When the US commodities regulator sought public input last year on a plan to damp oil speculation, most of the hundreds of missives it received were not about energy, but silver and gold.

One letter read: “I know your time is precious so I will make my request short and sweet. Please limit concentrated short positions in the silver futures market. This will allow the little guy a fighting chance against powerful market manipulators.”

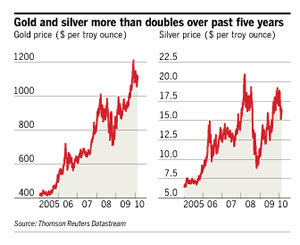

The barrage was the latest salvo from a group of small silver and gold investors who claim that a cabal of banks is conspiring to keep precious metals too cheap.

Now the silver and gold bugs have got the regulator’s ear. The Commodity Futures Trading Commission this week announced it would host a public meeting in late March to discuss speculation limits in US metal futures.

This accommodates critics accustomed to brush-offs by Wall Street’s precious metals traders.