Read the Interview

Read the transcript of The Bechtel Corporation with Sally Denton here PDF

Listen to the Interview MP3 audio file

The Solari Report 2016-08-11

Read the Money & Markets Notes

Read the notes from this week’s Money & Markets here (PDF)

Listen to the Money & Markets MP3 audio file

The Solari Report 2016-08-11

August 18 – Human Communications Between Reality and Official Reality with Jon Rappoport

August 25 – Solari Food Series – Pioneering Urban Farms with Will Allen

September 01 – Precious Metals Market Report

Subscriber Resources:

Productivity declines for third straight quarter

“We’re more about making money than making things.” ~Stephen D. Bechtel

By Catherine Austin Fitts

History shows that a civilization that gets engineering and infrastructure right is likely to thrive. Get them wrong, and the chance of success drops significantly. This means the success of our civilization depends on great engineering and the wise investment of resources to build productive, economic and reliable infrastructure. We need our engineers to share a strategic vision that supports civilization and builds a more powerful economy.

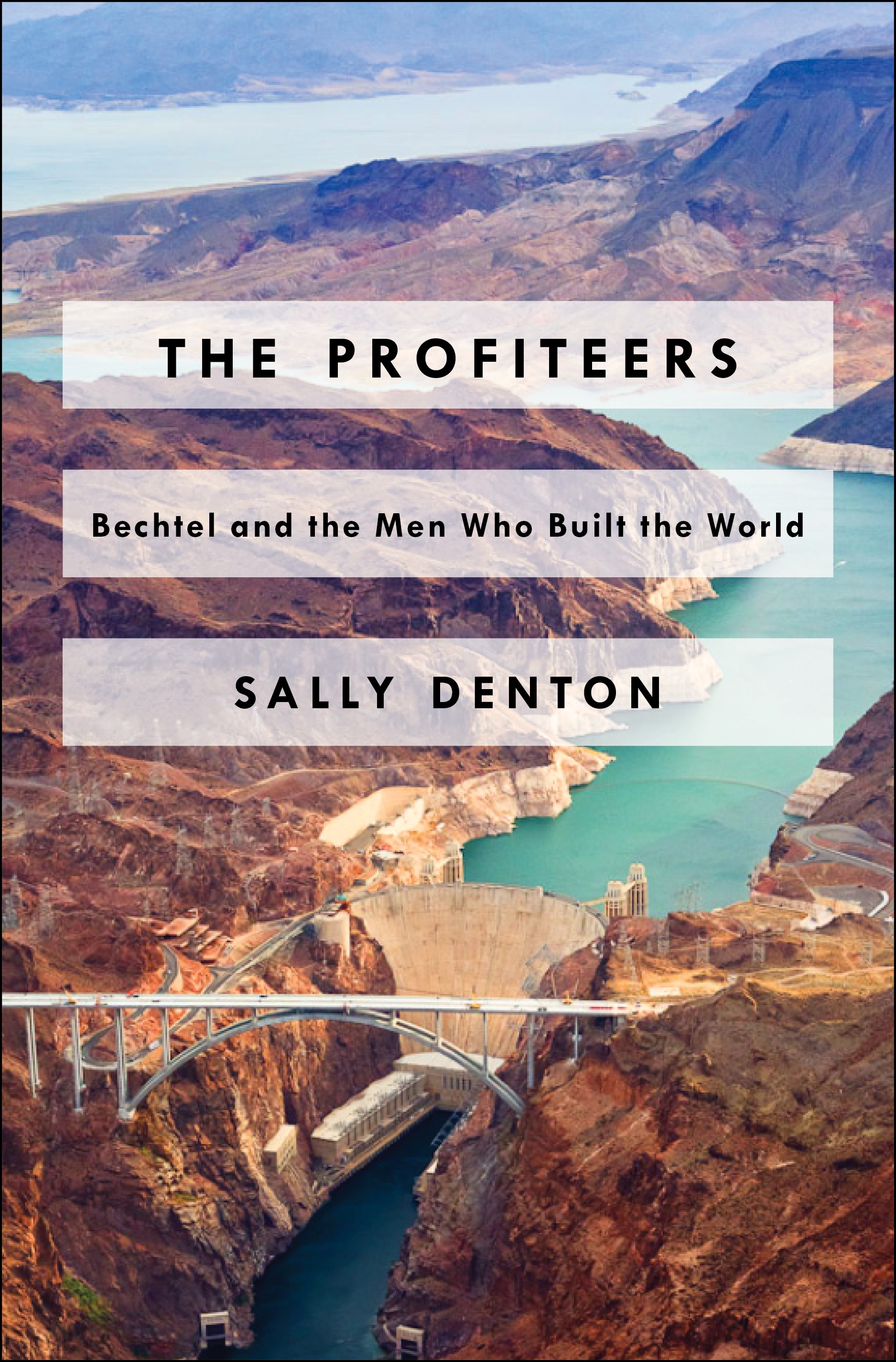

Sally Denton is one of America’s finest investigative reporters and historians. Sally joins me this week on the Solari Report to discuss her powerful new book, The Profiteers: Bechtel and the Men who Built the World. The Profiteers is the history of the mysterious San Francisco-based engineering and construction giant that built the Hoover Dam and a long list of other engineering wonders of the world.

In this fascinating interview Sally reminded me that we need engineers, not demagogues. However, when your mechanical, civil and technology engineers have become financial engineers and disaster capitalism profiteers who drain your economy, that creates the conditions in which demagogues arise. When did making money become more important than building transcontinental railroads or awe-inspiring dams, bridges and space stations?

I attribute the change, in part, to the “debt growth model,” by which an infinite amount of government debt can be issued and an infinite amount of fiat currency can be digitally manufactured. The discipline, however, to ensure that these investments produce a stronger economy simply disappeared as “crony capitalism” took over. As Denton brilliantly describes Bechtel’s role in the Iraq War — revolving-door Bechtel executives and directors such as George P. Shultz lobbied to start the war. And then Bechtel cashed in with no- risk, no-bid government contracts at usurious profit margins.

The combined cost of the wars in Afghanistan, Pakistan and Iraq, following 9/11, is now over $4 trillion, a cost that continues to grow as benefits owed to war veterans are paid. This sum includes a $212 billion Iraqi reconstruction effort which was largely a failure. Reports have it that most of that money was spent on security or was lost to waste and fraud. Bechtel charged the US government untold billions for services in Iraq reconstruction, including $5 billion to build just one specific hospital.

Alan Greenspan is running around the corporate media claiming that we will have trouble meeting pension fund and retirement obligations because of our lower productivity growth. Is the actual problem our lower productivity growth? Or is it $4 trillion missing from the US government plus $4 trillion spent for wars in the Middle East plus $27 trillion for bank bailouts combined with low interest rates to finance the government debt for these and other escapades?

During the George W. Bush Administration, Bechtel also assumed control of the US nuclear laboratories, calling this takeover a privatization. Another description would be “coup d’etat” — turning over the nation’s nuclear energy and weapon’s complex to a private company financially vested in starting a new cold war. Do you want the private investors who profited so richly on Iraq vested in starting a new cold war with the Soviet Union? Denton quotes a senior employee at Lawrence Livermore National Laboratory, who referred to this new style of private management of our nuclear energy and weapons infrastructure as a combination of “the worst aspects of the Department of Motor Vehicles and Goldman Sachs.”

Denton points out that there is now a new, younger generation of family leadership at Bechtel who is making changes. Let’s hope that one day we will view Bechtel as a company that helped to “Make America Great Again.” But if history were to stop now, the chances are that Bechtel would probably be remembered as the company (i) that lobbied for the right of a private family to own and control nuclear weapons, and (ii) which profited richly from 9/11, the destruction of US sovereignty and the wars and financial coup d’etat that ensured that American pension funds and retirement systems could not meet their obligations to the American people.

The debt growth model is over. Let’s pray we can all make the change successfully – Bechtel too — so that America’s obligations can be honored.

In Lets Go to the Movies, check out the trailer for a new movie about engineers financed by Bechtel, Dream Big. Look for it to be published in 2017. Here’s hoping the Bechtel family, board and senior management – for that matter every Bechtel employee – take it to heart.

My two favorite documentaries for inspiration regarding the power and importance of engineering have been recommended in Let’s Go to the Movies before:

- The Seven Wonders of the Industrial World produced by the BBC.

- Engineering an Empire produced by the History Channel.

After listening to this fascinating interview and contemplating the importance of serious investigative reporting and history, you can learn more about Sally, buy The Profiteers and access more excellent books and writing at her website here.

I will address the latest market developments in Money & Markets. Email or Post your questions for Ask Catherine here.

Talk to you Thursday!

Related Book Review

Book Review: The Profiteers: Bechtel and the Men Who Built the World

“Brady, Bush, Bechtel and “the Boys” from Dillon Read & Co Inc & the Aristocracy of Stock Profits