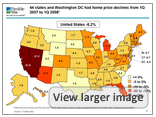

“Now previously we have said that we expect housing prices to fall at least 15% nationally, and today they [have fallen] about 9% through the measure we use which is relative to our market. We want to take a better look at the spring housing market to see whether or not the data is beginning to firm up. It is premature at this point from a data perspective to make a change in our formal estimate. However at this point we must say that the risk to the forecast are strongly weighted on the downside. Give the severity we have experienced, [we took] an increase in charge off in REO expenses associated with higher loan loss severities. As a result of this change, we raised our estimate for credit costs and increased our provision.” ~ Richard Syron, CEO, May 14, 2008 (emphasis added)

“Now previously we have said that we expect housing prices to fall at least 15% nationally, and today they [have fallen] about 9% through the measure we use which is relative to our market. We want to take a better look at the spring housing market to see whether or not the data is beginning to firm up. It is premature at this point from a data perspective to make a change in our formal estimate. However at this point we must say that the risk to the forecast are strongly weighted on the downside. Give the severity we have experienced, [we took] an increase in charge off in REO expenses associated with higher loan loss severities. As a result of this change, we raised our estimate for credit costs and increased our provision.” ~ Richard Syron, CEO, May 14, 2008 (emphasis added)

View full CalculatedRisk Blog Post (14 May 2008)