Read the Transcript

Read the transcript of Bitcoin 101 with Sarah Wiesner here (PDF)

Listen to the Interview MP3 audio file

Download the Interview audio file

Read the Money & Markets Notes

Read the notes from this week’s Money & Markets here (PDF)

Listen to the Money & Markets MP3 audio file

Download the Money & Markets audio file

Audio Chapters

ThemeThe theme this week is “The World has become a Global Armaments Expo”.

Money & MarketsThis week in Money & Markets, Catherine discusses the latest in market movements and geopolitical events.

HeroOur hero this week is Clifford Carnicom.

Let’s Go to the Movies!Catherine discusses recommended Bitcoin presentations.

Interview DiscussionCatherine discusses her interview with Sarah Wiesner.

Ask Catherine Catherine answers questions submitted by subscribers.

May 11 – Interest Rate Swaps with Robert Kirby

May 18 – Edward Bernays & the 10 Big Lies of the 21st Century with Junious Ricardo Stanton

“The swarm is headed towards us” – Satoshi Nakamoto, when WikiLeaks started accepting Bitcoin donations

By Catherine Austin Fitts

This week on the Solari Report, join me for a fascinating conversation with Sarah Wiesner of Bitcoin Embassy TLV.

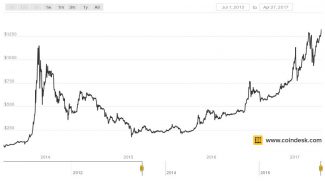

Interest in bitcoin is growing. One reason is the price. Bitcoin prices are rising, with market capitalization approaching approximately $25 billion – almost five times greater than the market cap of the next largest cryptocurrency.

Another reason is government policy. With central banks and governments engaged in liberal monetary and fiscal policies, involving both debasement of sovereign currencies and encouraging the creation of paper gold and silver investment vehicles, a stateless currency that limits its issue appeals to investors weary of inflation and market intervention.

The bitcoin market is tiny by financial market standards – we are still at the early stages of the development of it and other cryptocurrencies. At a market capitalization of approximately $35 billion, the entire cryptocurrency market is approximately one-third of the market capitalization of Starbucks.

The market is growing fast – it grew from $30 to $35 billion in the five day since Sarah and I recorded this interview. If the SEC approves the first Bitcoin ETF capital flow will accelerate. We could also face the same paper problem we have experienced in precious metals.

Whatever happens next, digital currency volumes are likely to grow supported by communities passionate about decentralization and financial privacy. According to research produced in 2017 by Cambridge University, there are between 2.9 million and 5.8 million unique users actively using a cryptocurrency wallet, most of them using bitcoin.

The $64,000 question is whether or not a trustworthy digital currency with encryption can operate on a digital infrastructure and platforms that lack integrity, controlled ultimately by the leadership promoting a global war on cash and eager to be relieved of liabilities for sovereign deposit insurance. No less than the The Economist declared on its cover this month “Why computers will never be safe.”

In Money & Markets this week I will discuss the latest in financial and geopolitical news. Please post or e-mail your questions for Ask Catherine.

For Let’s Go to the Movies, take a look at “Introduction to Bitcoin and Blockchain Technology” by Ofir Beigel of 99bitcoins.com or 99bitcoins’s “Bitcoin Video Crash Course“.

Talk to you Thursday!

If you are not a subscriber, you can Get a Taste or subscribe here.