By Christine Harper

Legislation to overhaul financial regulation will help curb risk-taking and boost capital buffers. What it won’t do is fundamentally reshape Wall Street’s biggest banks or prevent another crisis, analysts said.

A deal reached by members of a House and Senate conference early this morning diluted provisions from the tougher Senate bill, limiting rather than prohibiting the ability of federally insured banks to trade derivatives and invest in hedge funds or private equity funds.

Banks “dodged a bullet,” said Raj Date, executive director for Cambridge Winter Inc.’s center for financial institutions policy and a former Deutsche Bank AG executive. “This has to be a net positive.”

Continue reading Banks `Dodged a Bullet’ as U.S. Congress Dilutes Trading Rules

Related reading:

Byrd’s Death Puts Financial Reform Efforts at Risk

Yahoo News (28 June 10)

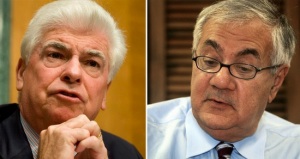

Dodd-Frank Wall Street Reform and Consumer Protection Act

The Dodd-Frank Bill Up Close

The New York Times (28 JUNE 10)

Scrambling For Senate Votes on Wall Street Reform

Yahoo Finance (28 June)

Dodd-Frank Bill Complete, Bankers React

Forbes.com (25 June 10)

Strong Enough for Tough Stains?

The New York Times (25 June 10)

Biggest Banks Dodge Some Bullets at The End

The Wall Street Journal (26 June 10)

Senator’s Concern May Complicate Wall Street Bill Vote

Reuters (26 June 10)