Monday, 18 February 2002, 10:13 am

Column: Catherine Austin Fitts

Narco Dollars for Beginners (Part 3)

How The Money Works In The Illicit Drug Trade

Part 3 in a 13 Part Series

By Catherine Austin Fitts

First published in the Narco News Bulletin

Originally Published Oct 2001

PARTS TO THIS SERIAL…

Part 1 – Narco Dollars for Beginners

Part 2 – Sam & Dave Do White Substances

Part 4 – On Your Map

Part 5 – Getting Out of Narco Dollars

Part 6 – Georgie And West Philadelphia

Part 7 – Dow Jones Up, Solari Index Down

Part 8 – Fast Food Franchise Pop

Part 9 – At the Heart of the Double Bind

Part 10 – Drugs as Currency

Part 11 – In Defense of American Drug Lords

Part 12 – We Have Met the Enemy and It is Us

Part 13 – The Real Deal: Americans Love A Winner

******

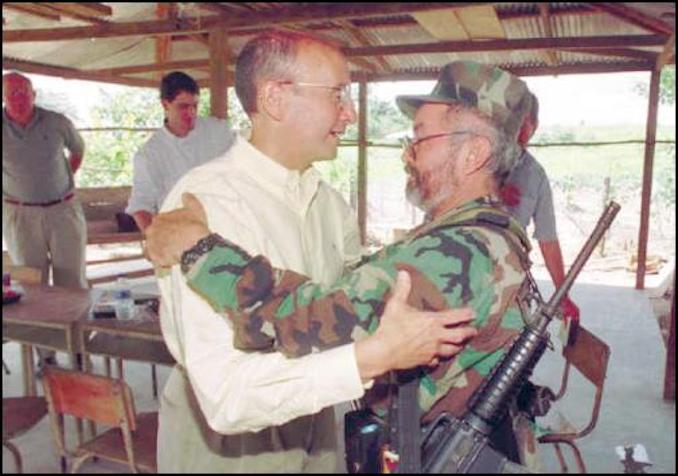

NYSE Chairman Richard Grasso Embracing A FARC Commander

A Real World Example:

NYSE’s Richard Grasso and the Ultimate New Business “Cold Call”

Lest you think that my comment about the New York Stock Exchange is too strong, let’s look at one event that occurred before our “war on drugs” went into high gear through Plan Colombia, banging heads over narco dollar market share in Latin America.

In late June 1999, numerous news services, including Associated Press, reported that Richard Grasso, Chairman of the New York Stock Exchange flew to Colombia to meet with a spokesperson for Raul Reyes of the Revolutionary Armed Forces of Columbia (FARC), the supposed “narco terrorists” with whom we are now at war.

The purpose of the trip was “to bring a message of cooperation from U.S. financial services” and to discuss foreign investment and the future role of U.S. businesses in Colombia.

Some reading in between the lines said to me that Grasso’s mission related to the continued circulation of cocaine capital through the US financial system. FARC, the Colombian rebels, were circulating their profits back into local development without the assistance of the American banking and investment system. Worse yet for the outlook for the US stock market’s strength from $500 billion – $1 trillion in annual money laundering – FARC was calling for the decriminalization of cocaine.

To understand the threat of decriminalization of the drug trade, just go back to your Sam and Dave estimate and recalculate the numbers given what decriminalization does to drive BIG PERCENT back to SLIM PERCENT and what that means to Wall Street and Washington’s cash flows. No narco dollars, no reinvestment into the stock markets, no campaign contributions.

It was only a few days after Grasso’s trip that BBC News reported a General Accounting Office (GAO) report to Congress as saying: “Colombia’s cocaine and heroin production is set to rise by as much as 50 percent as the U.S. backed drug war flounders, due largely to the growing strength of Marxist rebels”

I deduced from this incident that the liquidity of the NY Stock Exchange was sufficiently dependent on high margin cocaine profits (BIG PERCENT) that the Chairman of the New York Stock Exchange was willing for Associated Press to acknowledge he is making “cold calls” in rebel controlled peace zones in Colombian villages. “Cold calls” is what we used to call new business visits we would pay to people we had not yet done business with when I was on Wall Street.

I presume Grasso’s trip was not successful in turning the cash flow tide. Hence, Plan Colombia is proceeding apace to try to move narco deposits out of FARC’s control and back to the control of our traditional allies and, even if that does not work, to move Citibank’s market share and that of the other large US banks and financial institutions steadily up in Latin America.

Buy Banamex anyone?

(continues…)

******

…come back tomorrow for Part 4 – On Your Map

Part 5 – Getting Out of Narco Dollars

– AUTHOR NOTE: Catherine Austin Fitts, author of Scoop’s “The Real Deal” column, is a former managing director and member of the board of directors of Dillon Read & Co, Inc, a former Assistant Secretary of Housing-Federal Housing Commissioner in the first Bush Administration, and the former President of The Hamilton Securities Group, Inc. She is the President of Solari, Inc, an investment advisory firm. Solari provides risk management services to investors through Sanders Research Associates in London.

Anti©opyright Solari 2002