Overview

By Catherine Austin Fitts

Well, now I can stop saying, “The US stock market is long overdue for a 10-25% correction.” In August, the S&P was down 14% from its Q2 and Q3 highs and closed Q3 down 11%. However, an overview of the charts showed that just about everything was down across the equity, fixed income and commodities markets. Cash was the Q3 king.

US Dollar Index

The US dollar index has been down and sideways since peaking in the spring. It closed Q3 up 6.6% – combined with last year’s increase of 12% the result is nine straight months of a strong dollar.

Equities

The S&P closed Q3 down -6.7%. There was not a lot of divergence between small, medium and large caps stocks – they were all correcting together.

SCHA (US Small Caps), SCHM (US Mid Caps), SCHX (US Large Caps), PKW (Buybacks)

Q3 & YTD US Equities Sector Performance

The one positive sector in the S&P was consumer discretionary, up 4.1% for the year. Consumer staples was the next best performing sector at -1.0%.

IBB (Biotech)

The biotech stocks took quite a nosedive in Q3.

Obamacare ETFs: XLV(Health Care Select), IHE (US Pharmaceuticals), IHF (Providers), IBB (Biotech), IHI (Medical Devices)

The broader health care stocks, which have been leading the S&P, closed Q3 at -2.13 YTD.

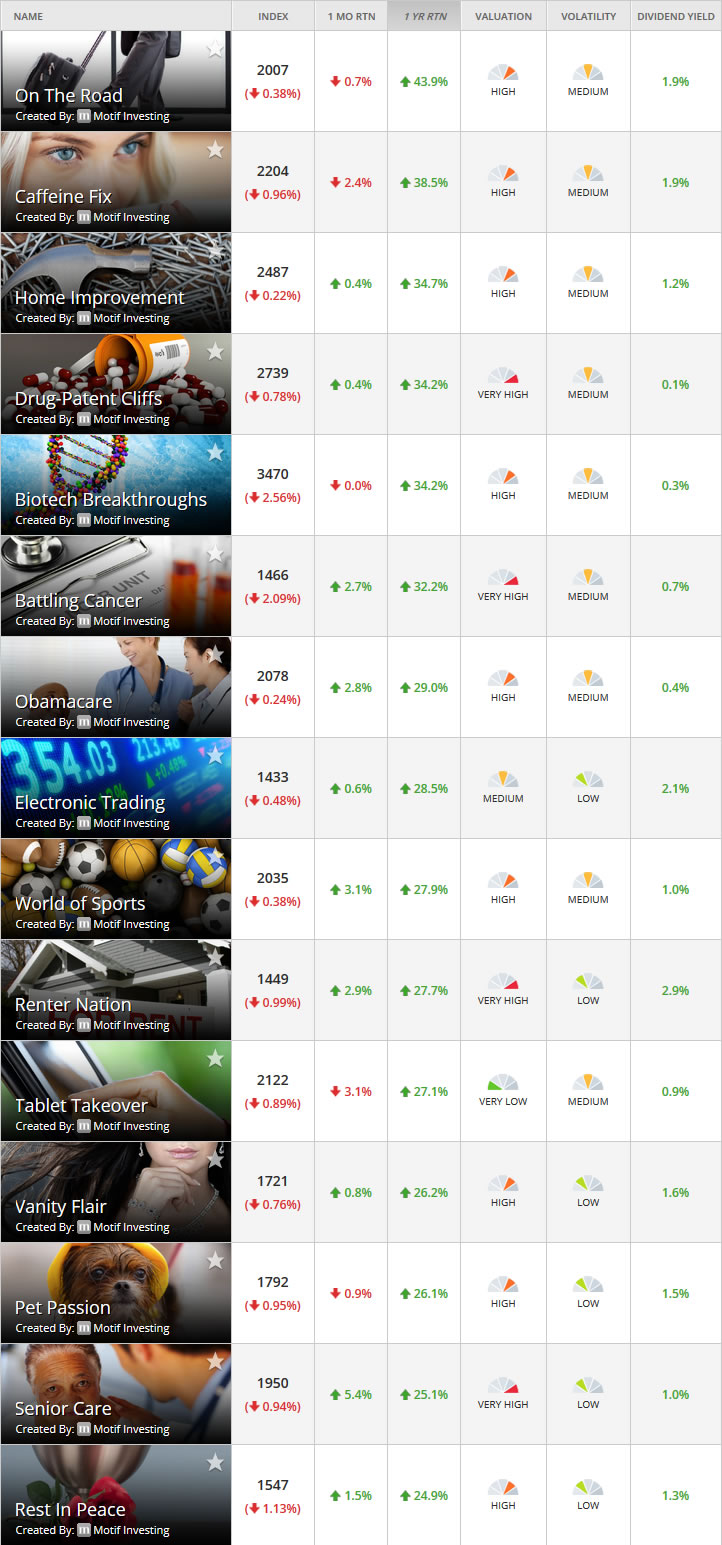

Motif Investing

Once again, a review of Motif Investing’s website proves that even when it feels like everything is down, there is a bull market somewhere. However, it does make things look a tad gruesome: Bear traders, funeral homes, cyber security and (presumably to help us cope with falling markets, death and being hacked) coffee!

ITB (US Home Construction)

US Homebuilders continue to outperform the market – which is not surprising given the fact that 2016 is a US Presidential election year. Freddie Mac 3% down 3% interest mortgages anyone?

IYR (US Real Estate)

Real estate, however, struggled with the market’s concern about rising interest rates.

OIL (Crude Oil)

Oil never regained its losses of 2014 and the first half of 2015, not even close. Oil closed Q3 down -32.8% for the year as producers kept pumping to cover overhead and debt service. The junk bond market started to worry about how low oil prices would translate into debt defaults.

RSX (Russia), OIL (Crude Oil)

The Russian ETF closed Q3 up 7.3%, a strong performance given the impact of oil prices on Russian revenues and G-7 economic sanctions.

DAX (Germany)

The German DAX closed Q3 down, which was quite a swan dive after having been up over 26% earlier in the year.

FXI (China Large Caps)

The deepest swan dive was, of course, China with the large cap China ETF closing Q3 down -33% from its 2015 high.

PIN (India)

India closed Q3 down -5.6%.

EEM (Emerging Markets)

The greatest concerns were for the emerging markets. What would happen if the Fed raised interest rates? The emerging market ETF closed Q3 down -17%.

EFA (International Developed)

The developed markets away from North America were relatively stronger, closing Q3 at -5.7%

WAFMX (Frontier Markets)

If emerging markets were a concern, clearly frontier markets were not going to do well. The Wasatch frontier market fund closed Q3 down -10.7% for the year.

Fixed Income

The fixed income markets have been more than interesting all year. All eyes continued on the Fed expecting an interest rate hike in September that never came. Market rates did rise in anticipation, but the real problems were in the high yield bond market as the revenue of commodities producers continued to suffer from plunging commodities prices.

AGG (Bond Aggregate), IEF (5-7yr Treasury), TLT (20yr+ Treasury), JNK (High-Yield)

Commodities

GLD (Gold), SLV (Silver)

Bull or bear? Bull or bear? The precious metals market was defined by emotional exhaustion trying to figure out which way things were going to go. This year, Schwab launched their intelligent portfolio index product with an automatic allocation to gold – a clear indication that retail investors now consider gold a core allocation in a balanced portfolio.

CRB (Commodities Index)

The air just kept coming out of the commodities balloon.

YTD Commodities Performance

To see how tough things were, we thought you might like a more detailed breakdown.

Baltic Dry Index

Shipping volume was way down in the summer but started to move up coming into the fall.

Markets go up and down. And for Q3 2015, the operative word was DOWN. While the central banks kept trying not to use the “D” word, we used “deflation” in our commentaries throughout Q3.