By Chuck Gibson

One of the really good market technicians I follow, JC Parets, took a look at presidential cycles and stock returns. What he found is that of the entire 4 year cycle, we are about to enter what is by far the worst period, if history is any indication of what’s to come. While it is not something you have to run and hide from, it should not be ignored as the data reaches back more than 80 years. No matter what ultimately happens though, what we need to accept is the next 13 months will most likely look nothing like the last 13. As such, investors should be prepared.

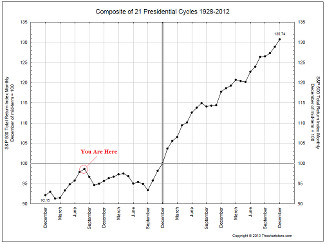

Here is a composite S&P500 chart of the last 21 Presidential Cycles taking us back to 1928. Coming into the month, seasonality clearly points to a near term top, one that could potentially last until a bottom next fall.