GoldMoney acquires metals from various refineries, including Rand Refinery Limited in South Africa, the world’s largest gold refinery, Metalor Technologies SA and Argor-Heraeus SA in Switzerland and Johnson Matthey Limited in the United Kingdom.

GoldMoney’s precious metals holdings on behalf of investors surpassed $1billion in June, 2010. The company is regulated as a money services business and investors are subject to identity verification and other anti-money-laundering requirements. Customer funds are held in bank accounts of customer-segregated funds managed by GoldMoney’s associated company, Net-Gold Services Limited, a limited liability company incorporated in Jersey, British Channel Islands, pending investment in precious metals and following liquidation of precious metals holdings.

In U.S. dollars, the fees (“buy rates”) charged for purchase of precious metals, depending upon the amount purchased, range from .98% – 2.49% for gold, 1.99 – 3.99% for silver and 2.19 – 4.39% for platinum. Purchases may also be made in British pounds, Japanese yen, Canadian dollars, Euros and Swiss francs. No fees are charged for selling precious metals to convert into currency—holders receive the full spot price. GoldMoney guarantees that it will buy back at the current spot price irrespective of the size of the holding.

Fees for conversion from one metal to another, or between vaults, paid in “goldgrams,” platinum grams and silver ounces, range from a high of 3.51% for less than $1,000 of platinum to a low of 0.78% for more than $1 million of gold. Annual storage fees range from 0.15 – 0.18% for gold, 0.39 – 0.99% for silver and 0.39 – 0.59% for platinum, depending upon the amount of holdings and the location of the vaults selected. A 1% transaction fee (subject to a minimum and maximum stated in goldgrams, silver ounces or platinum grams, but generally from about 20¢ to a maximum of approximately $5) is payable for transactions in digital currency. The currency-to-currency exchange fee is a flat .49%, which is in addition to any fees charged by the investor’s bank. Other fees are charged for bank wires, bar registration, shipping/insurance, special requests and redemption of goldgrams for kilo or 100 gram bars.

GoldMoney was co-founded and is operated by James Turk, who is its chairman and Geoff Turk, its CEO. James Turk is a former banker and author of The Coming Collapse of the Dollar (Doubleday 2004) [available at Amazon or at DollarCollapse.com].

VIA MAT is a Swiss company that operates transportation and storage facilities in or near Dubai, Singapore, Shanghai, Guangzhou, Hong Kong, Los Angeles, Miami, New York, Frankfurt am Main, London, Neuchatel (Switzerland) and Zurich. VIA MAT has been in business for approximately 60 years and is well known internationally.

VIA MAT is a Swiss company that operates transportation and storage facilities in or near Dubai, Singapore, Shanghai, Guangzhou, Hong Kong, Los Angeles, Miami, New York, Frankfurt am Main, London, Neuchatel (Switzerland) and Zurich. VIA MAT has been in business for approximately 60 years and is well known internationally.

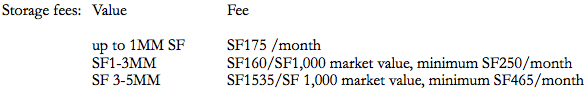

VIA MAT offers individual customers long term, short term and in-transit storage for precious metals and other valuables as well as open customs warehousing for goods that are to be re-sold or successively imported internationally. No storage quotes are available on the VIA MAT website, but according to a 2009 report by Casey Research, “The Gold Storage Solution: Switzerland,” the following storage fees were then in effect for Swiss holdings:

(3) Bullion Management Group, Inc.

BMG is a Canadian precious metals purchase and storage facility founded in 1998 and located in Markham, Ontario. BMG consists of:

- Bullion Management Group, Inc., the parent company

- Bullion Management Services, Inc., the Trustee and manager of BMG Bullion Fund (formerly Millenium Bullion Fund), which is a $250MM open-end mutual fund trust established in 2002 that purchases equal dollar amounts of allocated, unencumbered gold, silver and platinum bullion

- Bullion Custodial Services, Inc., manager of BMG BullionBars, which provides bullion purchase and sale (using real-time ScotiaMocatta pricing execution) and allocated custodial vaulting services through Bank of Nova Scotia in Toronto, Canada

- Bullion Marketing Services, Inc., which provides marketing services to BMG Bullion Fund

BMG deals exclusively with ScotiaMocatta, a division of The Bank of Nova Scotia, for all of its bullion purchases. ScotiaMocatta, before its purchase by Bank of Nova Scotia, was a founding member of the LBMA. Bank of Nova Scotia as custodian provides BMG on a regular basis a list of all gold, silver and platinum bars held for BMG customers, which is posted on the BMG website. As of June 1, ScotiaMocatta confirmed physical holdings for BMG Custodial Services of 360 bars (360,827.796 fine ounces) of silver, 216 bars (14,235.875 fine ounces) of gold and three bars (149.875 fine ounces) of platinum.

BMG represents that Bank of Nova Scotia stores customers’ precious metals on an allocated, audited and insured basis, but no further information is provided as to the allocation, auditing and insurance arrangements other than the statements that “the physical inventory is verified annually by KPMG as part of their audit for both BMG Funds and BMG” and “should it be discovered that a bar did not meet Good Delivery Standards or was not of the stated purity or weight, The Bank of Nova Scotia and the LBMA would intervene to correct the situation in order to meet the representations in their sales documentation.” According to the BMG website:

The website further explains what is involved in introducing bars into the LBMA system:

“If the documentation and the background checks passed scrutiny, then all bars coming from outside the Chain of Integrity are re-assayed and re-cast to Good Delivery standards at the cost of the owner. For bars coming directly from an acceptable refiner, or from another LBMA member, spot checks are made to confirm weight and purity.”

Nick Barisheff is the President and CEO of BMG. David Chapman, a securities professional associated with MGI Securities who publishes “The Technical Scoop” and has a regular column in Investor’s Digest of Canada, serves as a director. The other director of BMG is Larry Gamble, founder of Gamcor Real Estate Securities, Ltd., a licensed securities dealer and real estate syndication firm.

Perth Mint is a manufacturer and distributor of gold, silver and platinum coins and coin blanks for other mints located in Perth, Australia. It offers precious metal depository services to its customers as well as retail sales through its shop and a certificate program. Perth Mint was founded in 1899 as a branch of Britain’s Royal Mint to turn gold mined in Western Australia into British sovereigns. Control of the company passed to the Western Australian government in 1970. Then Gold Corporation was created under an Act of the Australian Parliament (Gold Corporation Act of 1987) to operate Perth Mint. Today, Perth Mint produces various Australian legal tender coins as well as commemorative coins. It is accredited by the LBMA, COMEX and Tokyo Commodities Exchange.

Perth Mint is a manufacturer and distributor of gold, silver and platinum coins and coin blanks for other mints located in Perth, Australia. It offers precious metal depository services to its customers as well as retail sales through its shop and a certificate program. Perth Mint was founded in 1899 as a branch of Britain’s Royal Mint to turn gold mined in Western Australia into British sovereigns. Control of the company passed to the Western Australian government in 1970. Then Gold Corporation was created under an Act of the Australian Parliament (Gold Corporation Act of 1987) to operate Perth Mint. Today, Perth Mint produces various Australian legal tender coins as well as commemorative coins. It is accredited by the LBMA, COMEX and Tokyo Commodities Exchange.

Perth Mint is subject to annual audit by the Auditor General of Western Australia and its internal auditor, PricewaterhouseCoopers. The government of Western Australia is the AAA-rated guarantor of Perth Mint’s liabilities. Perth Mint Group holds insurance with “reputable international insurers” for all precious metals owned or controlled by it. According to a letter to clients dated June 20, 2008, “metal held on behalf of depositors is used within the businesses of Perth Mint and its 40% owned refining facility, AGR Matthey” but “depositors’ metal is not leased to commercial counterparties” and “Perth Mint does not use futures or derivatives transactions to hedge or offset its metals liabilities to depositors.”2 Further, Perth Mint does not sell metal to create short positions and does not provide metal to any other organization for the purpose of short selling. The website warns that “clients should be aware that Gold Corporation may be required to provide certain transaction details under regulatory requirements to AUSTRAC,” Australia’s anti-money-laundering and counterterrorism financing regulator and specialist financial intelligence unit.

The Perth Mint Certificate Program allows investors to purchase and store precious metals on an allocated (segregated) or unallocated (unsegregated) basis and receive a certificate of ownership guaranteed by the Western Australian government. The minimum purchase to open a certificate account is $USD 10,000 ($5,000 AUD for Australian and New Zealand residents) and minimum additional purchase amounts are $5,000 in either U.S. or Australian dollars. There is no storage fee for unallocated accounts. A fabrication fee is payable only for allocated accounts or when investors take delivery of physical metals. Since conversion of unallocated holdings to physical form involves fabrication of coins or bars, there may be a delay for the time it takes to locate or fabricate the metals. Certificates, which are numbered, transferable and non-negotiable,3 may be purchased through an approved dealer network or, for New Zealand and Australian investors, directly from Perth Mint. Approved dealers are:

- Asset Strategies International, Inc., (Rockville, MD USA)

- BFI Wealth Management AG (Zurich, Switzerland)

- Euro Pacific Capital, Inc. (Newport Beach, CA USA)

- GoldCore Limited (Dublin and London)

- Jaggards Pty Ltd. (Royal Exchange, NSW Australia)

- Kitco Precious Metals (Montreal, Canada)

- PMCG Pty Ltd. (Double Bay, NSW Australia)

- Security of Assets, S.A. (Panama City, Panama)

- Thornton Group (Australia)

- Perth Mint Shop (Australia)

The Perth Mint depository program for purchase and storage of gold, silver and platinum bullion and gold and silver bars and coins has a minimum purchase amount of $250,000 USD for foreigners and $50,000 for Australians and New Zealanders, although foreigners may hold lesser amounts if they pay a 2% entrance fee and a 1% exit fee (in line with the certificate program fees). Storage fees are based upon the purchase price of metals, so do not increase if precious metals market prices increase. Fees are payable by electronic funds six months in advance. To open an account, clients must fill out and mail or fax an account form for Australian and New Zealand residents and this form for international clients and notarized copies of identification documents sufficient to satisfy AUSTAC requirements (a driver’s license, birth certificate or utility bill may be used). An account number and password is used to identify the client.

Prices for purchase of metals may be based upon international spot prices or the London AM or PM fix. Fabrication and storage fees are payable for allocated purchases. A 2% fee is levied upon purchase and a 1% fee is levied upon sale for accounts with balances less than $250,000 for international accounts ($50,000 for Australian and New Zealand residents). The allocated storage and insurance cost for gold is 1.5% per year and for silver is 2.5% based upon the cost at the time of allocation. Fabrication fees vary widely by product (see account schedules for prices prior to recent increases).

Perth Mint’s website notes that there is no Australian sales tax or transfer restrictions on precious metals in Australia.

(5) Delaware Depository Service Company, LLC

Located in Wilmington, Delaware, Delaware Depository Services Co., LLC is a precious metals custody and distribution center for institutional investors and industrial companies that deal in precious metals. It also provides accounting and shipping services. DDSC is licensed by the COMEX and Chicago Board of Trade to store silver bullion for exchange members and by the New York Mercantile Exchange to store platinum and palladium for its members. DDSC offers allocated and physically segregated custody accounts. Commercial inventories are physically segregated by corporate account.

All precious metals assets held by DDSC, which may be held in the form of bullion bars, bullion coins or certified coins, are held in allocated form, on either a segregated or non-segregated basis. Precious metals held in non-segregated accounts may  be commingled with those of other customers, whereas segregated storage involves physical separation of the customer’s metals. According to the non-commercial account agreement, DDSC or any custodian that holds the customer’s metals on its behalf is required to maintain “all risk” insurance covering the customer’s metals. All risk insurance is subject to standard exclusions (like losses due to terrorism and war), but covers physical loss and/or physical damage, including mysterious disappearance and/or unexplained loss and shortage, employee dishonesty and theft. Loss or damage from fire, flood or other natural disaster is also covered. DDSC makes no warranties as to the fineness, content, identification or value of the precious metals it stores. DDSC disclaims liability for losses due to failures by shippers or other third parties and losses due to various named acts beyond its control, including floods, fire, acts of terrorism, technical failures, storms, unusual market conditions, acts of war and sabotage. DDSC takes a security interest (i.e., lien) on the assets it stores to secure all amounts owed by the customer.

be commingled with those of other customers, whereas segregated storage involves physical separation of the customer’s metals. According to the non-commercial account agreement, DDSC or any custodian that holds the customer’s metals on its behalf is required to maintain “all risk” insurance covering the customer’s metals. All risk insurance is subject to standard exclusions (like losses due to terrorism and war), but covers physical loss and/or physical damage, including mysterious disappearance and/or unexplained loss and shortage, employee dishonesty and theft. Loss or damage from fire, flood or other natural disaster is also covered. DDSC makes no warranties as to the fineness, content, identification or value of the precious metals it stores. DDSC disclaims liability for losses due to failures by shippers or other third parties and losses due to various named acts beyond its control, including floods, fire, acts of terrorism, technical failures, storms, unusual market conditions, acts of war and sabotage. DDSC takes a security interest (i.e., lien) on the assets it stores to secure all amounts owed by the customer.

Find a copy of the company’s Non-commercial Depository Account Opening Form & Agreement here. Note that all joint accounts are held by joint tenancy with rights of survivorship and not tenancy in common. This means that upon the death of one joint owner, the other owner(s) automatically take(s) title to the entire account and the assets do not pass through the estate according to the will of or applicable laws of descent and distribution applicable to the deceased co-owner. Such an arrangement may not be appropriate for unmarried co-owners.

The annual rate for non-commercial segregated storage is 1.5% of the dollar value of the precious metals in storage. The rate for non-segregated storage is .75%. Certified coins may be held only in segregated storage, and the fee is calculated based upon values obtained from a generally accepted certified coin pricing system. The value of bullion bars is determined based upon spot prices on the last day of the billing period. Storage fees are billed on a semi-annual basis in arrears, with a minimum charge of $25 per billing. Generally, personal pick-up fees are $.10 an ounce or $10 per item, depending upon what the item is. Special handling charges may apply. There is a $25 minimum fee per out shipment for deliveries within the U.S. and postage, registration and insurance charges are billed C.O.D.

DDSC will store U.S. 90% or 40% silver coinage in bags containing only $100, $250, $500, $750 or $1,000 face value. The customer may elect to have the count of the coins contained in any bag verified (“count-verified”) by DDSC for a fee of $25.00 per bag. DDSC requires count-verification for all bags held in non-segregated storage accounts and will assess the appropriate fees. Count-verification is not required for segregated storage accounts.

Delaware Depository is typically used as the storage company for custodians that facilitate investment in precious metals through self directed IRAs in the United States.

Gold Silver Vault LLC is a recently-formed private armored vaulting facility located in Nampa, Idaho for storage and transportation of gold, silver, gems and other tangible valuables that has arrangements with other subcustodians throughout the United States and North America. It offers individual safekeeping accounts on a segregated basis whereby investors’ holdings are held physically apart from those of other customers in sealed containers, either at the company’s sub-custodial facilities in Idaho or at the facilities of a sub-custodian closer to the customer. Gold Silver Vault disclaims responsibility for the authenticity, content, weight, fineness, markings or other characteristics of the precious metals coins or bars delivered to it for storage. The sub-custodian is obligated to maintain all-risks insurance (with certain standard exclusions) with an unspecified insurance company and will provide copies of insurance certificates upon request.

Gold Silver Vault LLC is a recently-formed private armored vaulting facility located in Nampa, Idaho for storage and transportation of gold, silver, gems and other tangible valuables that has arrangements with other subcustodians throughout the United States and North America. It offers individual safekeeping accounts on a segregated basis whereby investors’ holdings are held physically apart from those of other customers in sealed containers, either at the company’s sub-custodial facilities in Idaho or at the facilities of a sub-custodian closer to the customer. Gold Silver Vault disclaims responsibility for the authenticity, content, weight, fineness, markings or other characteristics of the precious metals coins or bars delivered to it for storage. The sub-custodian is obligated to maintain all-risks insurance (with certain standard exclusions) with an unspecified insurance company and will provide copies of insurance certificates upon request.

See Gold Silver Vault’s standard custody agreement here. As is the case for DDSC (see explanation above) all joint accounts are held by joint tenancy with rights of survivorship and not tenancy in common. Gold Silver Vault takes a security interest in the customer’s metals to secure its fees.

Annual gold and silver storage fees (which are billed quarterly) for vaults in Idaho range from a low of 0.5% of the spot price for $10MM market value of gold and 0.52 of the spot price for $10MM market value of silver to a maximum of 0.78% or 0.80% for $50,000 – $100,000 market value of gold or silver, respectively. The fee rate is multiplied by the number of ounces held and there is a minimum $75 quarterly fee. Fees for storage in other locations vary according to location. Gold Silver Vault charges a $30 fee for release of valuables and arranges for shipping at the customer’s expense via U.S. Postal Service, FedEx or other commercial carrier or private armored carrier as directed by the customer.

Gold Silver Vault was founded by Bob Coleman. He is associated with Profits Plus Capital Management, LLC, an Idaho-registered investment adviser that appears to sponsor the Dollars and Cents Growth Fund, LP, which the website claims is “the only private fund in the country that buys and stores gold and silver bullion outside the U.S. financial system.”

(7) Security Center

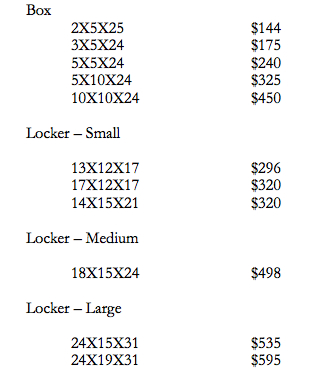

Security Center is a private safe deposit box facility located in New Orleans, LA that has been in business for over 30 years. It offers 24-hour vault access (with a $100 access fee for after-hours admission), a double-key locking system (with Security Center’s key held in a separate safe deposit box) and private numbered accounts. Annual box fees are as follows:

Since Security Center has no access to the boxes without the customer’s key, no auditing is offered. No customer identification is required to open an account and Security Center is not subject to bank or other reporting regulations with respect to its boxes. Security Center routinely receives shipments of gold and silver coins by registered mail through the U.S. Postal Service. As valuables arrive a package is logged  by the registered mail number, the customer’s name or number, date received and box number. Valuables are placed in the customer’s box along with a copy of the log receipt (assuming the customer’s key is held in safekeeping by Security Center or has not yet been sent to the customer following after initial assignment of storage). Valuables are stored at the renter’s risk of damage or loss due to acts of God and other events typically excluded under hazard insurance policies. Liability for theft is limited to the lower of actual value or 200 times the base storage rate. Although the account form seems to indicate that Security Center will insure the excess value, no such option is currently available.

by the registered mail number, the customer’s name or number, date received and box number. Valuables are placed in the customer’s box along with a copy of the log receipt (assuming the customer’s key is held in safekeeping by Security Center or has not yet been sent to the customer following after initial assignment of storage). Valuables are stored at the renter’s risk of damage or loss due to acts of God and other events typically excluded under hazard insurance policies. Liability for theft is limited to the lower of actual value or 200 times the base storage rate. Although the account form seems to indicate that Security Center will insure the excess value, no such option is currently available.

Security Center is located in a six-story building that was formerly the New Orleans Federal Reserve Bank building, so its safe deposit boxes are comparable to those typically located in a bank. It has approximately 450 safe deposit boxes and 300 lockers. The General Manager reports that the facility has a substantial customer base abroad and around the country. Most out-of-town customers leave their keys with Security Center and have identified themselves to the company by name, so that if they arrive at the facility in person, they are in a position to provide identification and obtain the key, which is stored in a separate safe deposit box. Alternatively, all arrangements may take place by mail. Anonymous customers are advised that they should provide some information as to a designee in case of death. In the event no storage charges are paid for a period of two years, the storage contents may be turned over to the Treasurer of the State of Louisiana according to Louisiana state law.

D. The Swiss Option

Traditionally, many precious metals investors wishing to hold their metals offshore have elected to use safe deposit boxes in banks in Switzerland, where bank secrecy statutes protected their privacy. Recent moves by the U.S. Internal Revenue Service to obtain information on undeclared profits of U.S. taxpayers from Swiss banks have resulted in compromises to such privacy, however. Further, U.S. investors now are required to report holdings in excess of $10,000 in foreign financial institutions to the U.S. Treasury on a Report of Foreign Bank and Financial Accounts (Form TD F 90-22). Since Swiss banks are financial institutions, the contents of their safe deposit boxes are reportable by U.S. customers. As a result of pressures to disclose foreign customer information, particularly from the U.S. government, many Swiss banks are making it more difficult for U.S. residents to open Swiss bank accounts (generally, a prerequisite to opening a safe deposit box), both by having hefty minimum balances (which may be as high as six figures) and by requiring relatively cumbersome identification documentation. For U.S. investors wishing to diversify their substantial precious metals holdings, however, this may still be a viable alternative at some banks.

Another option in Switzerland is storage in non-bank vaults or warehouses or “specialist depositories.” VIA MAT (described above) is one such facility.

According to a 2009 report by Casey Research, “The Gold Storage Solution: Switzerland“:

The Swiss value added tax (VAT), which is levied upon physically delivered precious metals other than gold, is 7.5% (8% from 2011 to 2017) according to Wikipedia.

E. In Conclusion

As investment in precious metals grows, storage options also proliferate. While we have reviewed some of the options available to both individuals and institutions, there are numerous other publicly available choices, as well as private vaults available by invitation only. Our failure to mention any particular storage facility should not be interpreted as a criticism.

Information has been derived from public sources or through emails or telephone conversations with representatives of these companies, without any further verification. Neither Solari nor the authors have done a complete due diligence on the options described in this article. Investors are advised to conduct their own due diligence before entering into arrangements for the storage of their precious metals by third parties.

Each owner of precious metals has unique goals and needs. We hope this review of selected options will help you understand the core considerations important to your defining and achieving your objectives in identifying and evaluating storage providers.

Biographies

Catherine Austin Fitts is the founder of Solari Inc. and Solari Investment Advisory Services, LLC, and co-founder of . Solari, Inc. publishes the Solari Report.

Carolyn Betts is an attorney practicing in Cincinnati, Ohio. She serves as counsel to Solari, Inc and Solari Investment Advisory Services, LLC.

Footnotes

1 Investors are advised to conduct their own due diligence before entering into arrangements for the storage of their precious metals by third parties.

2 Presumably, Perth Mint’s use of depositors’ metals as described in the letter is limited to unallocated accounts.

3 Generally, “non-negotiable” means that any transfer must be registered by the issuer.

Nothing in this Solari Report should be taken as individual investment advice. Anyone seeking investment advice for his or her personal financial situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate investment strategy.