[click on the image for a larger version]

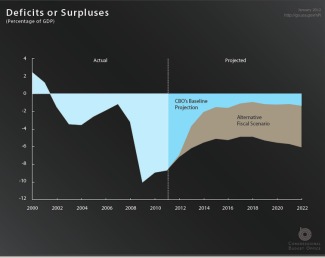

The United States fiscal cliff refers to a large predicted reduction in the budget deficit and a corresponding projected slowdown of the economy if specific laws are allowed to automatically expire or go into effect at the beginning of 2013. These laws include tax increases due to the expiration of the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 and the spending reductions (“sequestrations”) under the Budget Control Act of 2011

Under current law, which mandates these tax increases and spending cuts, total federal revenues would increase 11.33% and total federal spending would decrease 1.89% for fiscal year 2013. The deficit for 2013 is projected to be reduced by roughly half, with the cumulative deficit over the next ten years to be lowered by as much as $7.1 trillion. However, it is also projected to cause a double-dip recession in the first half of 2013.