By Richard Rubin

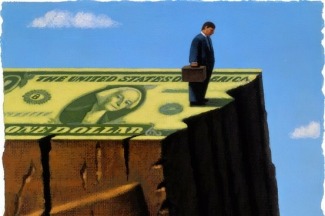

U.S. households are facing an average tax increase of $3,446 in 2013 if Congress doesn’t avert the so- called fiscal cliff, the nonpartisan Tax Policy Center said in a study released today in Washington.

The top 1 percent of households face some of the largest tax increases and would see their average federal tax rates hit 40.5 percent, up 7.2 percentage points from this year. That would translate to an average tax increase of $120,537.

About 88 percent of U.S. households would see their taxes increase in 2013, with a typical middle-income household facing a tax increase of about $2,000.

After the Nov. 6 election, Congress is scheduled to return to Washington to debate the automatic spending cuts and tax increases starting in January unless lawmakers act. For calendar year 2013, taxes would increase by $536 billion, or about 20 percent.