By Mark Lundeen

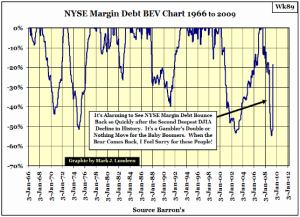

The NYSE published weekly Margin Debt (NYSE MD) numbers from the 1920s to 1965. Starting in 1966, they switched to a monthly basis. The change in data is clearly evident in the BEV Chart below. NYSE Margin Debt are loans made by brokerages to retail customers for the purpose of leveraging positions. If someone has $10,000, but wants to purchase $20,000 of a stock, they can do this with the use of margin debt. Buying your stocks with someone else’s money can double gains, * and losses * in a hurry.

The numbers for May 2009, NYSE MD’s came out last week in Barron’s. I found the increase in retail investor’s leverage alarming.

As with any financial series concerning debt or money, we can see how monetary inflation has increased since 1926. What’s amazing about this chart is the abrupt U-Turn NYSE MD has taken since April 2009. NYSE MD has increased 79% from its lows of February!

Continue Reading Mark Lundeen’s Bear Market Race to the Bottom