The recent international banking incident between the US government and Swiss banking authorities in which Treasury demanded private account information about holdings of US citizens in Swiss bank accounts is just one indication that federal enforcement authorities are stepping up their efforts to monitor and collect tax on foreign holdings by US taxpayers.

This reflects an ongoing trend by American regulators to discourage direct foreign investment by US investors that circumvent US financial institutions and intermediaries. Accounting professionals meeting in Washington this Spring report that in virtually every contact with IRS examiners, the main topic of conversation was the Service’s increased scrutiny of foreign financial accounts and focus on taxpayer requirements to report such accounts to the IRS and Treasury.

In May, Treasury released proposed regulations that would expand the scope of money services businesses subject to Bank Secrecy Act registration and reporting requirements so that any business dealing in “stored value” would be covered. Also in May, the Administration proposed new and stronger compliance requirements of US intermediaries that send funds to or receive funds from foreign accounts held by US taxpayers. (Also)

A little background is in order. Those of us who are not in a financially-related business may have only a vague understanding of anti-money laundering rules that require various filings with the Financial Crimes Enforcement Network (FinCEN), an agency of the Department of Treasury, and the Internal Revenue Service. In a nutshell, the Bank Secrecy Act and provisions of the USA Patriot Act require that certain domestic entities engaged in money-handling businesses report any currency transaction, or related transactions, in excess of $10,000 and any “suspicious activities” that could involve money laundering.

Originally, these requirements applied only to banks and other traditional financial institutions but, over the years, the Act has been amended to require filing by other businesses that might be used by criminals to launder proceeds of illegal transactions or to hide funds from taxing authorities. Thus, mutual funds, broker-dealers, casinos, precious metals dealers, money services businesses (e.g., currency exchanges, issuers of traveler’s checks and money orders and other money transmitters) and dealers in durable goods, among others, are now covered by the law.

Since the US government does not have jurisdiction over businesses in foreign countries, in order to track down money-laundering and tax-avoidance schemes involving US citizens engaging in financial transactions abroad, the Bank Secrecy Act requires US persons (including businesses) themselves to self-report foreign financial accounts that exceed $10,000 during a tax year.

Here is what the regulation [31 CFR 103.24(a)] says:

“Each person subject to the jurisdiction of the United States (except a foreign subsidiary of a U.S. person) having a financial interest in, or signature or other authority over, a bank, securities or other financial account in a foreign country shall report such relationship to the Commissioner of the Internal Revenue for each year in which such relationship exists, and shall provide such information as shall be specified in a report form prescribed by the Secretary to be filed by such persons.”

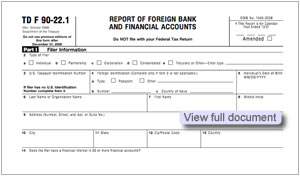

The report of the relationship to the IRS Commissioner comes in the form of boxes to be checked on Schedule B to the reporter’s IRS Form 1040, items 7a and b, which, for 2008, ask “At any time during 2008, did you have an interest in or a signature or other authority over a financial account in a foreign country, such as a bank account, securities account, or other financial account?” and “If ‘yes,’ enter the name of the foreign country.” The reporting form prescribed by the Secretary, Form TD 90.22.1, Report of Foreign Bank and Financial Accounts (commonly referred to as the “FBAR”), can be found as the last form here.

The filing due date is June 30 of the year following a year during which the account(s) exceed $10,000. That those with signature or other authority over the account are required to report means that, except in the case of public companies, individual employees who have check-writing or other authority over foreign financial accounts must individually meet the filing requirement if such accounts at any time exceed $10,000. See a law firm’s more detailed advice on the subject of who must file the FBAR report here.

With the exception of form instructions and the IRS’s FBAR Workbook on the Report of Foreign Bank and Financial Accounts, little formal guidance exists on what a reportable “foreign financial account” is. The FBAR form instructions state that the term includes foreign bank and brokerage accounts and mutual funds and other collective investment funds. Bonds, notes and stock certificates held directly by the filer are not included.

What about precious metals holdings abroad? A number of practitioners and commentators on the subject (for example, Mark Nestmann, an international tax attorney, on the American Sovereign Society website opine that unless a formal “account” with a financial institution is involved, there is no reporting requirement.

The IRS indictment of the digital currency and precious metals company, E-Gold, which is based in Nevis, on money laundering charges and , suggests that Treasury and IRS can be expected to scrutinize similar arrangements and may take the position that US customers should report holdings in such enterprises as foreign financial accounts. Other foreign digital precious metals dealers have voluntarily registered as money services businesses (a type of “financial institution” covered under the Bank Secrecy Act if subject to US law) and instituted systems to detect and report suspicious transactions to relevant money laundering enforcement authorities.

Treasury has delegated only civil enforcement authority over the FBAR filing requirement to the IRS, leaving criminal enforcement to FinCEN. Reportedly, this is the reason that at least one national accounting firm has a policy not to accept potential criminal cases involving failure to file the FBAR or filing of a false FBAR (on the theory that jurisdiction by Treasury rather than the IRS may present the risk that malpractice carriers may deny coverage and the potential for charges of practicing law without a license).

Another consequence of this jurisdictional demarcation is that IRS examiners are permitted to request a taxpayer’s FBAR filing only after obtaining permission that is predicated upon a showing of reasonable grounds to believe there may be a related tax violation.

Nevertheless, due to the potentially serious penalties for even a negligent violation of the FBAR filing requirements (up to $10,000 under 31 U.S.C. § 5321(a)(5)(B)) and recent focus on FBAR enforcement, it behooves the cautious US taxpayer who has more than $10,000 in foreign digital currency, bullion-related or other potential foreign financial accounts to consider seeking advice from a tax practitioner about whether a protective filing of the FBAR report is appropriate, even if the June 30 filing deadline has been missed, and an amendment to any tax return that failed to note such holdings on Schedule B.

Note that willful violations of the FBAR filing requirement and related recordkeeping requirements entail civil penalties of up to $100,000 and criminal penalties of up to $250,000 and up to five years’ imprisonment. See two law firm advisories for details about a six-month penalty initiative for non-filers who voluntarily disclose non-compliance. (Also)

See Update.