510 Weed Street, New Canaan, CT

“Be grateful for the home you have, knowing that at this moment, all you have is all you need.” ~Sarah Ban Breathnach

By Catherine Austin Fitts

The Census Bureau reported last week that the U.S. homeownership rate has hit a 51- year low, falling to 62.9%, a rate last seen in 1965.

This rate is remarkable given that US home ownership and mortgage markets are so heavily subsidized by federal credit and spending. The US federal budget funds extensive tax exemptions in support of home and real estate ownership. The US government also funds an extraordinary amount of the mortgage credit that finances private homes through its agencies, insurance funds and government sponsored entities. Add to these annual subsidies an estimated sum of $27 trillion to nationalize Freddie and Fannie and bailout mortgage fraud engineered at the highest levels of Washington and Wall Street. The bailouts alone were enough to retire all the residential mortgages in the county three times over. To say it another way, it was more than enough to buy a home for every family in America.

Instead, families in America keep losing their homes. And the same families also keep paying the taxes that fund the government bureaucracy that manages the subsidies that drive the housing and mortgage markets and which indirectly fund the millions of lawyers, lobbyists and public interest groups associated with it. Then they keep losing their homes.

I never used to think a lot about other people’s homes. My first home was a co-op off of Park Avenue on 75th Street on the east side of Manhattan in New York City. I would get up at night to do cash flows, worried about the size of our mortgage. I sold my share to my husband when we divorced.

Then I moved to Washington to become Assistant Secretary of Housing. I bought a big old southern town house in Woodley Park in Washington. Each time I put down roots in America, it was my mistake.

The Secretary of the Department of Housing and Urban Development (HUD) called me into his office when I served as Assistant Secretary of Housing. It was one of those odd conversations that was not about what it was about. He opened by saying that he was concerned that I was standoffish — I did not associate with the other political appointees. I was surprised and said, “I have invited all of the political appointees to my house for brunch, cocktails or dinner five times. In fact, I invited you each time and you have never come.” Shocked, he looked at me and said, “I would never come to your house. Your house is bigger than my house. I would find it castrating.” It was my turn to be shocked. Struggling to understand why Jack Kemp would even think about the size of my house, “I said, but I was at a party at Sherrie Rollins house (Sherrie was the Assistant Secretary for Public Affairs) and her house is bigger than my house.” Secretary Kemp looked at me like I was the silliest person in the world and said, “That’s not Sherrie’s house. That’s Ed’s house.” Sherrie was married to Ed Rollins, Jack’s former campaign manager. I was single. That was my first lesson in the unbelievable importance of the size of a home in the intense US political pecking order.

Appalled by the mortgage fraud I witnessed, I left my appointment at HUD and started an investment bank in Washington, persuaded that place-based financial transparency of government resources could help to reduce the mortgage fraud and rebuild the American economy. I sold my house to finance the company. My company was hired on competitive bid as financial advisor to HUD. Among other things we built software tools that allowed us to map mortgage data with GIS software.

After several years of my renting a home, the company was very successful. So, I bought a new home, a converted carriage house and stables — The Fraser Stables– in downtown Washington. It was quite beautiful, but buying it was another mistake.

I watched the Clinton administration engineer the next housing bubble and the theft of billions of funds from HUD. Among other things that bubbled required the targeting of a number of honest, hard working government employees as well as the destruction of my company and the seizure and theft of our software tools and databases. I described these events in my online book, Dillon, Read & Co. Inc and the Aristocracy of Stock Profits.

It was fascinating to watch the Democratic convention this year cheering and promoting the very same team that engineered the housing bubble in the first place. The inability of some of us to connect the dots between trillions of dollars in mortgage fraud and the falling home ownership rate is part of what is tearing America apart.

Gentrification was an essential part of the housing bubble in the 1990s. Gentrification was facilitated by the explosive growth in private prisons and the US prison population.

My online book, describes the financing of a private prison company by my old firm Dillon Read. The Dillon partners invested as well. Supported by a significant flow of government contracts and new laws ensuring more and longer prison sentences for nonviolent offenders, the company grew and went public and the Dillon partners and other investors exited their investment with significant profits.

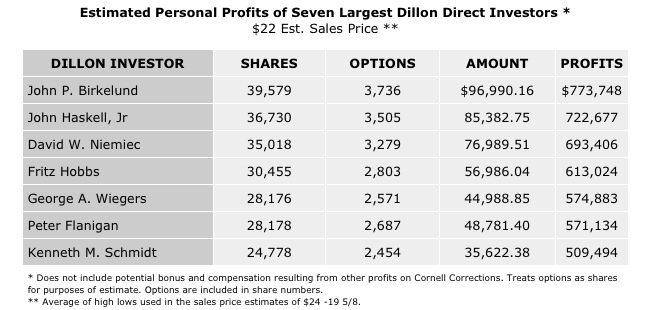

When John Birkelund, the Chairman of Dillon Read, sold his investment in Cornell Corrections, his profits were an estimated $773, 748 on his investment a few years earlier of $96,990.16, a 7.5X increase:

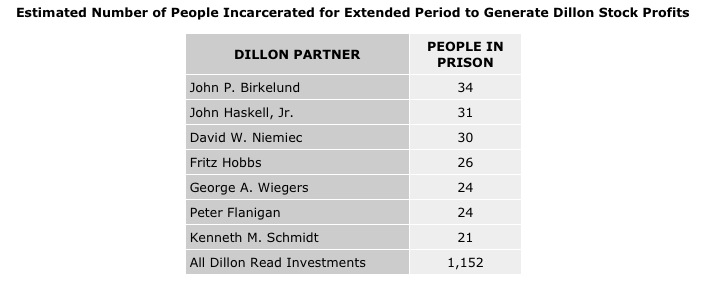

I estimated that 34 people would have to go to prison for a long term to justify the market capitalization to support John’s personal investment profits:.

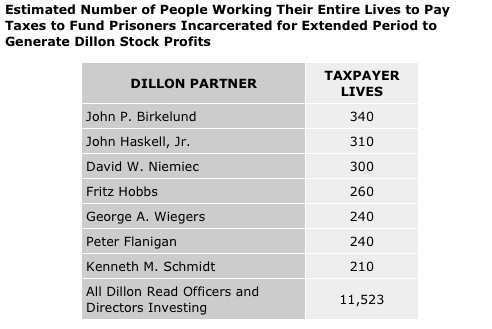

I also estimated that 340 American taxpayers would have to work their entire lives to fund the cost of funding those 34 prisoners:

You can read the full breakdown of these estimates in Chapter 15.

While John and the Dillon partners were generating large profits on their prison investments I was litigating with HUD, the Department of Justice and a private whistleblower. All three were working together to make sure that the obstacles to engineering mortgage fraud were obliterated on the way to engineering the largest housing bubble yet. I sold my house and most of my antiques, art work and furniture to fund litigation expenses. In the process I was often reminded as to how much pleasure this spectacle gave a wide variety of Washington politicos who were apparently jealous of the size and beauty of my home.

I also had to sell my share of the family farm in New Hampshire. My uncle was subpoenaed for the financial records. The allegation was that I was wining and dining government officials there. Since I had never taken a government official there, other than myself, it was another fishing expedition come up empty.

I moved to Tennessee where I rented a home in a small rural community. Every time I left town to travel, I would come home to find something of financial or personal value missing. After researching the situation, I discovered that this harassment pattern is not uncommon for people who stand up to powerful private interests in America. After thinking about the tactic, I made a list of all the furniture and art I had remaining that had any sentimental or financial value. Then I then proceeded to give all these pieces away to friends and family for Christmas and birthdays.

I ultimately won the lion share of the litigation inasmuch as I was able to prove the falsehoods involved in the attack, although the bailouts and the truth about mortgage fraud ultimately made the situation clear to most people. When the litigation settlement proceeds came in, I bought the two-bedroom, one-bathroom home I was renting. I never replaced what I had sold or given away. I archived all my records digitally. If the house fell victim to arson or tornado, it would be the insurance company and the bank loss. Not mine.

My mother once had a dear friend who was from an aristocratic Jewish family. She got her family out of Europe just in time before the Nazis came through sending family and friends to the camps. She married a successful doctor. They lived in a one-bedroom apartment with barely any possessions. They were ready to go at any time. Now I understand why.

If you look my house up on the Internet, it estimates the market value has dropped from where I bought it at $60,000. My annual property taxes are less than my monthly utility bill. I have essentially no zoning restrictions. The town has an excellent mayor in a county with a fine sheriff. I live across from the oldest operating small cotton gin in the country. Our downtown population is 152 with a greater SMSA of 1200 and we have our own post office.

I like my little country home the best of all my homes in America. I have rich soil, beautiful trees, my own well, a garden and a barn. My neighbors are good, hard-working people. Unfortunately, a huge cell tower was constructed behind me and then a smart meter placed on the house while I was in Europe. I planted more trees to put between myself and the cell tower. I looked for a place without a cell tower and smart meter and gave up. Now, instead, I live like a gypsy and roam the world.

Someone just published an article on the 10 worst communities in Tennessee. My town is on the list. This is good news. We have a better chance of being left alone.

Which brings me to the house owned by John Birkelund, the former Chairman of Dillon Read, who profited so well from sponsoring a private prison company.

There are six parcels owned by John Birkelund listed at the New Canaan, Connecticut property appraisal website

The main property at 510 Weed Street has 8 bedrooms and 6 baths. It is listed as two parcels purchased in 1986 and 1991 with a current appraised value of $5,934,300. In addition, 422 Weed and 466 Weed were purchased in 2003 and have a current appraised value of $1,867,800. A parcel at 131 Parish Lane was purchased in 2005 with a current appraised value of $1,009,300. Finally, land at 410 Weed was purchased in 2007 with a current appraised value of $1,141,300. The appraised value of the combined holdings of New Canaan residential property by John Birkelund and his wife total $9,952,700. Two pictures are available. One above is from the New Canan assessors office. The other from virtualglobetrotting.com

One of the great things about the American people is that they are remarkably generous. If someone builds a better mousetrap or pitches a World Series no-hitter, Amerians celebrate his or her success. They are happy to see them buy a big home. That’s the American dream.

I figure the after-tax profits on John’s prison investment were enough to pay the property taxes, landscaping, utilities, cleaning and facilities expenses on his home for two or three years, to pay for a special painting or sculpture or two. When I lived off of Park Avenue, we used to get a complementary magazine called Avenue. One of the first ads I saw in Avenue was for an antique chair, “For the price of a small home, you can own this chair.” Sometimes I remember that I have swapped the chair for the small home, and it makes me smile.

For the 340 Americans who will work their whole life to pay the taxes to fund sending 34 people to jail — innocent people or people guilty of things that should not be illegal, or guilty of things that John’s clients and investors were doing — the thought of John spending his capital gains of $773,748 is likely painful.

At the time John made his prison profits, the General Accounting Office estimated that the annual cost of all federal, state and local US prisoners, inclusive of building and prison and probation system overhead, was approximately $154,000 a year each.

What are the economics of taking people who could be modestly productive taxpayers, or could operate under home arrest with an ankle bracelet? What economics would instead round them up in a private prison at a cost of $154,000 a year each, where they can make uniforms for the military or provide outsourcing for private corporations?

Why add the expense of profit margins for a private corporation? Government pays for everything and assumes essentially all the risks. There is no market here.

So John Birkelund made lots of money — on housing bubble gentrifications and on private prisons. That profit was possible because the US government issues lots of debt that funded lots of government contracts to pay $154,000 per prisoner — all funded or backstopped by taxpayers who were making less on average than $50,000 a year.

A close look at that private prison investment as a case study shows an example of the extraordinary expense of the “debt growth model” – of financing uneconomic activities with explosive amounts of government debt. A close look at the bailouts says the same thing about providing cheap capital to Wall Street.

Now the debt growth model is over. Today’s headline in the WSJ says that productivity is falling. I know why.

When we pay bankers millions to convert taxpayers generating modest tax revenues to the government into prisoners that lose the government $154,000 per person per year, and when we grow that model by borrowing billions of dollars and loading on the debt, we create a perpetual negative return on investment!

The more you grow these activities, the more the economy loses. John, however, has a big house. The Clintons also have a big house in New York and one in Washington too, like most of the other people who engineered the housing and prison bubbles.

Of course, homeownership rates and productivity are falling. How could they not be falling? If you study the rise in value of American homes since WWII, the increase comes primarily from an increases in the average square footage and through inflation. Both were made possible by government fiscal and monetary policy. We have been subsidizing bigger homes while debasing our currency. I expect the average square footage to start to fall.

I don’t envy John the size of his home. That much overhead can be a headache when the music slows and then stops. Unfortunately, when an entire establishment is dependent on a negative return on investment model, it’s only a matter of time.

Related Reading