Read the 2nd Quarter Wrap Up – Financial Markets Round Up

Read 2nd Quarter Wrap Up – Financial Markets Round Up Here

Read the Rambus Blockbuster Chartology

Read Rambus’ presentation here.

Listen to the 2nd Quarter Equity Overview

The Solari Report 2016-07-21

Read the Money & Markets Notes

Read the notes from this week’s Money & Markets here (PDF)

Listen to the Money & Markets MP3 audio file

The Solari Report 2016-07-21

July 28 – 2nd Quarter Wrap Up – Productivity, Prosperity & the Popsicle Index

August 04 – Solari Food Series – Vital Soils – The Foundation of Life, Part I

August 11 – The Bechtel Corporation with Sally Denton

“If you are shopping for common stocks, choose them the way you would buy groceries, not the way you would buy perfume.” ~Benjamin Graham

By Catherine Austin Fitts

This coming week we will publish the quarterly written Blockbuster Chartology from Rambus, including a powerful in-depth review across precious metals and equity markets.

For our audio interview, I will solo to review insights from Rambus as well as our 2nd Quarter Wrap Up Financial Roundup. You can link to the Financial Roundup now in the web presentation for the 2nd Quarter Wrap Up linked from your Subscriber Resource Page or the last two Solari Report commentaries where we covered the News Trends & Stories, Part I and Part II with Dr. Farrell. A link to the Blockbuster Chartology will be posted on Thursday in your subscriber links.

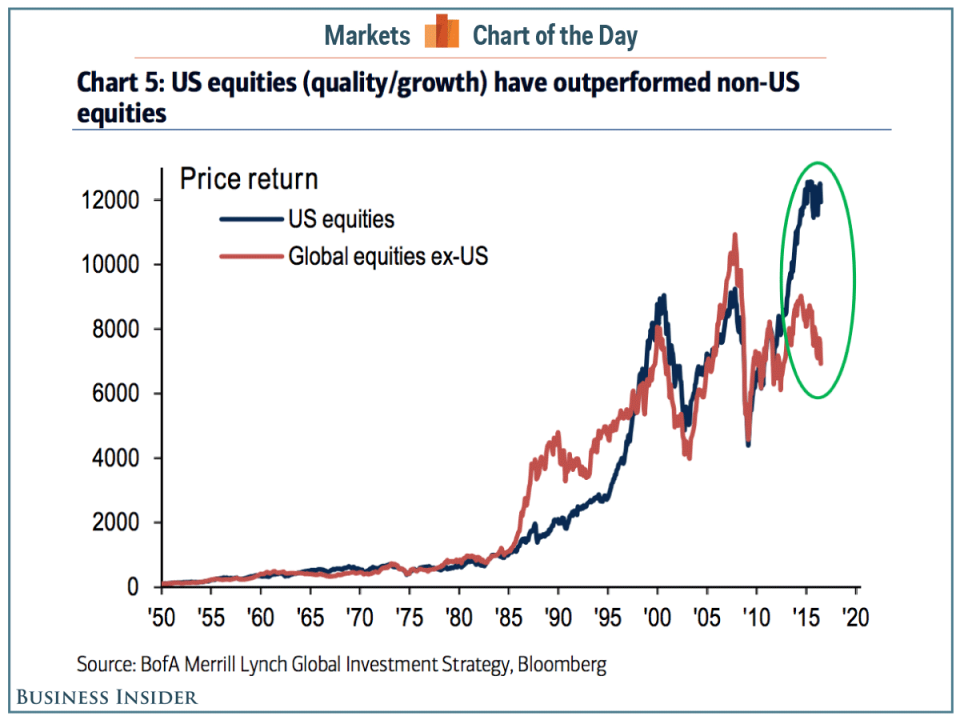

Gold, silver, and mining stocks have had a gangbuster rise in the first two quarters of 2016. Now the US equity markets are hitting record highs. Is the long-term bull market in precious metals finally reasserting itself? Does the US equity bull market have more room to rise? Will government and central bank interventions assure that prices continue to rise, or will slowing productivity growth, lower corporate earnings, and a slowing global economy ultimately ground prices down below current levels? The possible scenarios underscore that investors should be prepared for “volatility in possibilities.” This includes risks to the outlook and stability of the Euro and the US Dollar.

Posting from Lake Constance in southern Germany, I will address current events in Money & Markets. Please make sure to e-mail or post your questions for Ask Catherine. And thanks again for the great recommendations and links!