Read the Transcript

Read the transcript of The Oil Card – What’s Next? with Jim Norman here (PDF)

View the Money & Markets Presentation

Listen to the Interview MP3 audio file

Listen to the Money & Markets MP3 audio file

Audio Chapters

Introduction

Theme “Exercising Control Through Character Assassination”

Money & Markets This week in Money & Markets, Catherine discusses the latest happenings in the markets as well as how they might be affected by the increasingly cold weather.

Hero Our hero this week is Footballer turned farmer Jason Brown.

Ask Catherine Catherine answers questions submitted by subscribers.

Question #1:

Dear Catherine:

There is much evidence indicating that the Apollo moon landings were staged and never happened, and that we never landed on the moon via that technology. We may have landed on the moon using other technology, but do you believe that the Apollo moon landings may have been faked?

Question #2:

Dear Catherine:

In your opinion, how much money does the Federal Reserve and their policies end up costing the U.S. taxpayers every year?

I have never costed it out – tricky thing to do because it is all in the assumptions. — dividends paid to Treasury – easier to do on government appropriations and credit – increase wealth by 6X – now believe it is much more.

Question #3:

Hello Catherine- This is an interesting topic. My husband has just finished an excellent book – Command and Control- by Eric Schlosser. (also the author of Fast Food Nation- which I read)

Command and Control is an alarming account of how unsafe we are from our own doings.

Let’s Go to the Movies! This week in Let’s Go to the Movies!, Catherine reviews the documentary The Prize: The Epic Quest for Oil, Money & Power.

Interview Discussion Catherine discusses her interview with Jim Norman.

Closing

November 27: Vaccine Exemptions with Alan Phillips

December 04: Year-end tax planning with Patty Kemmerer

December 11: Precious Metals Market Report with Franklin Sanders

“Strange, strange are the dynamics of oil and the ways of oilmen.” ~ Thomas Pynchon, Gravity’s Rainbow

By Catherine Austin Fitts

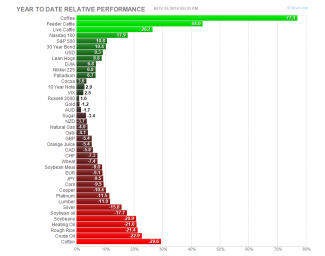

Oil is down 23% year to date – most of that fall has been in the last three months.

What does it mean? There are many variables at play – new supplies coming on line, global economy slowing, better economics for renewables and the integration of information technology globally. What about our old friend the Oil Card?

With exploration moving into the Arctic, the US faces the possibility that Russia could surpass the US in reserves controlled. We know from our recent interview with Anne Williamson, that the US and allies were successful in the 1990’s asserting greater control and ownership of Russian oil reserves and production capacity by particularly brutal means after successfully playing the Oil Card – manipulating the oil price lower to accelerate the collapse of the Soviet Union.

With Putin leading an effort to reassert sovereignty, including control of Russian oil and commodities, is the Oil Card game switching from checkmating China with a high price to bringing the Russians to heal with falling prices?

Veteran report Jim Norman returns to the Solari Report to discuss what is next for the Oil Card. If you have not read Jim’s book The Oil Card it is one of our top picks for understanding the global economy and the world around you.

I will cover the latest in financial markets in Money and Markets and why British Prime Minister Cameron’s comments after the latest G-20 meeting combined with recent announcements about British sex scandals add up to a new warning signal for the financial system. In Let’s Go to the Movies, I will review the documentary The Prize: The Epic Quest for Oil, Money & Power.

Talk to you Thursday!