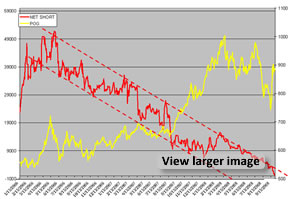

In the September 29 session on the Tokyo Commodity Exchange (TOCOM) Goldman Sachs COVERED 13 short contracts and bought 495 long contracts to bring their long position to 2,525 contracts AND AS A RESULT MAKING THEM NET LONG 28 CONTRACTS!!! The largest net short position they held was 52,000 contracts in March of 2006.

Below it is shown graphically.

The declining net short position has been going on for 30 months and I have predicted for some time that GS would eventually be net long just before the gold price explodes. Well here we are! John Reade of UBS poked fun at me for this analysis saying that GATA doesn’t know what an arbitrage position is. Well, Mr. Reade I do know, and this sure as hell isn’t one! This chart documents perfectly the demise of the gold Cartel. It should be noted that in July Goldman Sachs advised its clients to sell gold as they said gold was going to $740/oz. Their price prediction turned out to be accurate, however, they did not sell gold from their own account during that time; they covered their shorts with the aid of charitable donations from the clients’ who followed their advice!

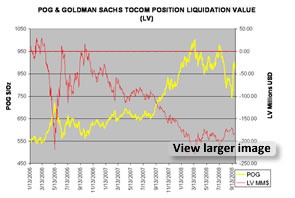

Here is the estimated liquidated value of the GS TOCOM gold position. I no longer have to extrapolate this as their net short position has now been eliminated. GS has lost approximately 185 MM$ on their TOCOM position since I started tracking the data in January 2006. One has to wonder why a company as smart as GS would tolerate being in an increasingly losing position for so long. I think we know the answer. The suppression of the gold price facilitated orders of magnitude larger profits to be made in other markets.

Here is the estimated liquidated value of the GS TOCOM gold position. I no longer have to extrapolate this as their net short position has now been eliminated. GS has lost approximately 185 MM$ on their TOCOM position since I started tracking the data in January 2006. One has to wonder why a company as smart as GS would tolerate being in an increasingly losing position for so long. I think we know the answer. The suppression of the gold price facilitated orders of magnitude larger profits to be made in other markets.

Now that Goldman Sachs has finally come on to the GATA side of the market we can expect a gold price explosion.

For a long time many in our camp wondered if the Cartel was so smart they could continue their manipulation for ever. We have seen in the last few weeks that some of the key players have stepped on their own land mines. The laws of economics can be frustrated but not repealed.

For a long time many in our camp wondered if the Cartel was so smart they could continue their manipulation for ever. We have seen in the last few weeks that some of the key players have stepped on their own land mines. The laws of economics can be frustrated but not repealed.