Listen to the MP3 audio file

The Solari Report – 17 Jun 2010

Download the MP3 audio file

If there is something growing faster than the plumes of oil spreading across the Gulf of Mexico, it is the unanswered questions about what is happening and what it means to all concerned:

- Was the sinking of the Deepwater Horizon drilling rig an accident or is there a deeper story?

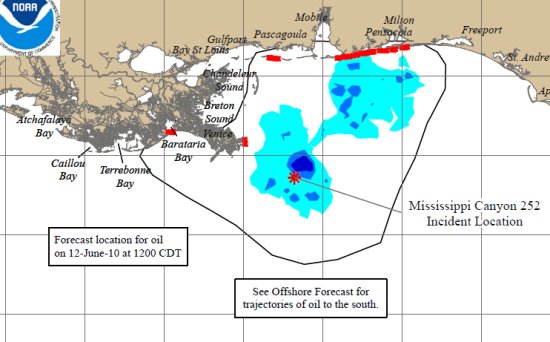

- What will the impact be on Gulf of Mexico – on the ocean, on the Southern states, their wetlands, Mexico, Cuba, the Caribbean, and their wildlife, people and economy?

- How long could the spill continue? What is the worst-case scenario? How far and wide could the oil go? What about related gas deposits?

- How does the ecosystem normally deal with oil spills and seepages? What are the most effective methods of addressing them? How long does it take for an ecosystem to deal with a spill on its own?

- Why were BP and its contractors not prepared to handle this event?

- What is BP’s contractual relationship with the US government. Who owns what and how much? Who is liable for what?

- Why did the federal regulators not require adequate contingency and disaster recovery plans?

- Why did BP appoint as its ombudsman a former General Counsel of the CIA who is on the record as allowing false affidavits to be filed in federal court?

- Why such remarkable similarities between the 1979 Gulf of Mexico oil spill and the current one?

- Why did Goldman Sachs sell such a large position in BP shares shortly before the spill? What about other unusual stock sales and transactions prior to the spill?

- Why has the response been so inadequate? Why have the state governors allowed BP and the federal government to control when the response appears inadequate?

- Why are chemical dispersants being used on the spill? What will the impact be on wetlands and on rainfall throughout North America?

- Could there be any truth to the rumors that the spill is helping the oil companies keep oil prices high and assert control of the wetlands along the gulf coast for future drilling?

- What happens if BP cuts its dividend or declares bankruptcy? Shareholders have lost $95 billion in wealth and could lose another $95 billion. Who will get hurt? Could the US subsidiaries be spilt out from the rest of the company?

- What does this mean for Exxon, Shell and the other companies in the oil and oil services industries.

- Is the NWO going to use the spill as an excuse to railroad a cap and trade bill through Congress?

- What is the impact of the spill going to be on the Anglo-American alliance?

- How do we protect our homes and our assets from this type of “disaster capitalism?”

- What can we change so that this can never happen again?

On this week’s Solari Report, I will be speaking with the person I most trust to help us understand events in the Gulf and its meaning around the globe, veteran reporter James R. (“Jim”) Norman, author of The Oil Card: Global Economic Warfare in the 21st Century.

Jim joined us on the Solari Report in March to discuss oil’s role in global economic warfare. It was one of the most fascinating Solari Reports to date. I encourage you to listen to it. It’s great background for understanding current events.

Jim writes for McGraw-Hill’s Platts Oilgram News. He has been a senior editor at Forbes Magazine and was at BusinessWeek, where he served as Houston bureau chief. Prior to that, he won an AP award for investigative reporting (on an oil and gas scam) while a reporter for the Ann Arbor News in his home state of Michigan.

Jim is one of those rare experts who can integrate the dots between billions in the futures markets in New York, with what that means to politics from Moscow and Beijing to London and Washington, and how that impacts you and me on Main Street. There is simply no one better to help us understand what the Gulf Oil Spill means to our environmental, political and economic ecosystems.

I will start with my round up in Money & Markets and Ask Catherine. No Let’s Go to the Movies this week. If you have not yet, make sure you watch the comparison of the 1979 Oil Gulf Oil Spill vs. the current spill that we watched last week. (See below) We will be going an extra thirty minutes because of the complexity and importance of this topic.

–

If you are a subscriber to The Solari Report, please post your questions for Jim and me at the cart.

Listen live on Thursday evening by phone, listen online, or by downloading the mp3 after it is posted on Friday.

If you would like to learn more about The Solari Report and subscribe, click here. Subscribers enjoy access to our complete MP3 archive. You can enjoy the Solari Report Digest podcasts for free. Click here.

This week’s Money and Markets charts will be posted at the blog.