Read the Transcript

Read the transcript of The Oil Card with Jim Norman here (PDF)

Listen to the Money & Markets MP3 audio file

Listen to the Interview MP3 audio file

Listen to the Complete MP3 audio file

Audio Chapters< Introduction

Theme

“Waiting for the Financial Godot.”

Money & Markets

In Money and Markets, Catherine covers the U.S. budget deal and state and local pension funds. She also discusses the recent approval of the Volcker Rule and other current events

Hero

For our Hero this week is Court Skinner

Ask Catherine

Catherine answers questions submitted by subscribers.

Discussion

For this week’s Solari Report Catherine interviews Jim Norman about the latest in the Oil and energy markets. They also discuss their takes on possible new energy sources.

Let’s Go to the Movies!

This week Catherine reviews 2 movies Hank: Five Years From the Brink, and also the PBS documentary The Warning

Closing

December 12: The Oil Card with Jim Norman

December 19: Winter Wellness with Dr. Laura Thompson

December 26: A Jon Rappoport Report

What are the real implications of the newly adopted “Volker Rule” and what are the obvious directions that the TBTF banks are going to take to side step their supposed inability to “take risky hedge funding bets”?

Subscriber Questions

Dear Solari:

I believe I heard Catherine say during the most recent Solari Report that she’s going to be traveling to Palm Desert, California. Since I live here in Southern California, will she be visiting any locations where Solari members can see her and/or meet with her?

Dear Catherine:

In your opinion, was John F. Kennedy, Jr. intentionally killed when his plane went down, or was it an accident? If he was intentionally killed, why did powerful people suddenly want him dead?

Similar Reports:

Click here to see similar Solari Reports!

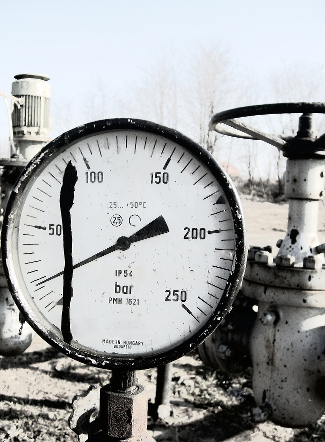

“Energy costs are 40 or 50 percent of the cost of manufacturing in the United States.” ~Jim Norman By Catherine Austin Fitts

The power politics of energy are in the air.

A high oil price checkmates China but puts money in Putin’s coffers. Fracking has repositioned America’s industrial base –- but not without controversy and concern about precious water supplies. Will Europe follow suit? Increased domestic supplies in North America and Europe will shift oil diplomacy in the Middle East.

Adoption of renewable energy is growing. The campaign is on in the U.S. to persuade university endowments to divest the securities of fossil fuel companies. In the face of growing concern about Fukishima, numerous countries have moved to phase out or reduce their reliance on nuclear energy.

To add to the uncertainty, the possibilities of breakthrough energy technologies continue to be considered.

This Thursday, veteran reporter and author Jim Norman will help us make sense of the shifting landscape and numerous controversies in the world of energy.

Jim is a veteran business journalist and energy reporter. He currently writes for McGraw-Hill’s Platts Oilgram News, has been a senior editor at Forbes and was the Houston bureau chief for BusinessWeek. Jim has authored my favorite book on the energy markets, The Oil Card.

In Money & Markets this week, I’ll discuss the latest trends in financial and commodities markets.

In Let’s Go to the Movies, I will review two documentaries that address the financial coup d’etat and bailouts:

- Hank: Five Years From the Brink, which documents Secretary of the Treasury Hank Paulson’s story of the Bush Administration bailouts; and

- The Warning, a PBS documentary about the efforts of Brooksley Born (as Chairman of the Commodities Future Trading Commission) to regulate derivatives during the Clinton Administration.

Talk to you Thursday!