By Catherine Austin Fitts

The news today is mapping out a picture. In the first quarter of 2014, the US economy contracted. And yet the OECD says that the global economy will grow at more than 3.4% this year. Why is that? It is because growth in the emerging markets is so much greater and more dynamic than in the United States?

Today, the WSJ headline blazes “China’s internet Crown Jewel Sets IPO” telling us that Internet juggernaut Alibaba is valued at more than $100 billion in its US filing. The US can claim the most powerful, liquid equity markets in the world. That’s why Alibaba, provider of online access to millions of Asian entrepreneurs and small businesses, wants to tap them.

Too bad America’s small businesses can not access these rich equity markets. Quite the contrary. America is in the middle of a long war on small business. Capital and resources are strictly channeled to ensure that American corporations enjoy the lowest possible cost of capital so they can compete with the Asian and G-20 juggernaut. Rich government contracts and subsidies make sure they have plenty of revenues and access to a flow of astonishing technology that ensures their global competitiveness. When trouble comes, they are bailed out, mergers are arranged, and recapitalizations are to be had.

To continue reading Catherine’s commentary on current events subscribe to The Solari Report here. Subscribers can log in to finish reading here.

But does that ensure the most dynamic, innovative economy and the most dynamic, innovative people and culture?

It’s open season warfare on small business. Small businesses must pay the taxes that ensure the government can pay local citizens unemployment and food stamps, while their farming businesses are shut down by food safety rules or forced to buy terminator seeds, government data servicing is outsourced through large banks and corporations to Asia that could provide local jobs in areas of high unemployment on a more economic basis, their 401ks are required to invest in the large corporations that are competing for their market share, they must fund the costs of security when drugs and related crime continue to show up in their community mysteriously allowed to flow into the country across borders that are supposed to be protected by the military and enforcement they pay for, and Internet companies are allowed to stalk them and steer customers into the corporate chains. And, of course, there is the blow that Obamacare just delivered to their bottom line.

Given the burst of new technology and the need to encourage start ups and investment in small business, a group of entrepreneurs lobbied for the passage of the Jobs Act in 2012, that would allow crowdfunding techniques to be applied to small business raising capital by selling securities through on line markets called portals. Today, I can easily spend my entire life savings on heroin and cocaine or on the lottery. I can not, however, easily make investments in local small businesses in my community on the theory that the government is trying to protect me. The regulations for the Jobs Act have yet to be issued,

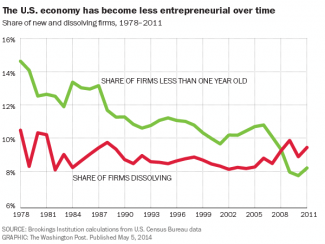

This week a new study from the Broookings Institute shows that small businesses are closing faster than new small businesses are being created. One reason is that our young entrepreneurs are overwhelmed by student loan debt. And yet, we see one of the people responsible for that situation, Bill Diefenderfer, newly promoted. If we keep promoting the people who bankrupt our young people, what do we think will happen?

We have to ask ourselves, is our goal to shut down small businesses? Is this a plan? Or is the flow of corporate money into campaign coffers simply buying an unintended consequence? No doubt the latest Supreme Court decision will allow the corporate purchasing of political favors to grow.

In the 1990’s, I had the opportunity to work with AT&T Bell Laboratories on the optimization software they had developed to route telephone calls. My company used their models to dramatically improve recovery rates on the defaulted mortgages at the Federal Housing Administration. AT&T Bell Labs had also applied this software to scheduling airline crews. Pilots, stewards and stewardesses could input a large list of preferences for routes and working times, and the model could optimize the scheduling of many crews globally. After many years of working with the airlines, they developed rich databases that would allow them to ask intriguing “what if” questions. One of the questions they asked was what the cost of different rules where – whether FAA, corporate or union rules.

One of the things they discovered was the staff seniority was so expensive, that if it was cancelled, the people with the most seniority would have had more of their preferences satisfied. That is, privilege so sub-optimized the total solution that even the privileged suffered from what was optimal if they would just relinquish their privilege.

American corporations have achieved phenomenal things. I am not in the “corporations are bad” camp. We need lots of companies, including big companies. American companies over the last year have delivered record payouts of over $1 trillion in dividends and stock buybacks that have filled pension fund and household coffers. They have worked very hard to do so – indeed it has become an increasingly brutal existence.

However, the failure to require government spending, contracts and credits to be allocated and disclosed according to law that has had such an important role in supporting corporate earnings has resulted in a sub-optimization of our economy by place. This process is harming our environment, draining households, bankrupting small farms and business and lowering our fundamental productivity as a people.

Companies are created, grow and die. Fine. But what is happening with small business is something else. It is, in part, the rotten stench of privilege, including that rigged through Wall Street, Washington and the perversion of valuable judicial and enforcement capacity to uphold privilege rather than the law. From what I see, that rotten stench is holding back the potential for the great American corporations as well. The price of privilege is now also draining the privileged.

It is time to revisit the real price of privilege and what all Americans can do to reenergize our businesses – whether old or new, great or small — along with our people and communities. The opportunity is there to be had.

Related Reading:

Dillon, Read and Co. Inc. & the Aristocracy of Stock Profits