Following my recent interpretation of the G20 communique, the editor of Expresso wrote back: “Catherine, can you elaborate a little more about this printing euphoria?”

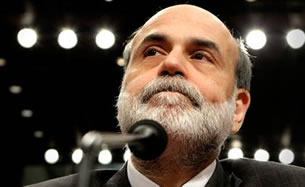

The Chairman of the Federal Reserve, Ben Bernake, has been adamant. He will not let a deflation take hold. He is fighting significant drops in stock and real estate market values and a “stall” in economic activity by expanding the money supply.

Hence, the Fed has been aggressive in providing loans and liquidity to the market while the Treasury has been generous with bailouts. However, much of these funds are simply covering losses in the large mortgage and derivative portfolios — the capital injections do not appear to be rippling through the larger economy. In essence, large institutions are hoarding the resources and cutting off the smaller institutions in a way that is devastating for the real economy.

That means that insiders can now buy up assets in the real economy on-the-cheap … which was their goal from the beginning. It’s another example of how “trickle down economics” translates into “drop dead economics.”

Part of the challenge is that our economy does not need more debt. We need more circulation of equity, greater transparency, and open competition that will improve performance on equity. Such changes, however, would be in conflict with continued centralization.

So, how do you keep an economy going when it is being heavily taxed by centralization and lawlessness in the allocation of capital? You print money. The theory is that consumers can keep spending on consumer products without ever having enough money to compete for ownership of the real economy. My prediction is that it will not work.