By Chuck Gibson

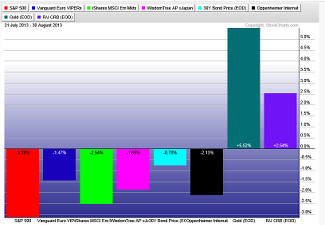

With the month of August wrapping up last week, I wanted to do a quick check back in on how different segments of the investment markets fared (reflected in the chart below). The main backdrop for most of August’s price movement was the potential FED tapering back on its bond purchases. Stock investors concerned the punchbowl may soon be pulled, began an early repositioning and lightened up on their holdings. Bond holders became afraid of the same outcome but for different reasons they sold off holdings driving interest rates to 2 year highs. Finally commodities seemed to have caught a bid (from where i sit it seems like it may not necessarily be the end of the 2 year downtrend) as investors began to look for a home for their freshly printed bond and stock sale proceeds.

From right to left – US based SP500 stock index (red), European stock index (blue), Emerging markets stock index (light green), Asian stock index (magenta), US 30yr bond (light blue), International Bonds (black), Gold (teal), Commodities (purple).