TENNESSEE’S GET OUR MONEY BACK CAMPAIGN 2002

Higher Tennessee Taxes? No Way!

It’s Time for Lower Federal Taxes and

Greater Local Control of Our Tax Resources

Published: July 4, 2002

Here’s How—

Local Sunshine + Local Action

+ Shifting Our $$$ to Those Who Get Our Money Back

Lower Taxes = More Local Control = Lower Taxes

by Catherine Austin Fitts

Hickory Valley, Tennessee

“People get ready, there’s a train a-coming

You don’t need no baggage, just a-get on board

All you need is faith to hear the diesel hummin’

You don’t need no ticket, just thank the Lord

People get ready for the train to Jordan

It’s picking up passengers from coast to coast

Faith is the key, open the doors and board on

There’s room for all amongst who love the most”

—Curtis Mayfield

Click On Image For Larger Version…

FELLOW CITIZENS OF TENNESSEE:

LEARN MORE ABOUT THE MISSING MONEY—- $3.3 TRILLION OF UNDOCUMENTABLE ADJUSTMENTS (“MISSING MONEY”) IN THE FEDERAL GOVERNMENT, 1998-2000 —THAT’S $11,700 PER AMERICAN RESIDENT

TENNESSEE’S 1999 INDIVIDUAL TAXES:

$29.4 BILLION

TENNESSEE’S ANNUALIZED SHARE OF $3.3 TRILLION OF THE MISSING MONEY:

$20.2 BILLION

CONTENTS….

For The Story Of The Missing Money and,

Why the Honest Citizens of Tennessee…

Are Working Harder and Getting Less: (click here)

For a State by State Breakdown of What the…

Missing Money is Costing You and Your Family: (click here)

Letter To Congressman Van Hilleary (R-Tenn.)

Letter Sent to Tennessee Candidates: (click here)

Questions For Van Hilleary (R-Tenn.)

From the Letter Sent to Tennessee Candidates: (click here)

For Kelly O’Meara’s Missing Money Series in Insight Magazine:

Government Fails Fiscal-Fitness Test

For THE CITIZENS OF TENNESSEE a Call To Action, and a treasure trove of resources through which you can learn “How The Money Works” and get some accountability via the upcoming 2002 US Midterm Election Campaign… read on…

CITIZENS OF TENNESSEE:

GET YOUR LOCAL REPORTERS, EDITORS AND RADIO TALK SHOW HOSTS TO DEMAND OUR MISSING MONEY BACK — AND SEND BONUS SUBSCRIPTIONS, ADS AND DONATIONS TO THOSE WHO DO!

Politics1.com Tennessee Media List

http://www.politics1.com/tn.htm

Barrie Walsh’s Tennessee Media List:

Financial Market Media

CITIZENS OF TENNESSEE:

ENLIST OUR STATE REPRESENTATIVES IN HELPING US GET OUR MISSING MONEY BACK TO FUND TENNESSEE BUDGET DEFICITS INSTEAD OF RAISING OUR TAXES — AND VOTE FOR A RAISE AND SEND DONATIONS TO THOSE WHO GET OUR MONEY BACK:

https://www.legislature.state.tn.us//

ENLIST OUR CANDIDATES FOR GOVERNOR AND STATE AND LOCAL OFFICES IN HELPING US GET OUR MISSING MONEY BACK TO FUND TENNESSEE BUDGET DEFICITS INSTEAD OF RAISING OUR TAXES — VOTE FOR THOSE WHO GET OUR MONEY BACK — VOTE FOR RAISES AND SEND DONATIONS TO THOSE WHO GET OUR MONEY BACK:

http://www.politics1.com/tn.htm

CITIZENS OF TENNESSEE:

ASK THE POLITICAL PARTIES OF TENNESSEE WHY THEY HAVE NOT BROUGHT THE MISSING MONEY TO OUR ATTENTION; DEMAND IMMEDIATE ACTIONS TO GET OUR MISSING MONEY BACK; JOIN AND SEND DONATIONS TO THOSE WHO GET OUR MONEY BACK:

America First Party of Tennessee: (Website Expected This Summer at http://www.americafirstparty.org/docs/history/abouttheparty.shtml)

Constitution Party of Tennessee: https://www.cpotn.com/

To Send an E-Mail:

Tennessee Democratic Party:

Leadership and Staff List & to Send an E-Mail:

Green Party of Tennessee:

Tennessee Independent Party (IAP):

https://www.independentamericanparty.org/

To Send an E-Mail:

tipchair@hotmail.com

Libertarian Party of Tennessee:

Leadership List w/ E-Mail Addresses:

http://www.lptn.org/Officers.htm

Natural Law Party of Tennessee:

http://www.natural-law.org/states/Tennessee.html

To Write or Call:

http://www.natural-law.org/states/Tennessee.html

To E-Mail:

rmsims@yahoo.com

Tennessee Republican Party:

Southern Independence Party of Tennessee: https://en.wikipedia.org/wiki/Southern_Party

CITIZENS OF TENNESSEE:

LEARN MORE ABOUT HOW THE MONEY WORKS FOR OUR CONGRESSMEN AND SENATORS WHILE OUR MONEY WENT MISSING AND THEY DID NOT STOP IT OR GET IT BACK YET:

To read the financial filings and donation history of our elected Representatives, as well as information on law firms, lobbyists and corporations and political action committees (PACS) and a treasure chest of other information on “how the money works” in your government, see:

OpenSecrets.org:

CITIZENS OF TENNESSEE:

ASK YOUR CONGRESSMAN AND SENATORS ABOUT STOCK MARKET PROFITS BY BANKS, CORPORATIONS, GOVERNMENT CONTRACTORS AND INVESTORS THAT FUND OUR POLITICAL PARTIES AND CONGRESSIONAL CAMPAIGNS;

To learn more about the corporations whose political action committees (PACs) and insider stock deals and stock option profits (fueled by government subsidies, credit programs and contracts) fund your specific candidates go to:

SEC filings:

(Corporate financial statements and stock filings with the Securities & Exchange Commission; annual proxies list boards, compensation and large investor’s ownership positions) If you get the names of their law and accounting firms and investors from the proxies, you can check their donations at Opensecrets.org as well as employees and their PAC as well: http://www.opensecrets.org

Stock Quotes & History:

(Track stock performance against policy and budget changes in government programs, contracts and regulations and failure to enforce and the flow of donations to your candidate)

GOVERNMENT CONTRACTS, CONTRACTORS AND SUBSIDIES

For All States—Eagle Eye:

State of Tennessee:

Top 10 Federal Agencies Awarding Contracts In State of Tennessee

Top 10 Contractors Awarded Federal Prime Contracts In State of Tennessee

Top 10 Metropolitan Areas Awarded Federal Prime Contracts In State of

Tennessee

http://www.eagleeyeinc.com/StateSpending/tn.htm

TOP BENEFICIARIES OF FEDERAL GRANT AND LOAN ASSISTANCE IN TENNESSEE

Types of Grant and Loan Assistance In State of Tennessee

Top 10 Federal Grant Titles Awarded In State of Tennessee CFDA Search Page

Top 10 Non-Profit Recipients Awarded Grants In State of Tennessee

Top 10 For-Profit Recipients Awarded Grants In State of Tennessee

Top 10 Cities Receiving Grants In State of Tennessee

http://www.eagleeyeinc.com/StateGrant/tn.htm

TOP FEDERAL CONTRACTORS

List of the Top 100 Defense Contractors

http://www.govexec.com/top200/01top/s3chart.htm

List of the Top 100 Federal Civilian Agency Contractors

http://www.govexec.com/top200/01top/s4chart.htm

List of the Top Federal Contractors By Civilian Agency

http://www.govexec.com/top200/01top/purchaseother.htm

List of the Top 100 Federal Information Technology Contractors

http://www.washingtontechnology.com/top-100-2001/top-100.html

Government Contractor Owned by Department of Justice: Federal Prison Industries, Inc. – UNICOR

(Federal agencies are required to buy products available from Unicor. It is a “mandatory source provider.” For a federal agency to buy products from another source requires obtaining a waiver from Unicor.) For Unicor’s product list:

http://www.unicor.gov/schedule/index.htm

US Treasury Depository (All Agencies):

NY Federal Reserve

Tennessee is divided between the Atlanta Fed Region:

and the St. Louis Fed:

(Stock ownership data is confidential; not available to American citizens; membership and board data is available)

CITIZENS OF TENNESSEE:

DO YOU PAY FOR THINGS THAT DON’T WORK? DO YOU PAY FOR PRODUCTS AND SERVICES THAT NEVER WORK YEAR AFTER YEAR? WHY ARE GOVERNMENT CONTRACTORS REWARDED FOR FAILURE?

WRITE TO THE CEO, BOARD MEMBERS AND INVESTORS OF THE GOVERNMENT CONTRACTORS PAID TO BUILD AND MANAGE RELIABLE COMPUTER ACCOUNTING AND PAYMENT SYSTEMS AT THE AGENCIES MISSING MONEY AND DEMAND OUR MONEY BACK — STARTING WHAT THEY WERE PAID TO MANAGE OUR MONEY!

INSIST THAT YOUR PENSION FUNDS, MUTUAL FUNDS, IRAS AND INVESTMENT ADVISORS DUMP THE STOCKS OF THESE COMPANIES UNTIL WE GET OUR MISSING MONEY BACK!

STOP PURCHASING THEIR PRODUCTS AND SERVICES!

PULL YOUR DEPOSITS OUT OF THEIR BANKS!

FIGURE OUT WHO THEIR INVESTORS ARE AND PULL YOUR MONEY OUT OF THEIR MUTUAL FUNDS AND BANKS AND OTHER COMPANIES!

WHILE OUR MONEY IS MISSING, THEY NEED TO BE MISSING OUR MONEY!

VOTE IN THE MARKETPLACE WITH YOUR TIME AND MONEY TODAY!

SWITCH YOUR PURCHASES, YOUR DEPOSITS, YOUR INVESTMENTS AND YOUR ASSOCIATIONS TO BANKS, COMPANIES AND INVESTMENT ADVISORS OWNED AND RUN BY PEOPLE NOT INVOLVED IN LOSING OR STEALING OUR MONEY OR IN ENRON TYPE ACTIVITIES THAT BURN UP OUR TAX MONEY!

FIND OUT WHO THEIR LAWYERS, ACCOUNTANTS AND LOBBYISTS ARE AND DO THE SAME WITH THEM!

HERE ARE THE CORPORATIONS WHO RUN THE FEDERAL AGENCIES WHERE OUR MONEY HAS GONE MISSING MONEY

ALL AGENCIES MISSING MONEY:

US Treasury Depository:

NY Federal Reserve (US Treasury Depository)(*):

Tennessee is divided between the Atlanta Fed Region:

and the St. Louis Fed:

(Membership and Board Data is Available; Stock ownership data is confidential; not available to American citizens; membership and board information is available)

DEPARTMENT OF DEFENSE:

Top 100 Defense Contractors (*) http://www.govexec.com/top200/01top/s3chart.htm

DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT:

Selected Contractors at HUD, including its financial operations Federal Housing Administration (FHA) and Government National Mortgage Association (Ginnie Mae):

Lockheed-Martin(*):

http://www.lockheedmartin.com/

J-P Morgan-Chase(*):

DynCorp(*):

AEW Capital Management:

http://www.aew.com/AEW/index.htm

AMS:

Arthur Anderson(*):

ARCO:

Harvard Corporation and Endowment (*):

Ervin & Associates:

http://www.contracts.ogc.doc.gov/fedcl/opinions/99opin/96-504C.html

EDS:

Price Waterhouse Coopers:

ICF Consulting:

Issuers, Dealers and Holders of Ginnie Mae (HUD) Securities and Other Securities Using FHA (HUD) credit and subsidy (*):

Top Holders of Ginnie Mae (HUD) Pass Through Certificates:

http://www.capital-access.com/MAB/01mableagues/holdiv.pdf All Ginnie Mae (HUD) Issuers: http://www.ginniemae.gov/issuers/sf_issuers.pdf

http://www.ginniemae.gov/issuers/mf_issuers.pdf

Top Issuers and Holders of Mortgage Securities:

http://www.capital-access.com/01_MAB_leagues.htm

DEPARTMENT OF THE INTERIOR — BUREAU OF INDIAN AFFAIRS DEPARTMENT OF EDUCATION US TREASURY – INTERNAL REVENUE SERVICE

http://www.govexec.com/top200/01top/purchaseother.htm

Congressional Oversight Committees:

Senate Governmental Affairs:

http://www.senate.gov/~gov_affairs/

Senator Fred Thompson’s Report “Government at the Brink”

http://www.senate.gov/~gov_affairs/issues.htm

House Committee on Government Reform: Subcommittee on Government Efficiency, Financial Management and Intergovernmental Relations

http://www.house.gov/reform/gefmir/index.htm

Congressman Horn’s Financial Management Report Card

Agencies Rated D or F, Fiscal Year 2001

(for the period ended September 30, 2001)

Environmental Protection Agency D+

Small Business Administration D+

Department of Health and Human Services D

Department of Housing and Urban Development D

Department of the Interior D

Department of Veterans Affairs D

Department of Commerce D-

Department of Education D-

Department of the Treasury D-

Nuclear Regulatory Commission D-

Department of Justice D-

Department of State D-

Department of Transportation D-

Agency for International Development F

Federal Emergency Management Administration F

Department of Agriculture F

Department of Defense F

National Aeronautics and Space Administration F

Government Wide Grade D

Note to Tennessee Farmers: The Department of Agriculture got an F on their report card and here are the top ten contractors, with Polytex Fibers Corp, Cargill Inc., IBM Corp., Bunge Corp. and Archer-Daniels-Midland Co. listed as # 1-5.

http://www.govexec.com/top200/01top/purchaseother.htm

(*) Indicates significant involvement of a board member, lead investor or the bank or corporation in Enron bankruptcy and Enron On Line Trading in public disclosure to date. For more on continuing Enron Cover Up, and potential linkages to our missing money see:

http://www.scoop.co.nz/mason/stories/HL0203/S00066.htm

CITIZENS OF TENNESSEE:

LEARN WHO ENGINEERS THE DEALS IN WASHINGTON AND MAKE SURE WE HELP GET OUR MONEY BACK FROM THEM TOO:

Biggest Donors by Industry: http://www.opensecrets.org/industries/index.asp

Top 20 Washington Law Firms: Revenues and Profits: And Profits Per Partner, 2001 http://www.law.com/special/professionals/chart_top_20_dc.html

Top Washington Lobbyists http://www.opensecrets.org/pubs/lobby98/topoverall.htm

Top Buyers of Lobbying Services: http://www.opensecrets.org/pubs/lobby98/topspend.htm

Top PACs: http://www.opensecrets.org/pacs/index.asp

Who Got Campaign Contributions from Enron and Arthur Anderson? http://www.opensecrets.org/news/enron/index.asp

CITIZENS OF TENNESSEE:

STOP WATCHING THE TV STATIONS OWNED BY THE GOVERNMENT CONTRACTORS (AND THEIR INVESTORS) WHO CONTROL THE COMPUTER, ACCOUNTING & PAYMENT SYSTEMS AT THE MISSING MONEY AGENCIES:

Who Controls the Media? http://www.nowfoundation.org/communications/tv/mediacontrol.html

CITIZENS OF TENNESSEE:

VISIT, FAX, E-MAIL, PHONE AND WRITE OUR CONGRESSMEN AND CONGRESSIONAL CANDIDATES TO DEMAND THEY GET OUR MISSING MONEY BACK!

BETTER YET, GO TO THEIR TOWN MEETINGS DURING CAMPAIGN SEASON AND ASK ABOUT OUR MISSING MONEY PUBLICLY!

MOVE YOUR VOTE AND DONATIONS AND VOLUNTEER TIME TO THOSE CANDIDATES WHO GET OUR MONEY BACK!

CURRENT CONGRESSMEN

Map of Tennessee Congressional Districts:

http://www.legislature.state.tn.us/info/congress.htm

Website for the House of Representatives:

Representative Bill Jenkins (R), 1st Congressional District of Tennessee

To send an E-Mail to Congressman Jenkins:

http://www.house.gov/writerep/

To Visit, Write or Fax:

320 West Center Street

Post Office Box 769

Kingsport, Tennessee 37662

Phone No. (423) 247-8161

Fax. (423) 247-1834

1708 Longworth Office Building

Washington, D.C. 20515

Phone No. (202) 225-6356

Fax. (202) 225-5714

CANDIDATES FOR 1st DISTRICT CONGRESSIONAL SEAT

http://www.politics1.com/tn.htm

Representative John Duncan, 2nd Congressional District of Tennessee http://www.house.gov/duncan/

To send an E-Mail to Congressman Duncan: http://www.house.gov/duncan/2002/email.htm

To Visit, Write or Fax:

800 Market Street, Suite 110 Knoxville, TN 37902 Phone: (865) 523-3772 Fax: (865 /544-0728

262 E. Broadway Maryville, TN 37804-5782 Phone: (865) 984-5464 Fax: (865) 984-0521

6 East Madison Avenue Athens, TN 37303-4297 Phone: (423) 745-4671 Fax: (423) 745-6025

2400 Rayburn Office Building Washington, D.C. 20515 Phone: (202) 225-5435 Fax: (202) 225-6440

CANDIDATES FOR 2nd DISTRICT CONGRESSIONAL SEAT

http://www.politics1.com/tn.htm

Representative Zach Wamp, 3rd Congressional District of Tennessee http://www.house.gov/wamp/

To send an E-Mail to Congressman Wamp : http://www.house.gov/wamp/IMA/get_address4.htm

To Visit, Write or Fax:

900 Georgia Avenue, Suite 126 Chattanooga, TN 37402 (423) 756-2342 Fax:(423) 756-6613

Federal Building, Suite 100 200 Administration Road Oak Ridge, TN 37830 (865) 576-1976 or 1-800-883-2369 Fax: (865) 576-3221

423 Cannon House Office Building Washington, DC 20515 (202) 225-3271 Fax: (202) 225-3494

CANDIDATES FOR 3rd DISTRICT CONGRESSIONAL SEAT

http://www.politics1.com/tn.htm

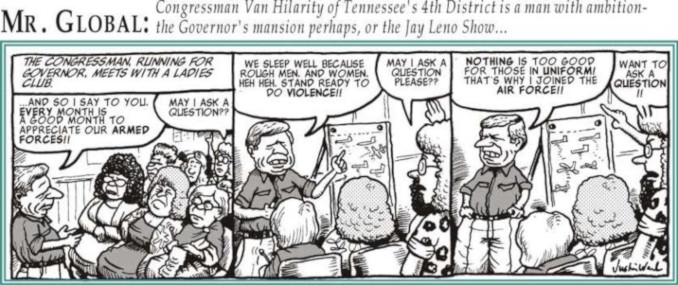

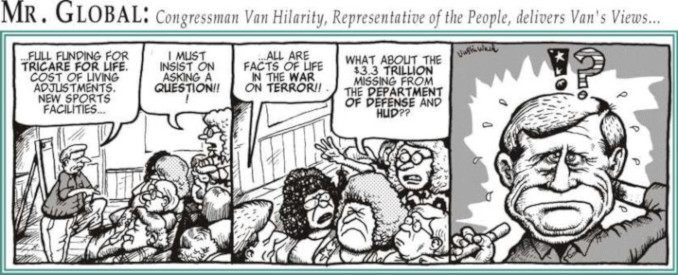

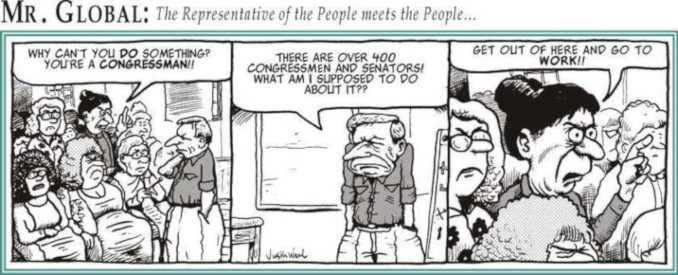

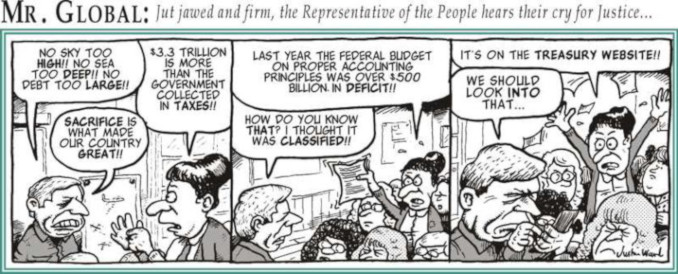

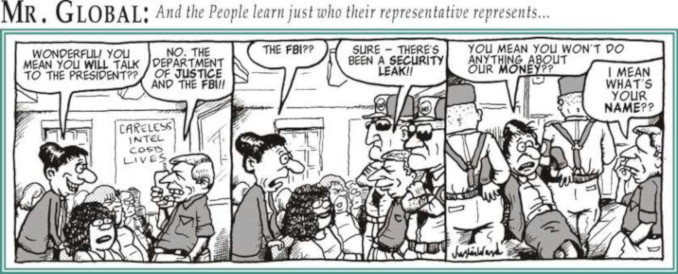

Representative Van Hilleary, 4th Congressional District of Tennessee (Starring in the Mr Global Cartoons appearing with this column…)

http://www.house.gov/hilleary/

To send an E-Mail to Congressman Hilleary:

http://www.house.gov/writerep/

To Visit, Write or Fax:

400 W. Main Street Suite 304 Morristown, TN 37814 phone: (423)587-0396 fax: (423)585-0065

106 N. Jackson Street Tullahoma, TN 37388 phone: (931)393-4764 fax: (931)393-4767

998 N. Main Street Suite 2 Crossville, TN 38555 phone: (931)484-1114 fax: (931)484-5097

http://www.house.gov/writerep/ CANDIDATE FOR GOVERNOR

Congressman Hilleary is a current Republican candidate for governor:

Website: http://www.vanhilleary.com/

E-Mail: headquarters@vanhilleary.com

Write or Phone: P.O. Box 680127 Franklin, TN 37068-0127 615-771-4VAN

Campaign E-Mail Updates: http://www.vanhilleary.com/

CANDIDATES FOR 4th DISTRICT CONGRESSIONAL SEAT

http://www.politics1.com/tn.htm

Representative Bob Clement , 5th Congressional District of Tennessee http://www.house.gov/clement/

To send Congressman Clement an E-Mail: Bob.Clement@mail.house.gov

Offices:

336 U.S. Courthouse, Nashville, TN 37203, phone (615) 736-5295, fax (615) 736-7479

2701 Jefferson St., Suite 103, Nashville, TN 37208, phone (615) 320-1363

101 5th Ave. West, Suite ‘D’, Springfield, TN 37172, phone (615) 384-6600

Room 2229 Rayburn HOB, Washington, DC, 20515-4205, phone (202) 225-4311 fax (202) 226-1035

CANDIDATE FOR SENATE

Congressman Clement is a candidate for the Senate seat being vacated by Fred Thompson

Website: http://www.bobclement.com/

E-Mail: info@bobclement.com

Write or Phone: Not Yet Available

Campaign E-Mail Updates: Not Yet Available

CANDIDATES FOR 5th DISTRICT CONGRESSIONAL SEAT http://www.politics1.com/tn.htm

Representative Bart Gordon , 6th Congressional District of Tennessee http://www.house.gov/gordon/

To send an E-Mail to Congressman Gordon : http://www.house.gov/writerep/

To Visit, Write or Fax:

106 S Maple, Murfreesboro Phone: (615) 896-1986

17 S Jefferson, Cookeville Phone: (931) 528-5907

2368 Rayburn House Office Building Washington, DC 20515 Phone: (202) 225-4231 Fax: (202) 225 6887

CANDIDATES FOR 6th DISTRICT CONGRESSIONAL SEAT

http://www.politics1.com/tn.htm

Representative Ed Bryant, 7th Congressional District of Tennessee

Send an E-Mail to Congressman Bryant: http://www.house.gov/writerep/

To Visit, Write or Fax:

Memphis (serving Chester, McNairy, Hardeman, Fayette, and part of Shelby counties) 5909 Shelby Oaks Drive Suite 213 Memphis, TN 38134 (901) 382-5811 FAX: (901) 373-8215

Clarksville (serving Montgomery, Dickson, Cheatham, and part of Robertson counties) 330 North Second Street Suite 111 Clarksville, TN 37040-3210 (931) 503-0391 FAX: (931) 503-0393

Columbia (serving Maury, Hickman, Lewis, Perry, Decatur, and Henderson counties) 609 West 7th Street Columbia, TN 38401 (931) 381-8100 FAX: (931) 381-1956

Washington DC (main legislative office) 408 Cannon HOB Washington, DC 20515-4207 (202) 225-2811 FAX: (202) 225-2989

==

CANDIDATE FOR SENATE

Congressman Bryant is a candidate for the Senate seat being vacated by Fred Thompson

Website: http://www.bryantforsenate.com/

E-Mail: vote@bryantforsenate.com.

Visit, Write or Fax:

Nashville – Main Office Bryant for Senate 2000 Glen Echo Road Suite 107 Nashville, TN 37215 PH: (615) 292-1345 FAX: (615) 463-9868

Memphis – Administrative Office Bryant for Senate 1160 Vickery Lane Suite 2 Cordova, TN 38016 PH: (901) 753-6348

Chattanooga – Field Office Bryant for Senate 6005 Century Oaks Drive Chattanooga, TN 37416 PH: (423) 648-3150

For five Field Representatives throughout Tennessee and local county chairmen across the state please contact one of Ed’s offices.

Campaign E-Mail Updates: http://www.bryantforsenate.com/join_joined.htm

==

CANDIDATES FOR 7th DISTRICT CONGRESSIONAL SEAT

http://www.politics1.com/tn.htm

===

Representative John Tanner, 8th Congressional District of Tennessee

To Send an E-Mail to Congressman John Tanner

http://www.house.gov/tanner/letstalk.htm

To Visit Write or Fax:

203 West Church Street Union City, TN 38261 731-885-7070 voice 731-885-7094 fax

Room B-7, The Federal Building Jackson, TN 38301 731-423-4848 voice 731-427-1537 fax

8120 Highway 51 North, Suite 3 Millington, TN 38053 901-873-5690 voice 901-873-5692 fax

1226 Longworth HOB, Washington, DC 20515 202-225-4714

CANDIDATES FOR 8th DISTRICT CONGRESSIONAL SEAT

http://www.politics1.com/tn.htm

Representative Harold Ford, Jr., 9th Congressional District of Tennessee

To send an E-Mail to Congressman Ford :

http://www.house.gov/writerep/

To Visit, Write or Fax:

The Federal Building 167 North Main, Suite #369 Memphis, Tennessee 38103 phone: (901) 544-4131 fax: (901) 544-4329

325 Cannon House Office Building Washington, D.C. 20515 phone: (202) 225-3265 fax: (202) 225-5663

CANDIDATES FOR 9th DISTRICT CONGRESSIONAL SEAT

http://www.politics1.com/tn.htm

CITIZENS OF TENNESSEE:

VISIT, FAX, E-MAIL, PHONE AND WRITE YOUR SENATOR AND SENATE TO DEMAND THEY GET OUR MISSING MONEY BACK!

BETTER YET, GO TO THEIR TOWN MEETINGS DURING CAMPAIGN SEASON AND ASK ABOUT OUR MISSING MONEY PUBLICLY!

MOVE YOUR VOTE AND DONATIONS AND VOLUNTEER TIME TO THOSE CANDIDATES WHO GET OUR MONEY BACK!

CURRENT SENATORS

Website for the Senate:

Bill Frist, Senator of Tennessee http://www.senate.gov/~frist/

To send an E-Mail to Senator Frist : http://www.senate.gov/~frist/Contact/contact.html

To Visit, Write or Fax:

James Building 735 Broad Street, Suite 701 Chattanooga, TN 37402 423-756-2757 423-756-5313 (fax)

200 East Main Street, Suite 111 Jackson, TN 38301 731-424-9655 731-424-8322 (fax)

10368 Wallace Alley Street, Suite 7 Kingsport, TN 37663 423-323-1252 423-323-0358 (fax)

28 White Bridge Road, Suite 211 Nashville, TN 37205 615-352-9411 615-352-9985 (fax)

5100 Poplar Avenue, Suite 514 Memphis, TN 38137 901-683-1910 901-683-3610 (fax)

Twelve Oaks Executive Park Building One, Suite 170 5401 Kingston Pike Knoxville, TN 37919 865-602-7977 865-602-7979 (fax)

416 Russell Senate Office Building Washington, DC 20510 202-224-3344 202-228-1264 (fax)

Fred Thompson, Senator of Tennessee http://thompson.senate.gov/ NOT STANDING FOR RE-ELECTION

CITIZENS OF TENNESSEE:

VISIT, FAX, E-MAIL, PHONE AND WRITE YOUR SENATE CANDIDATES TO GET OUR MISSING MONEY BACK

List of all Senate Candidates:

http://www.politics1.com/tn.htm

OTHER USEFUL LINKS

GET YOUR MONEY BACK CAMPAIGN 2002 PICTURES

ARE YOUR CONGRESSMAN AND SENATORS TELLING YOU TO TELL YOUR CHILDREN TO JUST SAY NOT TO DRUGS AND YES TO PAYING FOR MORE FEDERAL ENFORCEMENT?

PRINT OUT THESE PICTURES, TAKE THEM TO YOUR LOCAL CAMPAIGN STOP AND LOCAL PARTY MEETINGS AND TELL YOUR CONGRESSMAN AND SENATORS AND PARTY OFFICIALS TO LEARN HOW TO SAY NO TO WALL STREET, THE NEW YORK FEDERAL RESERVE BANK, GOVERNMENT CONTRACTORS CORPORATONS AND THEIR INVESTORS!

The Chairman of the New York Stock Exchange Says

YES with a Full Body Hug:

http://www.scoop.co.nz/mason/stories/HL0202/S00069.htm

Sundance Film Festival Award for Best On Line Video on Who Is Pushing Illegal Drugs to Our Kids

http://www.guerrillanews.com/crack/

OTHER TENNESSEE, FEDERAL AND PLACE BASED FINANCIAL INFORMATION

The Tennessee-American Society

http://www.tennessean-american.com/

Tax Free Tennessee

http://www.taxfreetennessee.org/

The Tennessee Taxpayer Protection Task Force

http://www.tennesseetaxpledge.com/

Tennessee Comptroller of the Treasury

http://www.comptroller.state.tn.us/

Gold Anti-Trust Action: US Treasury and NY Federal Reserve Bank Manipulation of the Gold Market

Consolidated Financial Reports for the Federal Government, fiscal 1995-2001

FirstGov (Umbrella Website for Federal & State and Local Websites) (Including Links to Individual Agency Inspector General Sites with Individual Agency Annual Audits and Performance and Material Weakness Reports)

General Accounting Office (Congressional Auditor)

Bureau of Economic Analysis

Methods to Determine Whether State and Local Governments Have Surpluses of Your Tax Dollars

http://www.cafrman.com/index.htm

Walter Burien’s Links (CAFR) to Information on the Comprehensive Annual Financial Reports

http://members.aol.com/_ht_a/cafr1/CAFR.html

BADGER ZIP LOCATOR http://badger.parl.com/locators/zipcode/

Community Information by Zip Code

http://library.csun.edu/mfinley/zipstats.html · U.S. Census Bureau http://www.census.gov/

Bureau of Labor Statistics http://www.bls.gov/home.htm

Fed Stats – The gateway to statistics from over 100 U.S. Federal agencies

FinanceNet financial Community (discontinued – has other links here)

County Business Patterns (U.S. Census Bureau)

http://tier2.census.gov/cbp_naics/index.html?

Annual Survey of Mfgrs’ Building Permits (U.S. Census Bureau)

http://tier2.census.gov/dbappweb.htm

Center For Public Integrity (50 states on line)

http://www.50statesonline.org/

Tax Information

Tax Protest:

http://www.theft-by-deception.com

Internal Revenue Service:

United States Code:

http://www4.law.cornell.edu/uscode/

SELECTED ARTICLES/TRANSCRIPTS ON THE MISSING MONEY AND RELATED GOVERNMENT CONTRACTORS

“$1/2 Trillion Federal Deficit for Fiscal 200,” by John Crudele

http://www.nypost.com/business/47855.htm

“Black Programs – Pentagon Defied Laws, Misused Funds,” by Tim Weiner

http://www.geocities.com/Area51/Shadowlands/6583/coverup042.html

The Kelly O’Meara “Missing Money” Series:

“Why is $59 Billion Missing from HUD?, by Kelly O’Meara

http://www.insightmag.com/main.cfm?include=detail&storyid=125906

Cuomo leaves HUD in Shambles,” by Kelly O’Meara

http://www.insightmag.com/main.cfm?include=detail&storyid=125762

“Inside HUD’s Financial Fiasco,” by Kelly O’Meara

http://www.freerepublic.com/forum/a3b17d96451e1.htm

“A Financial Fiasco is in the Making,” by Kelly O’Meara

http://www.insightmag.com/main.cfm/include/detail/storyid/161202.html

“The Government Fails Fiscal-Fitness Test,” by Kelly O’Meara

http://www.insightmag.com/main.cfm?include=detail&storyid=246188

“Rumsfield Inherits Financial Mess,” by Kelly O’Meara

http://www.insightmag.com/main.cfm?include=detail&storyid=139530

“Total Lack of Trust,” by Kelly O’Meara

http://www.restoringamerica.org/archive/elected/lack_of_trust.html

“Wasted Riches,” by Kelly O’Meara

http://www.insightmag.com/main.cfm/include/detail/storyid/108588.html

“Bureaucrats Circle Their Wagons,” by Kelly O’Meara

http://www.insightmag.com/main.cfm?include=detail&storyid=158428

“DynCorp Disgrace, by Kelly O’Meara http://www.insightmag.com/main.cfm/include/detail/storyid/163052.html

“Broken Wings,” by Kelly O’Meara http://www.insightmag.com/news/229690.html

“All That Glitters Is Not Gold,” by Kelly O’Meara http://www.insightmag.com/main.cfm/include/detail/storyid/180093.html

“What Does It Take to Lose a Contract?,” by Kelly O’Meara http://www.insightmag.com/main.cfm/include/detail/storyid/189894.html

“The Myth of the Rule of Law: How the Money Works — the Destruction of Hamilton Securities,” by Catherine Austin Fitts http://www.solari.com/gideon/q301.pdf

“Hold the Line: Harvard Watch’s “Trading Truth: A Report on Harvard’s Enron Entanglements,” by Catherine Austin Fitts http://www.truthout.com/docs_01/02.02G.Harvard.Watch.htm

“The Hijackers of Harvard: A Name and Address,” by Catherine Austin Fitts http://www.scoop.co.nz/mason/stories/HL0202/S00030.htm

“Enron: Let’s Play 20 Questions,” by Catherine Austin Fitts

http://www.drugwar.com/fitts20questions.shtm

Radio KPFA: Enron: Anatomy of a Cover Up (February 2002) See real audio archives for February 12, 13, 15, 26, 28th, March 6:

For summary national show on Enron Cover Up on February 28th, start 17 minutes in at:

http://www.Flashpoints.net/realaudio/fp20020228.ram

A transcript of the summary national show:

http://www.scoop.co.nz/mason/stories/HL0203/S00066.htm

Internet Real Audio of Gold Anti-Trust Action (GATA) Speech at the National Press Club (February 12, 2002)

http://www.gata.org/cspan.html

Gold Anti-Trust Action (GATA):

The War on Waste, CBS News, (January 29, 2002)

http://www.cbsnews.com/stories/2002/01/29/eveningnews/main325985.shtml

SELECTED ARTICLES ON THE IRS COMMISSIONER’s SPECIAL DEAL TO KEEP STOCK IN HUD CONTRACTOR WHO IS THE LEADING PROVIDER OF FINANCIAL SOFTWARE TO THE FEDERAL GOVERNMENT AND THE AGENCIES MISSING MONEY

“Federal Lawsuit Adds to AMS Woes Company Also Faces Trouble in Ohio, Vermont,” by Patience Wait:

http://www.washingtontechnology.com/news/16_9/federal/16922-1.html

“A Taxing Dilemma,” by John Berlau:

http://www.insightmag.com/main.cfm?include=detail&storyid=126235

“IRS Boss Snagged a Clinton Waiver,” by John Berlau:

http://www.insightmag.com/main.cfm?include=detail&storyid=126262

“News Alert: Eizenstat Explains Why He Gave Waiver to IRS Commissioner,” by John Berlau

http://www.insightmag.com/main.cfm?include=detail&storyid=126257

“How can Rossotti Reform the IRS?,” by John Berlau):

http://www.insightmag.com/main.cfm?include=detail&storyid=125994

“News Alert: Grassley Questions Rossotti’s Ties to AMS,” by John Berlau and Jamie Dettmer:

http://www.insightmag.com/main.cfm?include=detail&storyid=126003

“Rossotti Hires Raise Red Flags,” by John Berlau

http://www.insightmag.com/main.cfm?include=detail&storyid=84966

“IRS Chief on the Take: Charles Rossotti gets Kickbacks” by Uri Dowbenko

http://www.etherzone.com/2001/dowb050301.shtml

THE BIG PICTURE:

http://antwrp.gsfc.nasa.gov/apod/image/0011/earthlights_dmsp_big.jpg

You are encouraged to take over, lead, republish, forward, or otherwise use all or any part of TENNESSEE’s GET OUR MONEY BACK CAMPAIGN 2002.

If you are a attorney, accountant or judge interested in researching how we can ensure that our tax payments, federal credit and appropriations only go for lawful purposes and that the federal government is in compliance with federal laws regarding transparency and accountability, please contact Catherine Austin Fitts at catherine@solari.com.

To join the Solari Action Network for updates:

catherine@solari.com

Solari, Inc. PO Box 157, Hickory Valley, TN 38042,

phone: 731.764.2515

http://www.solari.com

No one ever ensured their family’s safety and freedom by voting for and donating to government leaders who rose to power by stealing our money and enjoying the profits from drug sales to our children.

No one ever ensured their family’s safety and freedom by purchasing from or depositing and investing with banking and corporate leaders who financed their market share by stealing our private pension and public money and enjoying the profits from drug sales to our children.

No one ever ensured their family’s safety and freedom by watching broadcasters or reading editors and journalists who stood silent or afraid in complicit support.

—Catherine Austin Fitts, Solari

AUTHORS NOTE…. Catherine Austin Fitts is a former managing director and member of the board of directors of Dillon Read & Co, Inc, a former Assistant Secretary of Housing-Federal Housing Commissioner in the first Bush Administration, and the former President of The Hamilton Securities Group, Inc.

CONTENTS….

A.

Why the Citizens of Tennessee Are Working Harder & Getting Less

Click On Image For Larger Version…

The Missing Money:

Why the Citizens of Tennessee Are Working Harder

&

Getting Less

by

Catherine Austin Fitts

Catherine@solari.com

In June 2001 the Senate Governmental Affairs Committee, under the leadership of Senator Fred Thompson (R- Tenn.), published its study, “Government at the Brink.” [1] The study describes the failure of federal government agencies to maintain reliable financial systems and/or to publish required independent annual audited financial statements. The President’s initial 2002 budget (before increases for 9-11) proposed that approximately 85% of all federal appropriations be awarded to the very same agencies the Thompson study states either (a) fail to maintain reliable financial systems, (b) fail to publish trustworthy or, in some cases, any, independent certified financial statements (as required by law), or both. [2]

What this means is that the citizens of Tennessee are paying an average of $5, 175 per person in federal taxes[3] of which $4, 472 is appropriated by our Congressional representatives to agencies and their outside contractors who fail to account for use of our money[4]. In other words, most federal agencies and their contractors are not held accountable for performance, raising the question what the people of Tennessee are getting for their significant investment in taxes paid to the U. S. Treasury and collected by the Internal Revenue Service (IRS). While government agencies thumb their noses at laws requiring accountability, we spend enormous amounts of time and energy providing the IRS with accurate and complete annual financial reports on ourselves. Is our Federal government not to be held accountable to the same standards or rigorous financial reporting requirements as we the taxpayers?

Every year, Congressman Steve Horn (R-Calif.), Chairman of the House Government Reform subcommittee on Government Efficiency, Financial Management and Intergovernmental Relations [5] issues a report card regarding attempts by federal agencies to produce reliable annual audited financial statements.

Congressman Horn’s Financial Management Report Card

Agencies Rated D or F, Fiscal Year 2001 (Ended 9/30)

D+

=============================

Environmental Protection Agency

Small Business Administration

D

=============================

Department of Health and Human Services

Department of Housing and Urban Development

Department of the Interior

Department of Veterans Affairs

D-

=============================

Department of Commerce

Department of Education

Department of the Treasury

Nuclear Regulatory Commission

Department of Justice

Department of State

Department of Transportation

Agency for International Development

F

=============================

Department of Agriculture

Department of Defense

Federal Emergency Management Administration

National Aeronautics and Space Administration

Other reports from sources like agency inspectors general and government whistleblowers charge that the problems are much deeper than mere accounting: they allege stolen and missing inventory (planes, tanks, etc.) and in some cases actually admit that they rely on black budget funding (i.e., funding that is “off balance sheet” and not subject to Congressional oversight). The existence of such reports requires that we ask whether the very government officials and contractors who are paid handsomely to protect and manage our resources in accordance with the law are looting the federal government.

Total undocumented accounting adjustments for reported periods for the Department of Defense (fall of 1997 to date) amount to a whopping $3.3 trillion, or $11,700 for every American. (Many American families don’t even have $11,700 in savings in their bank accounts.) The Department of Defense has failed to produce independent audited financial statements since the requirement went into effect in 1995. HUD’s Inspector General refused to certify HUD’s fiscal 1999 financial statements. Since both agencies have refused to explain the undocumented adjustments in adequate detail for some years and declined to report or make public undocumented adjustments, we have no evidence to document that large amounts of assets or money are not being stolen. [6]

In the summer of 2000, as the former Assistant Secretary of Housing – Federal Housing Commissioner and former contractor to HUD, I visited offices of the Senate Appropriations subcommittee for HUD. [7] While there, a senior staff member of the Chairman of the subcommittee asked me what was going on at HUD. When I deferred, this staffer said, “HUD is being run as a criminal enterprise.”[8] The US Treasury, the Department of Justice, the New York Federal Reserve as depository and some or all of the major HUD contractors would have to be complicit if this charge is true. If they know what is going on at HUD and do nothing to stop it, then they are complicit! (Do we have a case of racketeering under the RICO criminal statutes?)

I subsequently communicated this situation to the Tennessee staff for my Congressional delegation. In response, one staff member advised me to “stop trying to save the world.” Later that year, all three members of my delegation, Senator Fred Thompson, Senator Bill Frist, and Congressman Ed Bryant, voted “yes” to a $1.7 billion increase in HUD’s budget. Letters from my attorney to Senator Thompson regarding HUD and from me to all Congressional representatives regarding growing criminal influence in government went unanswered. (Their inaction and their lack of response, suggest guilt and complicity. It’s much the same as a person involved in an auto accident when a pedestrian is run down and they flee the scene. They are usually suspected of being involved in a “hit and run.”)

In response to an invitation from the Hardeman County Republican Party, I had the opportunity to attend a presentation with friends and neighbors given by Congressman Van Hilleary (R-Tenn.) at the offices of the First South Bank in Bolivar. Congressman Hilleary presented his qualifications to serve as our next Governor of Tennessee, stressing his qualifications to bring financial responsibility and accountability to Tennessee state government. During questions and answers, Congressman Hilleary confirmed that he was aware that there was $3.3 trillion missing at the DOD and HUD. I asked him what he had done to figure out what money is gone and how we can get it back. I explained that getting our money back is the only way to make sure more money doesn’t disappear in the future. His response was that he was only one of more than 400 members of the House of Representatives and that there was really nothing he could do. When I returned home, a visit to Congressman Hilleary’s website confirmed that he is in fact one of a much smaller group who serves on the House Armed Services and Budget Committees and he strongly supported the $48 billion increase in our military budget without so much as a contingency placed on such spending to require compliance with the laws that regulate agency financial management.

Why is this situation relevant to my family, friends and neighbors in Hardeman County, Tennessee during this election season? (And indeed relevant to the other 49 states and 3,066 counties in this great country.) Recent Bureau of Economic Analysis statistics indicate that the average American citizen has revenues of approximately $31, 817, expenses of $37, 118 and is financing day-to-day living expenses by liquidating assets and borrowing approximately $5,301. Meantime, corporate assets continue to rise as citizens’ assets decline. This trend has remained unchanged for the last few years.

What that means is that the amount of assets we have to sell or borrow to make ends meet is about the same as the amount we are paying to the federal government, most of which is disappearing down a federal “black hole.” Meanwhile, Washington confers even more contracts and special benefits upon private companies like those managing the accounting and information systems at HUD and DOD and supports inside deals for companies like Enron. Indeed, many of the companies that run HUD were intimately involved with Enron. Yard sales, car sales, small business bankruptcies and mortgage and consumer debt defaults increase as ordinary men and women throughout Tennessee try to foot the bill.

I believe that Tennessee’s pro rata share of the “missing money” is more than enough to fund any increased budget needs here in Tennessee. Rather than imposing a state income tax or increasing individual state taxes, why not simply fund any state deficits with our portion of recaptured resources that were lost or stolen by the federal government? Indeed, why not lower state and federal taxes. Based on many years of managing and reengineering private and government funds and cleaning up billions of Iran Contra, S&L and HUD financial fraud, it is possible to reengineer federal budgets on a local level in a manner that could lead to a much lower tax and debt burden.

The campaigns and elections this year offer a unique opportunity for the citizens of Tennessee —as well as the other 49 states of the U.S. — to ensure that we only pay taxes that are used for lawful and economic purposes. We can demand a return of amounts paid to defaulting government contractors and the profits of fraud and crime — whether by corporations or in government — to fund current budgets.

It is time to get our money back to fund state and local needs rather than consider tax increases and to ensure local control and accountability for our resources. Our federal representatives are paid to serve us. If they fail to observe their legal mandates, we need to vote them out and vote in people who can. It is also time to ask our local representatives to take the steps that they can to get our missing federal tax dollars back.. But let’s not stop there. It is time to ask our local tax attorneys, judges and accountants what legal steps can be taken to establish judgments and set asides, escrow tax payments or to ask the courts to condition appropriations on compliance with the law. It is time to insist that all government contract budgets and contracts be fully disclosed and web accessible so that we can see whether the same corporations and banks that have devastated private savings are also responsible for raiding our public assets and savings and failing to perform on their contracts.

Long ago, when Americans tossed bales of British team into Boston Harbor, the slogan was, “No Taxation without Representation!” Now the new slogan should be: “No Taxation without Transparency and Accountability!”

May 22, 2002

Hickory Valley, Tennessee

NOTES:

1. http://www.senate.gov/~gov_affairs/issues.htm

2. Wasted Riches, by Kelly Patricia O’Meara, Insight Magazine, October 22, 2001, http://www.insightmag.com/main.cfm/include/detail/storyid/108588.html

3. Based on IRS 1999 collections of individual taxes.

4. Wasted Riches, by Kelly Patricia O’Meara, Insight Magazine, October 22, 2001, http://www.insightmag.com/main.cfm/include/detail/storyid/108588.html

5. http://www.house.gov/reform/gefmir/index.htm

6. The War on Waste, CBS News, (January 29, 2002) http://www.cbsnews.com/stories/2002/01/29/eveningnews/main325985.shtml ; Rumsfeld Inherits Financial Mess by Kelly Patricia O’Meara, Insight Magazine, September 3, 2001. http://www.insightmag.com/main.cfm?include=detail&storyid=139530

7. Bio, see http://www.solari.com/about/ca_fitts.html

8. In support of the Senate staffer’s position, see The Myth of the Rule of Law, by Catherine Austin Fitts, SRA Quarterly, London, November 2001, http://www.solari.com/gideon/q301.pdf HUD’s outside contractors include Lockheed Martin, DynCorp, AMS, JP Morgan-Chase, Arthur Andersen and Harvard.

B.

How Missing Money is Costing You and Your Family

Click On Image For Larger Version…

HOW MUCH OF OUR MONEY GOES TO BOOKS

“COOKED” BY

FEDERAL AGENCIES & GOVERNMENT CONTRACTORS

& US TREASURY BANK DEPOSITORIES?

STATE BY STATE

by

Catherine Austin Fitts

www.solari.com

To learn more about cooked books and the missing

money see:

Background for Tennessee Citizens on Our Missing Money

(CLICK HERE)

USA AVERAGE

Residents (April 2000 census): 281,421,906

1999 IRS Individual Taxes: $1.6 trillion

Taxes per Resident: $5,688

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$4,835

IF YOU LIVE IN ALABAMA

Residents (April 2000 census): 4,447,100

1999 IRS Individual Taxes: $15.9 billion

Taxes per Resident: $ 3,572

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$3,078

IF YOU LIVE IN ALASKA

Residents (April 2000 census): 626,932

1999 IRS Individual Taxes: $2.7 billion

Taxes per Resident: $4,290

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$3,750

IF YOU LIVE IN ARIZONA

Residents (April 2000 census): 5,130,632

1999 IRS Individual Taxes: $19.2 billion

Taxes per Resident: $3,749

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$3,234

IF YOU LIVE IN ARKANSAS

Residents (April 2000 census): 2,673,400

1999 IRS Individual Taxes: $12. 3 billion

Taxes per Resident: $ 4,598

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$3,983

IF YOU LIVE IN CALIFORNIA

Residents (April 2000 census): 33,871,648

1999 IRS Individual Taxes: $185.2 billion

Taxes per Resident: $5,467

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$4,724

IF YOU LIVE IN COLORADO

Residents (April 2000 census): 4,301,261

1999 IRS Individual Taxes: $29.4 billion

Taxes per Resident: $6,833

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$5,916

IF YOU LIVE IN CONNECTICUT

Residents (April 2000 census): 3,405,565

1999 IRS Individual Taxes: $31.4 billion

Taxes per Resident: $9,232

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$7,959

IF YOU LIVE IN DELAWARE

Residents (April 2000 census):783,600

1999 IRS Individual Taxes: $6.1 billion

Taxes per Resident: $7,810

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$6,706

IF YOU LIVE IN FLORIDA

Residents (April 2000 census): 15,982,378

1999 IRS Individual Taxes: $ 76.5 billion

Taxes per Resident: $4,787

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$4,136

IF YOU LIVE IN GEORGIA

Residents (April 2000 census): 8,186,453

1999 IRS Individual Taxes: $43,590,023

Taxes per Resident: $5,324

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$4,595

IF YOU LIVE IN HAWAII

Residents (April 2000 census): 1,211,537

1999 IRS Individual Taxes: $4.8 billion

Taxes per Resident: $3,947

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$3,424

IF YOU LIVE IN IDAHO

Residents (April 2000 census): 1,293,953

1999 IRS Individual Taxes: $5.4 billion

Taxes per Resident: $ 4,197

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$3,633

IF YOU LIVE IN ILLINOIS

Residents (April 2000 census): 12,419,293

1999 IRS Individual Taxes: $90.7 billion

Taxes per Resident: $7,304

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$6,314

IF YOU LIVE IN INDIANA

Residents (April 2000 census): 6,080,485

1999 IRS Individual Taxes: $29.7 billion

Taxes per Resident: $4,880

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$4,207

IF YOU LIVE IN IOWA

Residents (April 2000 census): 2,926,324

1999 IRS Individual Taxes: $12.1 billion

Taxes per Resident: $4,145

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$3,591

IF YOU LIVE IN KANSAS

Residents (April 2000 census): 2,688,418

1999 IRS Individual Taxes: $13.7 billion

Taxes per Resident: $5,086

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$4,372

IF YOU LIVE IN KENTUCKY

Residents (April 2000 census): 4,041,769

1999 IRS Individual Taxes: $ 14.8 billion

Taxes per Resident: $ 3,671

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$3,182

IF YOU LIVE IN LOUISIANA

Residents (April 2000 census): 4,468,976

1999 IRS Individual Taxes: $ 13.6 billion

Taxes per Resident: $3,034

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$2,630

IF YOU LIVE IN MAINE

Residents (April 2000 census): 1,274,923

1999 IRS Individual Taxes: $4.5 billion

Taxes per Resident: $3,531

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$3,037

IF YOU LIVE IN MARYLAND & DC

Residents (April 2000 census): 5,868,545

1999 IRS Individual Taxes: $ 44.9 billion

Taxes per Resident: $7,658

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$6,622

IF YOU LIVE IN MASSACHUSETTS

Residents (April 2000 census): 6,349,097

1999 IRS Individual Taxes: $ 50.9 billion

Taxes per Resident: $8,022

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$6,926

IF YOU LIVE IN MICHIGAN

Residents (April 2000 census): 9,938,444

1999 IRS Individual Taxes: $ 63.7 billion

Taxes per Resident: $6,406

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$5,538

IF YOU LIVE IN MINNESOTA

Residents (April 2000 census): 4,919,479

1999 IRS Individual Taxes: $ 42.8 billion

Taxes per Resident: $ 8,694

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$ 7,506

IF YOU LIVE IN MISSISSIPPI

Residents (April 2000 census): 2,844.658

1999 IRS Individual Taxes: $ 8.0 billion

Taxes per Resident: $ 2,824

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$2,430

IF YOU LIVE IN MISSOURI

Residents (April 2000 census): 5,595,211

1999 IRS Individual Taxes: $33.2 billion

Taxes per Resident: $ 5,926

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$5,116

IF YOU LIVE IN MONTANA

Residents (April 2000 census): 902,195

1999 IRS Individual Taxes: $2.7 billion

Taxes per Resident: $2,984

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$2,605

IF YOU LIVE IN NEBRASKA

Residents (April 2000 census): 1,711,263

1999 IRS Individual Taxes: $9.8 billion

Taxes per Resident: $5,701

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$4,929

IF YOU LIVE IN NEVADA

Residents (April 2000 census): 1,998,257

1999 IRS Individual Taxes: $9.6 billion

Taxes per Resident: $4,811

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$4,152

IF YOU LIVE IN NEW HAMPSHIRE

Residents (April 2000 census): 1,235,786

1999 IRS Individual Taxes: $6.3 billion

Taxes per Resident: $5,047

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$4,364

IF YOU LIVE IN NEW JERSEY

Residents (April 2000 census): 8,414,350

1999 IRS Individual Taxes: $69.4 billion

Taxes per Resident: $8,250

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$7,133

F YOU LIVE IN NEW MEXICO

Residents (April 2000 census): 1,819,046

1999 IRS Individual Taxes: $5.5 billion

Taxes per Resident: $ 3,007

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$2,584

IF YOU LIVE IN NEW YORK

Residents (April 2000 census): 18,976,457

1999 IRS Individual Taxes: $ 145.8 billion

Taxes per Resident: $7,681

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$6,639

IF YOU LIVE IN NORTH CAROLINA

Residents (April 2000 census): 8,049,313

1999 IRS Individual Taxes: $35.4 billion

Taxes per Resident: $4,394

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$3,797

IF YOU LIVE IN NORTH DAKOTA

Residents (April 2000 census): 642,200

1999 IRS Individual Taxes: $2.4 billion

Taxes per Resident: $3,690

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$3,230

IF YOU LIVE IN OHIO

Residents (April 2000 census): 11,353,140

1999 IRS Individual Taxes: $ 66.7 billion

Taxes per Resident: $5,876

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$5,079

IF YOU LIVE IN OREGON

Residents (April 2000 census): 3,421,399

1999 IRS Individual Taxes: $ 16.1 billion

Taxes per Resident: $ 4,687

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$4,042

IF YOU LIVE IN PENNSYLVANIA

Residents (April 2000 census): 12,281,054

1999 IRS Individual Taxes: $70.6 billion

Taxes per Resident: $5,751

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$4,966

IF YOU LIVE IN RHODE ISLAND

Residents (April 2000 census): 1,048,319

1999 IRS Individual Taxes: $5.5 billion

Taxes per Resident: $5,288

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$4,617

IF YOU LIVE IN SOUTH CAROLINA

Residents (April 2000 census): 4,012,012

1999 IRS Individual Taxes: $15.8 billion

Taxes per Resident: $3,943

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$3,412

IF YOU LIVE IN SOUTH DAKOTA

Residents (April 2000 census): 754,844

1999 IRS Individual Taxes: $3.0 billion

Taxes per Resident: $3,999

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$3,481

IF YOU LIVE IN TENNESSEE

Residents (April 2000 census): 5,689,283

1999 IRS Individual Taxes: $ 29.4 billion

Taxes per Resident: $5,175

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$4,472

IF YOU LIVE IN TEXAS

Texas Residents (April 2000 census): 20,851,820

1999 IRS Individual Taxes: $104.4 billion

Taxes per Resident: $5,007

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$4,324

IF YOU LIVE IN UTAH

Residents (April 2000 census): 2,233,169

1999 IRS Individual Taxes: $ 8.8 billion

Taxes per Resident: $ 3,934

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$ 3,406

IF YOU LIVE IN VERMONT

Residents (April 2000 census): 608,827

1999 IRS Individual Taxes: $2.5 billion

Taxes per Resident: $4,109

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$3,634

IF YOU LIVE IN VIRGINIA

Residents (April 2000 census): 7,078,515

1999 IRS Individual Taxes: $ 40.1 billion

Taxes per Resident: $5,667

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$4904

IF YOU LIVE IN WASHINGTON

Residents (April 2000 census): 5,894,121

1999 IRS Individual Taxes: $ 38.4 billion

Taxes per Resident: $6,521

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$5,631

IF YOU LIVE IN WEST VIRGINIA

Residents (April 2000 census): 1,808,344

1999 IRS Individual Taxes: $4.4 billion

Taxes per Resident: $2,434

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$2,064

IF YOU LIVE IN WISCONSIN

Residents (April 2000 census): 5,363,675

1999 IRS Individual Taxes: $28.6 billion

Taxes per Resident: $5,340

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$4,615

IF YOU LIVE IN WYOMING

Residents (April 2000 census): 493,782

1999 IRS Individual Taxes: $1.9 billion

Taxes per Resident: $3,976

2002 Proposed Appropriations to Federal Agencies Without Reliable

Financial Systems and/or Audits per Resident…$3,360

BASED ON

Audit reports and testimony by federal agency inspectors general and the

General Accounting Office for federal fiscal 1998-2000, “report cards” from

Congressman Horn’s subcommittee of the House Government Reform Committee and Chairman Thompson’s report on Senate Governmental Affairs Committee, “Government on the Brink.”

AND TO MAKE MATTERS WORSE, YOU HAVE ALREADY LOST…..

Two of the agencies that cannot produce working financial systems,

DOD and HUD, have reported $3.3 trillion missing for fiscal 1998, 1999

and 2000. That works out to about $11, 700 per US resident, based on

April 2000 census of 281,421,906 Americans.

Send corrections and suggestions to:

May 22, 2002

Hickory Valley, Tennessee

BACK TO PAGE CONTENTS

C.

Letter To Congressman Van Hilleary (R-Tenn.)

Click On Image For Larger Version…

May 22, 2002

Congressman Van Hilleary (R-Tenn.)

114 Cannon House Office Building

Washington, DC 20515

Van Hilleary for Governor

P.O. Box 680127

Franklin, TN 37068-0127

Re: Failure of Federal Agencies to Produce Independent Annual Certified Financial Statements and Reliable Financial Systems; $3.3 Trillion of Undocumented Adjustments at the Department of Housing and Urban Development (HUD) and Department of Defense (DOD) for fiscal 1998-2000 (the “missing money”).

Dear Congressman Hilleary:

I had the opportunity to attend your presentation in early March at the offices of First South Bank in Bolivar. You reviewed your qualifications to serve as our next Governor of Tennessee. Your focus was on the importance of your qualifications and ability to bring financial responsibility and accountability to Tennessee state government. During questions and answers, you confirmed that you were aware that there was over $3.3 trillion of missing money at DOD and HUD for fiscal 1998-2000. When asked what you had done to figure out what money is gone and how we get it back and make sure that this does not happen again, your response was that you were only one of more than 400 members of the House of Representatives and that there was really nothing you could do.

As a follow up, I have prepared the following questions with the help of the members of the Hickory Valley Baptist Church Women’s Bible Class. Your responses to more specific questions are necessary for us to assess your qualifications to manage complex government budgets and financial problems. They will also help us to understand what actions we can take to ensure that our tax dollars are managed according to the law and lost or stolen money is recovered and returned to the US Treasury.

We appreciate your sending a written response to our questions to:

The Hickory Valley Baptist Church – Women’s Bible Class

PO Box 157

Hickory Valley, Tennessee 38042

We anticipate asking these or similar questions to the other candidates running in Tennessee this year.

If you have any questions, please do not hesitate to contact me at catherine@solari.com. Thank you for your attention to this matter.

Sincerely yours,

Catherine Austin Fitts

Solari, Inc.

Attachment: Questions

Cc:

Members, Hickory Valley Baptist Church, Women’s Bible Class

Tennessee Media

BACK TO PAGE CONTENTS

Click On Image For Larger Version…

D. Questions: Actions You Have Taken to Identify and Return Our Missing Money

I. Committee Positions and Appropriation Votes

What have your committee responsibilities been since the fall of 1997? Please explain briefly how they relate to oversight of the agencies that have reported large undocumented adjustments and missing money from fiscal 1998 on, including DOD, HUD, Education and the Department of Interior – Bureau of Indian Affairs, and provide your voting record on appropriations for these agencies for the federal budget years 1999-2003.

II. Education

What steps have you taken to inform yourself about the missing money and the failure of federal agencies to manage their resources properly from the fall of 1997 to date?

III. Staff Assignments

What steps have you taken to assign your staff resources to investigating or trying to illuminate or recapture the missing money from fiscal 1998 to date? Please describe briefly.

IV. Letters and Meetings

What correspondence have you initiated and what meetings have you requested with the following agencies to stop any losses and fraud and to get any missing money back?

– Department of Treasury

– DOD

– HUD

– Department of Education

– Office of Management and Budget

– Department of Interior – Bureau of Indian Affairs

What steps have you taken to have the above agencies illuminate cash bonus payments to personnel involved in accounting and financial management or agency leadership? In this respect, what correspondence and meetings have you initiated with:

– Office of Personnel Management

V. Requests for Investigations

Please list all requests for investigations that you have made of the agencies and offices with responsibility to investigate federal financial and contracting fraud and related personnel and contractor management issues, including:

General Accounting Office

Inspector General – DOD

Inspector General – HUD

Inspector General — Education

Inspector General — Department of Treasury

Inspector General – Interior (Bureau of Indian Affairs)

Department of Justice

President’s Council on Integrity and Efficiency

Office of Personnel Management

Please list all requests that you have made for analysis of the impact of the missing money on the federal credit and the feasibility and cost of financing the federal deficit and government operations as well as the impact on the competitive value of the US dollar in world markets, including from:

Congressional Budget Office

Congressional Research Office

Department of Treasury

VI. Disclosure and Oversight of Contractors

Please list all efforts you have made with any agencies to:

– publicly identify contractors responsible for management of agency computer and information systems as well as accounting, depository

and payment software and systems;

– hold contractors accountable for performance;

– recapture payments where contractors fail to perform.

Have you asked for recommendations for reform regarding contractor choice, compensation and accountability from?

General Services Administration

DOD Audit

Department of Justice

Will you commit to provide the public during this election cycle with a contracting budget for each agency that is missing money? If not, why not?

VII. Hearings

What hearings have you held or intend to hold regarding the missing money?

VIII. Floor Speeches by Special Order

How many floor speeches have you given or do you intend to give about the missing money?

IX. Education and Enlistment of other Congressional Representatives

What efforts have you made to educate or enlist your other Congressional representatives and leadership?

X. Education of Constituents

The missing money is the equivalent of $11,700 per American citizen. What is your annual budget funded by taxpayers to communicate with your constituents? Please list the efforts you have made to communicate about the missing money with your constituents and engage their support in protecting our resources?

XI. Legislation

What legislation have you introduced or co-sponsored to enforce financial accountability in the federal government, including recapturing monies lost or stolen?

What legislation have you introduced or co-sponsored to ensure transparency or support enforcement efforts with concrete consequences for failure to perform:

– Accessible public disclosure of all federal contracts and contracting budgets by agency and by geographic location;

– Accessible public disclosure of all federal appropriations, assets and credit originations and portfolios by place;

– Firing and debarment of contractors who fail to perform their responsibilities to build and manage reliable and trustworthy financial systems;

– Conditioning of budget authorizations and appropriations on maintenance of financial standards;

– Conditioning of agency cash bonuses on agency financial performance;

– Recapturing of missing money.

XII. Campaign Donations

Please list the campaign donations you have received from federal government contractors at DOD, HUD, the Department of Treasury and Interior, as well as their law firms, lobbyists, employees and investors.

XIII. Your Actions Prior to November

Please list the actions that you will commit to take between now and the elections to find our missing money and get it back.