A MAJOR OVERHAULING OF INSTITUTIONS

“Driving through New Jersey, Nitze [asked] Dillon if he thought the market decline an omen of hard times ahead . . . Dillon thought for a few minutes and replied, “I think it presages the end of an era.” By this Dillon meant that what lay ahead was not merely a period of retrenchment, after which affairs would be conducted as before. Rather, the world was in for a major overhauling of institutions.”

—Clarence Dillon and Paul Nitze in 1929

It is 2014, and a major overhauling of institutions has begun. Again.

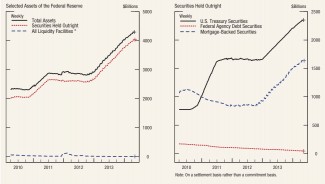

#1 THE SLOW BURN FRAYS AS THE FED TAPERS

The slow burn may be headed for trouble this fall as the Fed ends the taper. This presents real dangers for the people managing the economy.

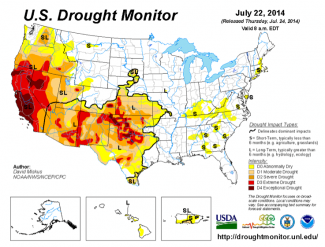

Illegal immigration and drug cartel warfare on the border, events in the Ukraine and related sanctions as well as in Gaza and the drought in North America are not helping.

#2: SHARING OUR NEIGHBORHOOD WITH THE BREAKAWAY CIVILIZATION

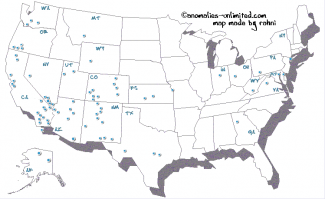

US Map: Estimates of Underground Bases

The % of missing money going towards building underground bases and transportation systems appears significant. Congress is having an unbearable time balancing between getting elected and allocating resources between the various constituencies. This will make the mid-term elections very interesting.

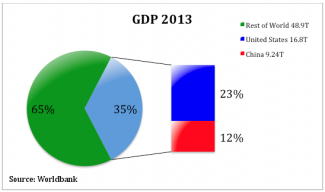

#3: RE-BALANCING WITH CHINA AND THE EMERGING MARKETS ACCELERATES

Make sure you listen to our interview with Steve Roach about his new book Unbalanced. We need to do this “nice,” not “rough.”

#4: THE ENERGY MODEL EVOLVES

Major breakthroughs in renewable energy are underway, which will put greater pressure on the dollar system which is on a oil standard.

POINT #5: SMART PHONES AND DIGITAL CURRENCIES & PAYMENT MECHANISMS ARE GROWING IN IMPORTANCE

Will Google’s Wallet revitalize the dollar system? See links on these topics in the 2013 Annual Wrap Up and 1st Quarter Wrap Up:

#6: THE DRUMBEATS OF WAR ARE RISING

The risks of war are rising. Economic war. Covert war. Nuclear war.

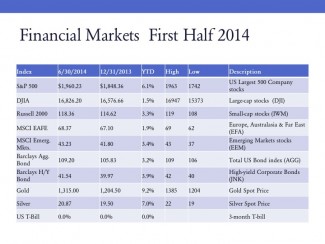

#7: EXPECT THE SHIFT TO QUALITY IN THE FINANCIAL MARKETS TO CONTINUE

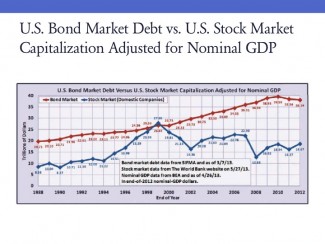

Where is the money leaving the bond market going to go?

“A new round of questions was inspired by the June publication by think tank OMFIF of a survey of global central banks, sovereign wealth funds and public pension funds which reports that public institutions now own $29.1 trillion of the estimated $130 trillion in cross border assets. This includes $13 trillion held by 157 central banks (reported before the recent increases from quantitative easing), $9.5 trillion held by 156 public pension funds and $6.5 trillion by 87 sovereign wealth funds. OMFIF reported a broad based shift of central bank assets into the equity markets. China’s central bank with $3.9 trillion of assets has now become the world’s largest public investor in equities. The Swiss National Bank reports holding 15% of its foreign exchange assets in shares.”

S&P – Long Term

S&P vs Gold – 5 Year

Central Fund of Canada (Gold & Silver) – Long Term

Union Pacific Railroad vs. Central Fund of Canada

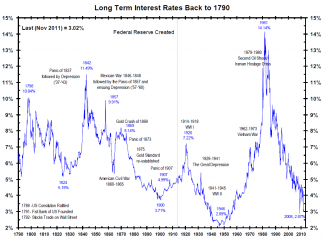

TLT – 20+ Year Treasury

Long-Term Interest Rates Back to 1790

Previous Wrap Up Web Presentations: