Thursday, 3 April 2003, 12:42 am

Column: Catherine Austin Fitts

Mapping the Real Deal…

The Real Deal About Enron

… an interview with Scoop Real Deal Columnist Catherine Austin Fitts

Part One Of Seven Parts

By Daniel Armstrong*

Originally Published By Sanders Research Associates

If my years working on the clean up of BCCI and the S&L crisis taught me one thing that I would communicate today to the shareholders, retirees and employees who have been harmed, it is this: people like those on the board of Enron absolutely make money from insider trading, bid rigging and fraud, and they do so with help from the highest levels.

— Catherine Austin Fitts.

IMAGE: Enron

What investment banker Catherine Austin Fitts invariably emphasizes in her discussion of global money flows is the extent to which criminal proceeds play a part in the real world economy. This should come as no surprise to anyone. Not after all America watched their pension funds stripped away, while dotcom CEO’s pocketed millions of dollars in profits from stock market “pumpanddump” schemes. Not after energy traders like Enron, Dynergy, and Reliant have been accused of using the California energy crisis to manipulate the market, causing vicious price hikes, rolling browns out and power shortages. No. In this past year, our naiveté and trust in Wall Street, perhaps the world in general, has collapsed much like the World Trade Center did that fateful September morning.

The world really isn’t any different, it’s just that some of the veils have been shorn away, and longtime Wall Street insider Fitts figures there’s no sense pretending innocence any longer. Tax evasion, insider trading, drugs sales, black budgets, and terrorism are a significant part of global economic dynamics. It’s simply how the money works in a financial system where so-called creative accounting methods are as transparent as mud and money laundering is part of the quantum mechanics of financial law. “The Real Deal,” as Fitts refers to her straighton analysis of money flows, “is that financial fraud, in all its wide variety of deceits, is the most profitable business on the planet today.” Based on her eleven years experience on Wall Street and eight working with federal agencies cleaning up HUD and several large banking scandals, my guess is that Ms. Fitts knows what she’s talking about.

The United States Department of Justice estimates that $500 billion to $1 trillion in criminal proceeds are laundered annually worldwide. It may be twice that. And the Real Deal is you can’t do accurate economics if this isn’t accounted for. Sums this large—hundreds of billions of dollars, says Fitts, can only be laundered into the system through Wall Street and the central banking system. Companies like WorldCom, Tyco, and Global Crossing. Banks like Citigroup, JP

IMAGE: This is not Paul Volcker

MorganChase and the New York Fed. This isn’t wild talk. We’ve heard it all in the unraveling of the Enron web already. The largest banks do the largest business transactions and they are the only ones capable of disguising the underside of these vast financial flows. This is curious and profound commentary from a former Managing Director and board member for the elite New York investment firm Dillon Read, Inc. and onetime Assistant Secretary of HUD. When she looks at the Enron bankruptcy, with her BCCI and S&L cleanup experiences to draw upon, she aptly quotes Yogi Berra, not Paul Volcker, to describe what she sees: “It’s déjà vu all over again.”

Catherine Austin Fitts began her career in 1978 at Dillon Read in corporate finance and mergers and acquisitions. Eight years later she became the firm’s first woman Managing Director and board member. Her success raising capital for the renovation of New York’s subway system, City University of New York, and several other major projects prompted Business Week to refer to her as a “Wonder Woman” and generated a reputation in financial circles that she could fix anything.

Fitts left Dillon Read in 1989 to join the first Bush Administration, working as Assistant Secretary to Jack Kemp at the Department of Housing and Urban Development with the task of “fixing” HUD and the Federal Housing Administration and cleaning up the S&L scandals. In 1990, she was named to the Securities and Exchange Commission’s Emerging Market Advisory Committee. A year later, President Clinton’s Treasury Secretary Nicolas Brady and Chief of Staff John Sununu, asked her to be a governor on the Federal Reserve Board and a member of the board of Sallie Mae. This was heady stuff for a woman of forty. But she’d already started her own investment bank and software firm, Hamilton Securities Group, Inc and turned down the Federal Reserve offer.

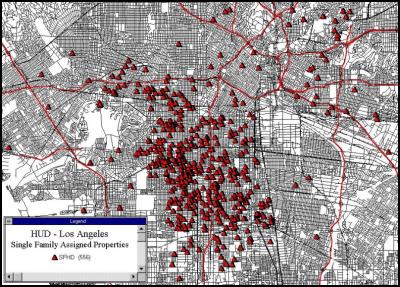

In 1993, Hamilton Securities, Inc successfully won a competitive contract bid with HUD to reengineer portions of its $500 billion portfolio of mortgage insurance, mortgages, and properties. While fulfilling its contract, repackaging and auctioning off $10 billion of defaulted FHA loans, Hamilton developed a package of software tools to access publicly available online government financial records. This included an online disclosure and bid optimization system for the sale of defaulted HUD loans and an easytooperate program called Community Wizard, which allowed local users to create “placebased” data bases to track government money flows and facilitate business in their own neighborhoods.

IMAGE: Community Wizard

Hamilton’s efforts and loan sales software would save the FHA funds billions of dollars and earned Vice-President Al Gore’s Hammer Award for reengineering government. Also Community Wizard, perhaps Hamilton’s most powerful innovation, became the central piece in prototyping a computerlearning center and data processing service in the Edgewood Terrace apartment building, as part of Fitts’ idea to move neighborhoods from government subsidy to entrepreneurial business through private markets and investment. Following her very successful career line, Fitts again was a shining light in the dark world of federal credit and balance sheets.

An unforeseen side effect of online tools like Community Wizard, however, was that while clearly showing how clean money worked in neighborhoods, the software also showed how the dirty money worked, inadvertently, providing a checks and balances for the use of federal housing monies. Certain HUD problems became more visible. This included suspicious patterns of high HUD mortgage defaults in the same areas that were the target of CIA complicit narcotics trafficking con firmed by CIA Inspector General investigations into the so called “Dark Alliance” allegations published by Gary Webb and the San Jose Mercury News in the summer of 1996. “These are the types of HUD mortgage scam that have been popularized by The Soprano TV show,” says Fitts, “and were instrumental in combination with narcotics trafficking with destroying my childhood neighborhood.” The detailed “placebased” data provided the basis to estimate who had been getting inside sweetheart deals or where fraud was indicated. There were also many discrepancies in HUD’s books—later it became apparent that they ran into the tens of billions of dollars.

IMAGE: South Central House Repos

**** # # # ****

Housing corruption: reality TV?

Bada bing! Tony Soprano reinvents government, HUDstyle

James Gandolfini as Tony Soprano, center, with Steven Van Zandt as Silvio Dante, left, and Tony Sirico as Paulie Walnuts in HBO’s hit television series, ‘The Sopranos’

Dec. 10 Credit Tony Soprano with doing something no one for the past 37 years has been able to do. He’s taught millions of Americans that there is a federal Department of Housing and Urban Development. And he’s shown how you can use it.

In Tony Soprano’s mob world, HUD exists to facilitate embezzlement, theft, and extortion. Of course, this isn’t what Congress intended when it passed the Department of Housing and Urban Development Act of 1965.

**** # # # ****

The next thing Fitts knew she was under investigation by the DOJ, FBI, and the HUD Inspector General in response to a series of law suits filed by a HUD contractor Ervin Associates whose servicing contracts and responsibilities doing defaulted mortgage workouts had been displaced by Hamilton’s loans sales auctions. This began a process of eighteen audits, investigations and inquiries as well as a smear campaign to discredit Fitts personally and professionally. For all its benefit to accounting clarity and the efforts of honest people, Community Wizard’s open window to federal money and credit was not what the politically inbred contractor fraternity wanted.

Seven years and all hell to pay later—she compares her life during this period to that of the character played by Will Smith in the movie Enemy of the State—Fitts and Hamilton Securities, Inc emerged entirely exonerated from all allegations of wrongdoing.

IMAGE: Enemy Of The State

More than that, it was proven she had done a lot of good for the taxpayers and communities. In these times, when honesty and accountability must be held at a premium, Fitts’ bold revelations into the holes in HUD’s books and several other federal agencies, as well as her insights into the relationships between government and banking syndicates, have made her more respected in serious financial circles than ever before.

Today Catherine Austin Fitts is Solari, Inc, a pioneering investment advisory firm aimed at bringing the power of investment databases and equity finance to neighborhoods. That is, she’s out there with a positive vision, offering to all communities what she prototyped at Edgewood Terrace in 1994. Make no mistake about it. Fitts is all Wall Street experience and straight-ahead common sense. She minces no words bringing transparency to the now one-yearold Enron fiasco. “I will bet the last dollar I have that Enron was part of the largest laundromat of stolen and tax evading dollars in American history and that the Department of Justice’s primary goal is cover-up.” And, as the following interview will attest, she’s seen enough in her time to lay out a pretty convincing case.

*************************

In Part Two, the interview transcript begins.

Click Here For Part two

*************************