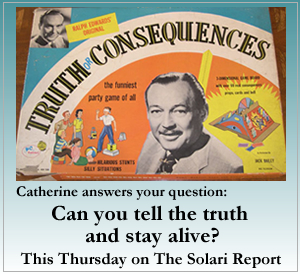

How To Tell The Truth and Stay Alive ~ Catherine’s 12 Points (pdf)

Listen to the MP3 audio file

The Solari Report – 03 Dec 2009

Download the MP3 audio file

On this week’s Solari Report, I will be talking about something very much on my heart – a subscriber question about whether it is possible to tell the truth without getting killed.

Specifically, I will address the principles and practices that can help you combine your thirst for a realistic understanding of events with practical discretion.

- How do we enjoy the company of friends and family who may not want to know what’s happening?

- How do we interact with colleagues who embrace the “official reality?”

- How do we navigate “the matrix” of corporate, government and class interests without creating unwelcome risks?

- How do we avoid getting caught in the “divide and conquer” manipulations and other disinformation?

- How do we use a more powerful understanding of events to help us accomplish our purpose and goals?

- How do we face the risks before us in a way that is energizing to those we love and enhances our capacity to love?

- How do we shift the course of events in positive ways without inviting more risk than we can handle?

I have been answering this question one principle at a time on recent Solari Reports. In fact, you can hear the initial discussion Truth or Consequences in our latest Solari Report Digest #6 .

I was planning on interviewing Terri Cullen on identity fraud this week. Terri had to reschedule, so she will join us in February for that very important discussion. The blessing is that I can focus this week on your questions, which I am most eager to do.

I will be covering Money and Markets. As you can see from the Blog, there is a lot happening this week.

Our movie this week is Win Wender’s The End of Violence which explores the use of communications technology for surveillance and assassination. These are techniques used to keep the dollar from falling too fast, markets managed and the slow burn going.

If you are a subscriber to The Solari Report, you can post your questions at your private panel. Listen live on Thursday evening by phone, listen online, or by downloading the mp3 after it is posted on Friday.

If you would like to learn more about The Solari Report and subscribe, click here. Subscribers enjoy access to our complete MP3 archive. Our monthly highlights are published in The Solari Report Digest which you can access and subscribe to for free here.

This week’s Money and Markets charts will be posted at the blog on Thursday morning.