The “lead left” bank leads the IPO underwriting process — its name in the upper-left-hand corner of the actual prospectus — and typically receives higher fees than the other banks in the syndicate. Goldman Sachs and Morgan Stanley had reportedly battled over that status for Facebook’s IPO. Previous reports suggested that Morgan Stanley won out because Facebook was displeased with Goldman’s botched, $1.5 billion private placement in the company shares last January, in which the bank ran afoul of SEC rules and was forced to close the offering off to U.S. investors.

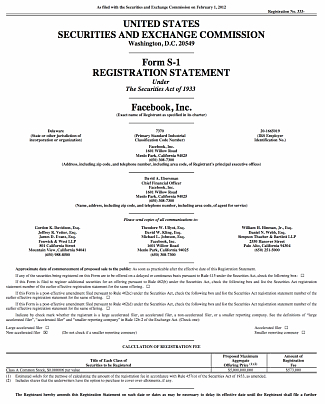

Facebook will file its IPO prospectus with the Securities and Exchange Comission, which will scrutinize the company’s financial statements. Potential public market investors will also get a chance look at Facebook’s books for the first time.

PROSPECTUS (Subject to Completion)

Dated February 1, 2012