Listen to the MP3 audio file

Download the MP3 audio file

Read the transcript

Transcript of the January 12, 2012 Precious Metals Market Report

Audio Chapters

1. Introduction – 0:00 – Mandate of heaven shifts. The Mandate of Heaven (Chinese: ??; pinyin: Ti?nmìng) is a traditional Chinese philosophical concept concerning the legitimacy of rulersThe Mandate of Heaven postulates that heaven (?; Tian) would bless the authority of a just ruler, as defined by the Five Confucian Relationships, but would be displeased with a despotic ruler and would withdraw its mandate, leading to the overthrow of that ruler. The Mandate of Heaven would then transfer to those who would rule best. The mere fact of a leader having been overthrown is itself indication that he has lost the Mandate of Heaven. The Mandate of Heaven is a well-accepted and popular idea among the people of China, as it argues for the removal of incompetent or despotic rulers, and provided an incentive for rulers to rule well and justly. The concept is often invoked by philosophers and scholars in ancient China as a way to curtail the abuse of power by the ruler, in a system that otherwise offered no other check to this power. The Mandate of Heaven had no time limitations, instead depending on the just and able performance of the ruler. In the past, times of poverty and natural disasters were taken as signs that heaven considered the incumbent ruler unjust and thus in need of replacement; Meantime, positive everywhere. Ever greater signs of insecurity are reminding us all that we are the ones responsible to build a new world. A lot of positive is happening. The more whacky, out of control and insecure the government is behaving the more sensible people share their head and emotionally and mentally separate themselves from the lawlessness to go to work on something positive. …

2. Money& Markets – 2:02 – Bloomberg reports today the dance over asserting control over Iran continuers to twist and turn. A European Union embargo on imports of Iranian (OPCRIRAN) oil will probably be delayed for six months to let countries such as Greece, Italy and Spain find alternative supplies, an EU official with knowledge of the talks said. The embargo, which would need to be accepted by the 27- nation bloc’s foreign ministers on Jan. 23, also is likely to include an exemption for Italy, so crude can be sold to pay off debts to Rome-based Eni SpA (ENI), Italy’s largest oil company, according to the official, who declined to be identified because the talks are private. A reminder at how interdependent the world is. Discussions on Iran competed for attention in European capitals with a growing realization that Greece is likely….going back to the drachma gives Greece the ability to engage in competitive devaluations. THE PROFITABILITY OF THE CENTRAL BANKING MODEL FOR THE TRIXSTERS CONTINUES UNABATED. While European and American taxpayers continue to bail out bankers right and left. JPMorgan is projected to report a record $18.5 billion in 2011 – so when JP Morgan very profitably grabbed customer accounts at MF Global, it was not because they were in financial trouble…making the possibilities that this was a money making hit deep into farm country and the precious metals market look more plausible…with farmers losing over $1billion, no doubt there will be family farms having to sell land. Carlyle Founders Paid $137 Million Each. Obama sends request to congress for $1.2 trillion debt ceiling increase. US vs Japan. Wegelin bank was negotiating to settle criminal investigation…they have been critical of America and its policies – beautiful piece called Goodbye American. Swiss National Bank President resigns in what looks like an intelligence operation – on wife’s currency trading. Any connection to the fact that Swiss banks like Wegelin were counting on the local authorities for support based on the law instead of doing what was good for Americans. Reminded of the DOJ declaring a criminal investigation of S&P after they downgraded their ratings. CONCERN FOR CAPITAL CONTROLS. …

3. Solari Hero – 9:30 – Dr Konrad Hummler, Managing Partner of Wegelin. See Blog Commentary “Where Can We Look For Hope?“. Wrote Farewell America, deeply brilliant and beautiful written commentary on the investment and economic landscape. …

4. Interview – 10:14 – Franklin Sanders of The Moneychanger. Market Report. 2011: Pump and dump of silver in the spring; gold up every year since 2001; retail does not show up; speculators and hedge funds in futures makes the swings worse; MF GLobal. 2012: Elliot Wave analysis; nature of intermediation. What are you going to do this year. Prediction for 2012? Catherine – end year at 2000 – could get as high as 2250; Franklin; New Year Resolutions. …

5. Ask Catherine – 51:52 – Trying to understand the implications of the fractional reserve banking system and whether it is inherently doomed to collapse. What about Ron Paul and Tarpley? …

6. Let’s Go to the Movies – 32:36 – Thrive #1 Transformational Movie by viewers of Aware Guide; Buck about horse whisperer Buck Brannaman. …

7. Up Next & Closing – 59:00 – January 19: Lynne McTaggert – author of The Field and The Bond; February 2: Jon Rappoport: Nuts and Bolts of The Matrix; February 9: Precious Metals Market Report …

Charts:

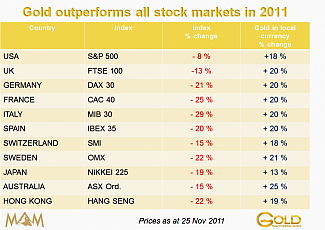

Here is how gold was performing vs. the global stock markets at the end of November, prior to the December price correction.

[click on the image for a larger version]

Source: Matterhorn Asset Management AG

By Catherine Austin Fitts

This week Franklin Sanders and I will provide a wrap up for silver and gold in 2011 and our outlook for 2012.

We will review the most important events in 2011 and make our price predictions for 2012.

Volatility was the word that defined 2011. Silver started the year at $30.67 rose to a high close of $48.70 at the end of April and then dropped, closing the year down at $28.18 .

[Click image to view larger format]

[Click image to view larger format]

Gold started the year at $1388 then rose to a high close of $1895 in August and then dropped in the fourth quarter, closing the year at $1531.

[Click image to view larger format]

This means gold has closed higher every year since the beginning of the 21st century. Somehow it did not feel so wonderful with the price plunge in December, coming on the heals of MF Global’s assault on customers accounts and the commodities futures market. Those who bought during the highs this year were more than frustrated.

[Click image to view larger format]

Source

A review of price corrections over the last decade helps put this last correction in perspective. Gold’s 20% price decline from August through the end of the fourth quarter of 2011 compares to a 22% correction in 2006 and and 29% in 2008.

[click on the image for a larger version]

Source

We will start with Money & Markets and Franklin’s update on the gold and silver markets. Franklin and I will focus on questions on precious metals. Post your questions in the comments section for this blog post.

In Let’s Go to the Movies, a comment on Cedar Creek Productions wonderful documentary Buck, about horse whisperer Buck Brannaman.

[arve url=”http://www.youtube.com/embed/IShjmWYuHZ0″ frameborder=”0″ width=”325″ height=”242″>

YouTube

Buck

Talk to you Thursday!

If you have comments, thoughts or questions that you would like me to address, please post by Thursday.