“I am a student of uncertainty. I have no idea where the stock market is going to be.”

~ Hugh Hendry

The following charts are reviewed in my audio comments for the Financial Market Round Up. Click on these charts to view a full-size versions:

Overview

Let’s start with an overview of performance in the financial and commodities markets year to date.

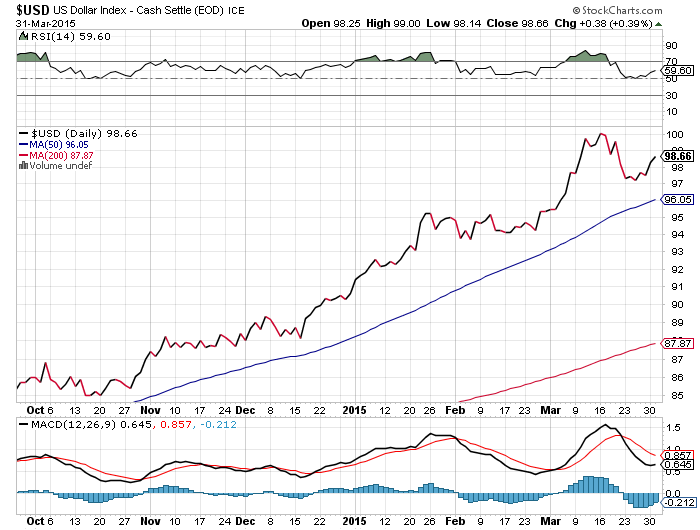

US Dollar Index

After a 12% rise in 2014, the US Dollar continued to rise in 2015.

Equities

The US equity markets closed sideways for the quarter. We continue to be way overdue for a 10-25% correction. A strong US dollar is putting pressure on corporate earnings, although low interest rates continue to provide low cost capital for large corporations. This includes financing for stock repurchases.

A strong dollar in 2014 and Presidential elections coming up in 2016 both argue for a bull trend to continue.

Mid-caps, small caps and stocks with buyback programs outperformed the large caps.

SCHA, SCHM, SCHX

Morningstar Sectors

A review of Morningstar sectors shows that real estate was the strongest sector for the quarter, followed by health care and communication services.

IBB

After a strong 2014, biotechs corrected in the first quarter.

Obamacre ETFs

The stock profits of Obamacare continued to support the US markets.

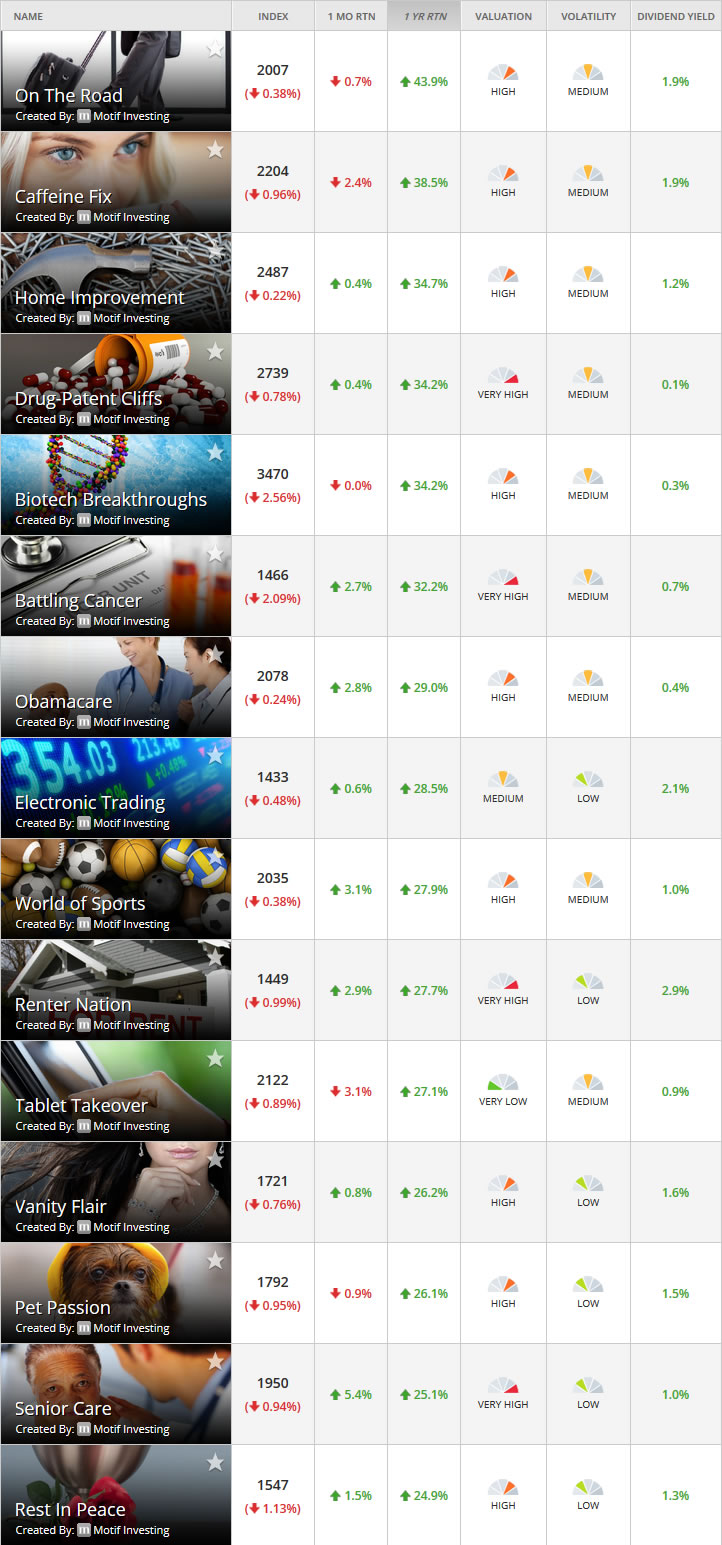

Motif Investing

A review of “motifs” with the most successful annual returns underscored the benefits of lower fuel prices for airlines and transportation companies.

ITB

As the Administration and housing institutions moved to ease mortgage lending terms and interest rates remained low, the home building industry outperformed the broad market.

IYR

Real estate outperformed, as well.

OIL

Oil and gas prices remained depressed.

RSX

Despite the continued “oil card” – low oil and gas prices reducing revenues – Russian equities recovered some of their losses of 2014.

Surprise was in the air as global equities shrugged off a higher dollar and began to close the divergence created between the US and global markets as the US equity markets rose strongly over the last few years.

DAX

German equities led the way as the ECB announced a bond buying program.

FXI

China moved up to match the German performance in early April.

ASHR

PIN

India continued to rise, following on a strong performance in 2014.

EEM

With China and India leading the way, the emerging market broad index moved up…

EFA

…as did the index for developed markets outside of North America.

WAFMX

However, the frontier markets were down.

Fixed Income

The Fed was surprised by a sluggish US economy. As one Governor put it, “Growth has disappointed to the downside.” Consequently, it appears that rate hikes are delayed. This offered a reprieve to the bond market. Yields stayed low, and prices held for the most part.

AGG IEF TLT

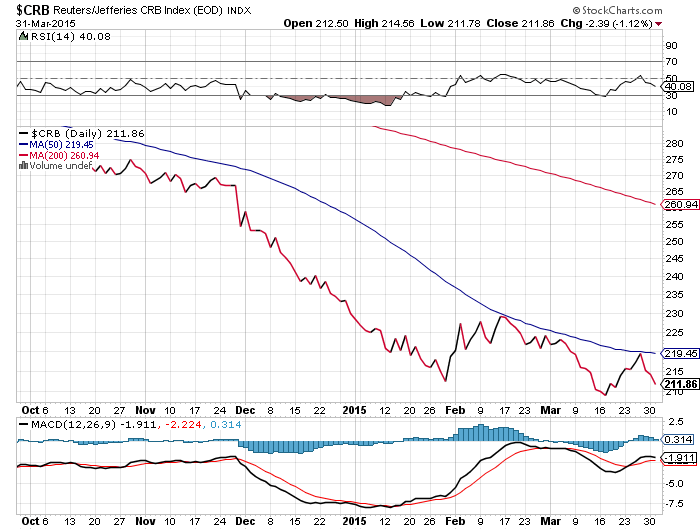

Commodities

GLD, SLV

Precious metals got off to a good start but are back to going sideways. Gold keeps hugging that $1200 line – and it keeps getting tested there.

CRB

Commodities continued to send deflationary signals, although how much was global slowdown and how much was the “oil card” is hard to say.