**CAF Note: Are computers replacing FX trades because they are more efficient? Or because they are more obedient at implementing illegal schemes?**

By Ambereen Choudhury and Julia Verlaine

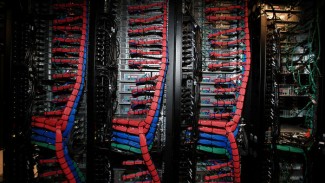

A widening probe of the foreign-exchange market is roiling an industry already under pressure to reduce costs as computer platforms displace human traders.

Electronic dealing, which accounted for 66 percent of all currency transactions in 2013 and 20 percent in 2001, will increase to 76 percent within five years, according to Aite Group LLC, a Boston-based consulting firm that reviewed Bank for International Settlements data. About 81 percent of spot trading — the buying and selling of currency for immediate delivery — will be electronic by 2018, Aite said.

Related: Banker Death Watch

Investment Banker Jumps to Death from JP Morgan’s Headquarters in Central

More On The Epidemic Of “Suicided” Banksters…

Suspicious Death of JPMorgan Vice President, Gabriel Magee, Under Investigation in London

Exposing What Lies Beneath the Bodies of Dead Bankers and What Lies Ahead For Us

Did 5 Banksters and 1 Journalist All Fake Their Deaths?

Under Investigation, American Title CEO Dead in Grisly Suicide