The dominant theme in the 2014 Wrap Up is the growth of global equity markets.

ALIBABA LAUNCHES THE LARGEST IPO EVER

In a recent online survey asking for votes on the top story of 2014, I voted for the Alibaba IPO.

After submitting my vote, I learned that 2% of the voters agreed with me. The vast majority voted for stories I considered fabricated or irrelevant to the trends that are and will be shaping our lives in 2015.

I think the Alibaba IPO is the most important story of the year. It speaks to Planet Equity – the power of the equity markets as they grow and create global financial interdependence. We are investing in each other. We are creating a world where we can profit from each others’ success.

Commentary

English teacher Jack Ma started Alibaba in the mid-1990’s in his living room in China. Twenty years later he launched the largest IPO in the history of the world for a company that has a market valuation which is larger than the GDP of many countries. Alibaba’s story speaks to the growth of Asia, of the online market exploding in size with smartphones and mobile payment systems, and of the access and liquidity these developments offer millions of small businesses and consumers.

In the process, despite running what is now one of the largest companies in the world, Jack Ma spoke to a global media audience and to the largest, most influential investors in the world about the importance of serving the dreams and aspirations of the little guy.

While Alibaba was launching its IPO, Apple was growing even larger. The year ended with commentators asking if 2015 would be the year in which Apple became the first $1 trillion company. With the US having high hopes for Apple Pay, the race is on. Here is the listing from Wikipedia of the largest companies in the world:

GLOBAL STOCK MARKETS ARE GROWING

The global equity markets have grown by $60 trillion in the last twenty-five years, from approximately $11 trillion to $70 trillion.

Some of this growth has come from the debasement of global currencies. As more money is printed, the value of stocks go up while the currency in which they are denominated has a lower value, not because corporate profits have risen or companies are worth more. Indeed, one of the reasons that predictions of hyperinflation (as a result of expansionary monetary policy) have not come to pass is that this securitization process is soaking up a great deal of excess liquidity.

In the developed world, growth in equity markets has come from companies assuming ownership of a larger portion of assets and operations. The more dramatic growth has been in the emerging markets where countries have developed new securities markets, including stock exchanges. These exchanges have facilitated the flow of capital into the creation and growth of companies, and the shift of investment capital from West to East. This has contributed to a greater percent of GDP in their areas being represented in the equity markets – as well as contributing to growth in GDP as liquid capital becomes available to more businesses and entrepreneurs.

According to the World Federation of Exchanges, its member exchanges (which unfortunately no longer include the London Exchange, which also owns the Italian Bourse) now have listings for a total of 44,326 companies:

- 24, 265 companies are on Asian exchanges with a market capitalization of $20.6 trillion;

- 10,320 are on exchanges in the Americas with a market capitalization of $30.6 trillion;

- 9,741 are on European, Middle Eastern and African Exchanges with a market capitalization of $12.9 trillion;

New company listings in 2014 were highest in Asia with (903) new listings, compared to (317) in the Americas and (134) in Europe, the Middle East & Africa.

In the United States, private equity, mergers and equities constrained the growth of new listings in 2014 while stock buybacks continued to shrink the outstanding float for many existing companies.

The value of outstanding Exchange Traded Funds has now reached $1 trillion globally, and most of that is in the United States. This has made it possible for American investors to access a broad index of stocks traded on emerging market exchanges, typically by country. A retail investor can invest in an index of the Indonesia or Brazil markets, including many stocks not listed on the US exchanges, through an ETF and pay US discount firm commissions.

This process of representing a growing portion of global assets, corporate income flows and country GDP in liquid equity markets is a significant development.

In one sense it is the “securitization of everything.” At the root, it represents a shift from a world run by sovereign governments to a world where a greater portion of the economy is run by companies and their investors. But the shift is messy. Much of the more baffling, even unpleasant things going on around us is the result of companies aggressively vying for markets and earnings, at times in destructive ways, as rising stock prices increase their incentives to grow profits.

You can hear some of the discomfort with this process from leaders, such as Vladimir Putin, who prefer their country to be governed by a sovereign government as opposed to being picked over by corporate interests as they were in the “global supermarket sweepstakes” of the 1990’s.

Then there are times that companies are the voice speaking on behalf of cooperation – Russian sanctions harm their business and policies that squeeze the middle class shrink their consumer base and profits.

Companies trade in the equity markets for a multiple of their net income – the price earnings ratio or P/E. If a company makes a dollar and its stock is valued at $20 dollars, we say that its P/E ratio is 20X. For every dollar of additional net income, shareholder value increases by $20. So if I buy a stock and double the companies earnings, the value of my stock is likely to double. My profits from the increased value are capital gains.

Capital gains on stocks and real estate are the single largest source of political contributions in the United States.

Politicians do things that cause a company’s profits to go up. Grateful investors then send the politicians campaign contributions with a percent of their profits. I describe a case study of how this system works in Dillon, Read & the Aristocracy of Stock Profits Dillon Read and Company

DEBT OR EQUITY?

As economies in the developed world have matured, they have relied on increasing amounts of government debt. Currently, emerging markets are growing globally, so it is not surprising that they rely more heavily on equity.

WILL YOUNG PEOPLE INVEST IN EQUITIES?

One of the most important questions impacting projections of financial markets is whether participation in equity ownership will continue to grow. First, US households have traditionally invested in the equity markets.

However, as government fiscal and monetary policies have shifted savings out of households and into corporations, the question is whether households will have sufficient assets to invest in equities. One variable driving the consolidation of wealth may be a forced consolidation of capital to provide continued availability of savings and investment into capital pools, including equity, to ensure that US companies have access to sufficient capital to dominate globally.

Recent polls indicate that the 2006-2010 financial crisis and bailouts left many young Americans appropriately alienated from large banks and financial markets. Starting in 2014, a major effort is underway on the part of US financial institutions to rekindle their interest in investing. We are seeing media designed to encourage young people to invest.

The Young Investor

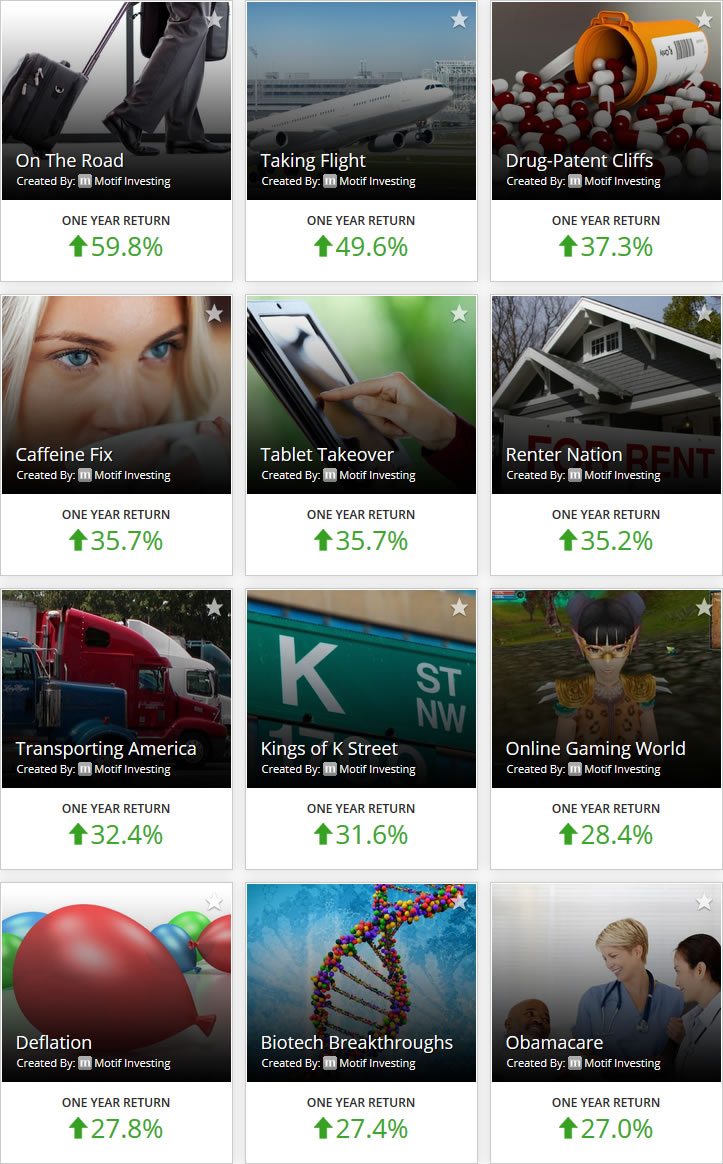

We are also seeing software technology being used to organize investment vehicles which appeal to the Millennial Generation. For example, Motif Investing is an online broker based in Silicon Valley that invites you to create or invest in exchange traded funds organized around a trend in the economy — a “motif.” Here were the (15) best performing motifs for 2014 (please note we don’t show the worst performing (15) motifs!).

The technological developments that will make equity investment most accessible to the next generations are ongoing innovations in human-computing interfaces. Just as Amazon.com makes it far too easy for me to buy books with one click, smartphone apps for brokerage firms will also make it possible for the global online market to buy with a single click.

However, financial institutions will not stop there. Note Fidelity’s launch this year of its ‘StockCity.’

Fidelity Launches ‘StockCity’ to Lure Millennials

WILL A GROWING GLOBAL MIDDLE CLASS AND ONLINE MARKET INVEST IN EQUITIES?

While the ongoing participation rates in the G-7 nations will have a significant impact, the big question is whether the growing global middle class – hundreds of millions of people who have never invested in the equity markets – begin to invest in the securities markets. We are watching the growth of the online Asian market overtake the US and European consumer markets in numbers – and someday in size. Can and will it do the same to the flow of savings and investments? The move towards global parity says that this is likely. The potential for a rising middle class to shift a portion of their growing capital from bank deposits and real estate into mutual funds and liquid securities represents a major opportunity for the financial markets.

While households in the emerging markets own a relatively small portion of equity investments, emerging market institutions have been closing the gap with institutional investment.

In June 2014, the think-tank OMFIF published a survey of global central banks, sovereign wealth funds and public pension funds which reported that public institutions owned $29.1 trillion of the estimated $130 trillion in cross-border assets. This includes $13 trillion held by (157) central banks (reported before the recent increases from quantitative easing), $9.5 trillion held by (156) public pension funds and $6.5 trillion by (87) sovereign wealth funds. OMFIF reported a broad-based shift of central bank assets into the equity markets. China’s central bank with $3.9 trillion in assets has now become the world’s largest public investor in equities.

Many emerging market countries do not have pension fund systems. To the extent that they adopt them, such arrangements may also create a volume of equity investment as those countries grow.

HOW MUCH MORE GROWTH?

Global rebalancing of the economy means global rebalancing of the equity markets. And that means equity markets have more growing to do. Many variables can drive the short and intermediate swings. The unraveling of the Bretton Woods system and geopolitical tensions can slow things down, creating significant losses for some and windfall profits for others. Wars and environmental disasters can stop and reverse the process for a time.

One of the big variables is the general level of P/E ratios. The S&P 500 P/E ratio is above the historical mean. However it is far below the high in the P/E ratio of the roaring 20’s or the Internet stock boom – both were periods of explosive growth from new technology married with “pump and dump” antics of the Western financial system.

On one hand, I could argue that the introduction of mobile payment systems and the integration of digital technology into our infrastructure along with dramatic improvements in the human-computing interface could send P/Es much higher. On the other hand, a growing population stripping natural resources and experiencing weird weather which compromises the global harvests could find itself mired in an ugly competition for natural resources and capital. Higher interest rates causing high defaults of debt and derivatives could send both corporate earnings and P/Es much lower.

The Anglo-American alliance has been the dominant player in the global financial markets for a century or more. While the Bretton Woods model is a large flow model, it is arguable that the global financial markets constitute an even more powerful one. The power to convert $1 of profits into $10-100 of shareholders value, and lever it with debt and derivatives, is the goose that laid the golden egg. It attracts – and attraction is a more powerful economic engine than physical and military force. China’s conversion to markets has proven this yet again.

In theory, global equity markets have the potential to organize capital into a system that encourages us to allocate capital to the productive among us (and to those who have a vested interest in their success) without regard to social status, race, color, creed or nationality. That power depends, however, on a common commitment to the rule of law which creates and maintains the trust which is the basis for liquidity and leverage in the system. A shared belief in the rule of law is the basis of the goose that lays the golden egg.

When there is law, $1 in profits can create many multiples of that in equity value. When there is no law, $1 in profits can create little or no equity value as the only value is today’s cash flow and what you can protect with a gun or standing army that day.

This is not an inconsequential point. The financial coup d’etat engineered by US financial institutions came close to destroying confidence in the financial markets. It was preserved by a thread as the US Treasury and Federal Reserve provided trillions to replenish the funds stolen from global investors with fraudulent securities and related derivatives. Millions of investors took permanent losses. There are still trillions in fraudulently issued bonds and stocks floating around the global financial system. High frequency trading, naked short selling and other institutionalized practices that generate enormous profits “above the law” continue. The dark pools grow.

The mass media has been promoting an endless flow of lies and false realities for years to ensure that the Anglo-American institutions can combine the benefits of non-transparency, money laundering (organized crime) and tactics of financial and economic warfare (the oil card) with the financial leverage of liquid markets. We have arrived at a highly Orwellian state where the financial markets make no sense to even the most sophisticated investor because the national security state requires secrecy to effect its manipulations.

Also eroding trust in the US system are regulations to minimize liquidity at the local level. Small business owners are told that they cannot raise equity capital by using crowdfunding or online systems due to possible fraud. But, they are encouraged to spend their life savings on lottery tickets every day. As a result, small investors leave their money in the bank where it is channeled into US Treasury securities (with no real return to the investor) or in a brokerage account which ensures that their equity investment flows through Wall Street.

If recent surveys of the Millennials are true, US politicians and bankers have come dangerously close to killing the goose that laid the golden egg. Whether due to lawlessness at home or lawlessness abroad, the US has a credibility problem that cannot be solved with dazzling software and expensive marketing campaigns.

However, a failure of US political and investment leadership will not prevent the growth of the global equity markets. It may simply move the mantle of leadership to the country or international consortium with sufficient integrity and infrastructure to manage it, likely fueled by the demographics of a growing global middle class.

The evolution of leadership in the equity markets is intimately tied to the governance of the global currency. In 2015, there will be no more interesting sport on the planet than the competition between global factions vying for a seat at the table.